Africa’s Crazed Crypto Uptake Gives Mobile Gaming A New Liftoff

According to a 2021 report commissioned by Newzoo and Carry1st, Sub-Saharan Africa is one of the world’s fast-growing mobile gaming markets.

While the region had just 77 million gamers in 2015, that number grew by 16 percent to 186 million in 2021, meteorically accelerated by increased digitization and the unprecedented coronavirus pandemic.

Much of the gaming gyration in Africa is happening on mobile, as at least 95 percent of gamers across the sub-region play on smartphones and tablets—despite the rest of the world already binging on consoles and computers.

Of the 186 million gamers here, about 63 million (or 34 percent) are willing to pay to play. At its current pace, Sub-Saharan Africa grows faster than other regions in terms of pay-to-play gamers.

Conventionally, Africa has not been highly considered by the international gaming and investment ecosystem, thanks to third-world problems like low internet penetration, splintered digitized payments, and fractured distribution channels.

Notwithstanding, a 1.3 billion populace, 45 percent of which use mobile phones, and a median age of 19 (it’s 44 in Western Europe, for instance) make Sub-Saharan Africa the world’s most promising gaming frontier.

Agreed: Africans are big on mobile games. But are there any tailwinds?

Last May, Carry1st, a South Africa-headquartered startup which started out with a quiz-for-cheese offering and evolved into a game studio, raised USD 6 M in Series A to recultivate its play into game publishing and development. Konvoy Ventures, a United States-based VC Fund that invests only in gaming companies (like Bunch), led the round.

“We have partners in countries like Ethiopia, South Africa, and Mozambique. They were basically enabling us to look for an opportunity to invest in African gaming,” Jackson Vaughan, Managing Partner at Konvoy Ventures, explained to WeeTracker at the time. “In October 2020, we discovered Carry1st, reached out to Cordel and told him we’d be interested to participate whenever they raise. That was how it happened”.

Today, Cordel Robbin-Coker, Lucy Hoffman and Tinotenda Mundangepfupfu have raised a Series A extension of USD 20 M to scale Carry1st’s interactive gaming content across the continent, where it is operational in 18 countries. While local/Africa-focused VCs backed the startup during its USD 2.5 M seed round, this new round attracted a high-profile rollcall of investors from a diversity of industries.

For one, Andreeseen Horowitz (a16z) led the Series A extension, marking its first backing for an Africa-headquartered company. Secondly, Google’s USD 50 M Africa Investment Fund, which made its first investment in Uganda’s SafeBoda a month ago, joined to invest in Carry1st and help the company deepen its digital penetration in the continent.

Meanwhile, Avenir Growth Capital, a New York-based investment fund which joined the lead for the “mega” Series C extension that hatched the unicorn in Nigeria’s Flutterwave, participated to consolidate on Carry1st’s game-focused fintech infrastructure.

While it is interesting to see such participation in a gaming startup from a previously overlooked region, the Cape Town-based outfit’s latest raise unlocks new levels for African gaming.

One fast-growing market meets another?

Legendary rapper Nasir Jones (better known as Nas) also invested in Carry1st via his investment vehicle, QueensBridge Venture Partners. Nas, sometimes referred to as “half man, half venture capital”, is one of the people who bullishly put money early into Coinbase by joining the company’s USD 25 M Series B round back in 2013.

Fast-forward to April 2021, Nas emerged as an unlikely winner when Coinbase IPO’d at a USD 99 B valuation, leaving the star with no less than USD 40 M in profits.

As of the time Nas backed Coinbase, the company was valued at just USD 150 M, which is, surprisingly, less than a percentage of its current worth. During the bet, he invested alongside friends and business partners; basketball player Kevin Durant, Andreeseen Horowitz, and Union Square Ventures.

Nas, who once called himself a “cryptocurrency scarface” is also making his first African investment in Carry1st likely because the company, in addition to bank transfers and mobile money, accepts cryptocurrency from paying players as it looks to enable tokens SLP, AXS and MANA remittances for play-to-earn gamers on its platform.

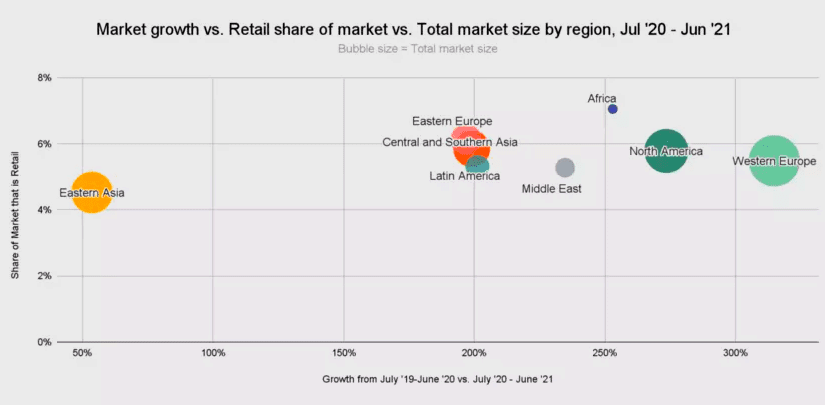

Per a report from Chainanalysis Insights, Africa’s crypto market grew by more than USD 105.6 B from July 2020 to mid-2021. The continent leads the world in retail-sized Bitcoin payments, with a transaction volume of 7 percent (whereas the world average stands at 5.5 percent). Nigeria, South Africa and Kenya are among the top 20 countries on the Global Crypto Adoption Index.

In terms of annual gaming revenues, South Africa leads in the continent with USD 290 M in 2021; Nigeria, Ghana, Kenya and Ethiopia grossed USD 185 M, USD 42 M, USD 38 M, and USD 35 M, respectively.

What’s more? 43 percent of South African gamers pay for games via traditional channels. In Nigeria and Kenya, it stands at 32 percent, while Ghana and Ethiopia conclude the A-list with 33 percent each.

On the back of its push towards a crypto-centric payments infrastructure, Carry1st is looking to bring Web3 into the mix. Founders from Axie Infinity, who run the largest Web3 gaming company on the planet, is also one of Carry1st’s newest investors. While Africa missed Web 1.0 (between 1990 and 2000) and Web 2.0 (between 2000 and 2010), the signs are: it won’t quite miss out on the new craze that is Web 3.0.

Gaming and crypto are two fast-growing markets locally and globally. Combined with the advent of NFTs and Web3, a 728 percent growth in African gaming revenues by the next decade no longer seems farfetched.

Featured Image: Cloudfront.net