Nigeria’s Wealthtech Startups Scramble To Survive As Wealth Grows Scarce

Amid inflation, currency depreciation, and economic uncertainty, Nigeria’s wealthtech startups face a daunting question: Can investment platforms thrive where wealth itself is becoming scarce?

This question is particularly relevant as companies like Bamboo, Risevest, and PiggyVest grapple with a shifting landscape, navigating a wave of challenges at home while making strategic moves abroad.

Inflation and Currency Troubles

PiggyVest’s latest Savings Report for 2024 highlights just how grim the economic situation has become. Inflation has skyrocketed, rising from 25.08% in 2023 to 32.15% in 2024. Nearly 90% of the 10,000 Nigerians surveyed have experienced a sharp increase in expenses.

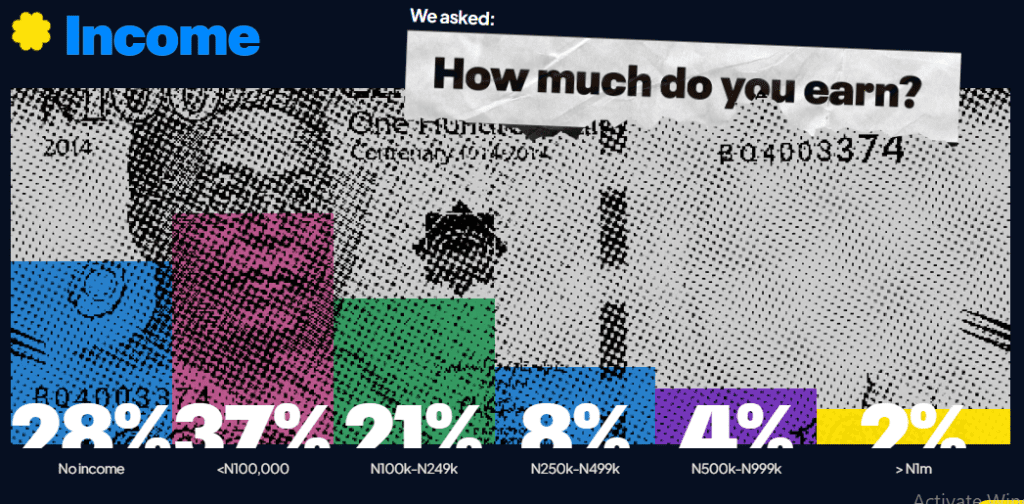

Income remains low as 37% earn below NGN 100 K (~USD 60.00) monthly and another 28% earn no income at all, while the proportion of Nigerians earning within various higher income brackets (between NGN 100 K and NGN 1 M) has dipped significantly relative to the previous year.

As a result, savings habits have deteriorated. As much as 43% of respondents are unable to save at all while only 47% of respondents say they save monthly, a steep drop from 64% last year. The burden of inflation and rising costs is palpable. As one Mr James Uche, a civil servant, lamented, “The increase in school fees, electricity tariffs, and even the cost of fuel has made it very difficult to continue [saving].”

This economic strain extends to investment behaviours. The naira’s value has plunged more than 70% against the U.S. dollar in the past year, drastically eroding wealth. For platforms like Bamboo, which built their brand on offering access to U.S. securities, this currency devaluation has hit hard. As the cost of buying foreign stocks has soared, user activity on these platforms has inevitably declined.

Strategic Diversification

In response to these pressures, wealthtech startups are not standing still. Bamboo has executed a series of calculated expansions and product launches. In May 2024, it introduced Nigerian stocks on its platform, giving local investors access to blue-chip companies like MTN Nigeria and Dangote Cement. Bamboo CEO Richmond Bassey emphasised the growing demand for these assets, citing their strong returns: “Nigerian stocks are the most in-demand asset class due to their outstanding ROI.”

Beyond Nigeria, Bamboo has expanded into Ghana and South Africa, and this week, it rolled out a new remittance service, Coins by Bamboo, aimed at reducing cross-border transfer costs for the African diaspora.

With Nigeria ranking as the fourth-largest source of immigrants to Canada, Bamboo has secured a Money Service Business (MSB) license to operate there. “Many Africans want to invest back home, but complexity, high commissions, and fees discourage it,” Bassey explained. This remittance play, entering a competitive market against players like Nala and LemFi, is critical to Bamboo’s survival strategy.

Risevest’s East African Play

Meanwhile, Risevest is eyeing East Africa, having recently acquired Kenyan investment startup Hisa. This acquisition allows Risevest, which has some 600,000 users, to operate in Kenya without securing new licenses, leveraging Hisa’s local market knowledge. It follows Risevest’s acquisition of Chaka in 2023, another move aimed at strengthening its local and regional foothold.

By expanding beyond Nigeria, Risevest hopes to tap into the burgeoning digital investment market in Kenya. Risevest CEO Eke Urum has hinted at a cautious approach, saying, “It’s time to understand the company, culture, context, and market” before implementing any sweeping changes.

The stakes are high. As these startups pivot and diversify, the underlying challenge remains: building wealth management platforms in a context where wealth is scarce. Odunayo Eweniyi, Co-Founder & COO of PiggyVest which boasts 5 million users, underscores the gravity of the situation, emphasising that saving has “become more difficult for many Nigerians in the current economic climate.”

Yet, she remains committed to offering features that make saving and investing as accessible as possible, even under immense economic pressure. Inflation-resistant assets and savings options catering to recurring meagre sums are among its solutions.

Market Consolidation and Future Outlook

The wealthtech sector is also seeing signs of consolidation. With Risevest’s recent acquisitions and increasing competition, more mergers and strategic partnerships may be on the horizon. The trend is clear: startups must adapt or risk obsolescence. But can they thrive long-term? The answer could depend on their ability to innovate, localise, and scale across diverse markets.

The proliferation of stock trading platforms across Africa is a testament to the continent’s investment potential. However, their success hinges on more than just product offerings. As economic headwinds batter their core user base in Nigeria, the sustainability of these wealthtech platforms depends on a delicate balance: catering to an audience under severe financial strain while expanding into markets with untapped opportunities.

Bamboo, Risevest, and PiggyVest are betting that their adjustment strategies will pay off. But in an environment where wealth itself is becoming a luxury, the path forward is anything but certain. For now, these startups remain resilient, adapting to serve a user base facing unprecedented economic challenges.