From Chaos To Catalyst: Moniepoint Finds Cash Crisis Doubled Digital Payments In Nigeria

A policy gaffe that rocked Nigeria in 2023 under the orders of the country’s financial industry regulator is inadvertently pushing the country’s digital payments landscape forward and proving a win for fintech startups, a new report shows.

In a key revelation from the 2024 Informal Economy Report put together by fintech leader Moniepoint, the adoption of digital payments in Nigeria has doubled following the severe cash crunch in the first quarter of 2023. This dramatic shift underscores a pivotal transformation in the financial behaviors of Nigeria’s micro, small, and medium enterprises (MSMEs), nearly 90% of which operate within the informal economy.

In the first quarter of 2023, Nigeria’s financial landscape was upended by a significant policy misstep from the Central Bank of Nigeria (CBN). An ill-fated attempt to recalibrate the country’s cash usage led to a severe cash crunch that lasted nearly four months, leaving many Nigerians struggling to access currency notes and costing the country’s economy an estimated USD 43 B.

Despite the turmoil, this cash crisis unwittingly spurred rapid adoption of digital payments, doubling their usage and reshaping the financial behaviours of millions, Moniepoint data suggests, backing up what was previously anecdotal evidence with numbers for the first time.

The report reveals that despite their preference for cash, digital payment methods like cards and transfers still accounted for the bulk of how informal economy players were paid, finding that Only 15.2% of these businesses listed cash as exclusively as their customer’s preferred means of payment.

The Impact of the Cash Crunch

The Central Bank of Nigeria’s (CBN) attempt to enforce banknote reform and stamp out what it deemed excess currency in circulation at the start of 2023 inadvertently catalysed this change. The policy aimed to reduce cash usage by redesigning high denomination naira notes and mandating the return of old bills. However, the rapid implementation led to widespread cash shortages, pushing businesses and consumers to adopt digital payments out of necessity – a trend that has persisted despite the reversal of the policy, the report finds.

“The cash scarcity issue changed things. Moniepoint was in a unique position,” Edidiong Uwemakpan, VP of Global Marketing at Moniepoint, told WT earlier this year. “On one side, cash scarcity affected the cash-in, cash-out aspect of the agent business. On the other side, Moniepoint also had a robust business banking operation.”

Shift to Digital Payments

Nigeria’s informal economy, often referred to as the shadow economy, consists of untaxed and unregistered businesses. This group makes up over half of Nigeria’s Gross Domestic Product and accounts for the vast majority of Nigeria’s approximately 40 million MSMEs, reflecting the entrepreneurial spirit of many Nigerians. Moniepoint’s report delves deep into this sector, gathering insights from over 2 million businesses across the country.

Before the crisis, cash was king, particularly in low-trust environments where small businesses relied on it for ease of use and immediate cash flow needs. However, the cash shortage forced a reevaluation of payment methods. Moniepoint’s data reveals that card payments have become the most common method for in-person transactions, accounting for 80.2% of payments in the informal economy.

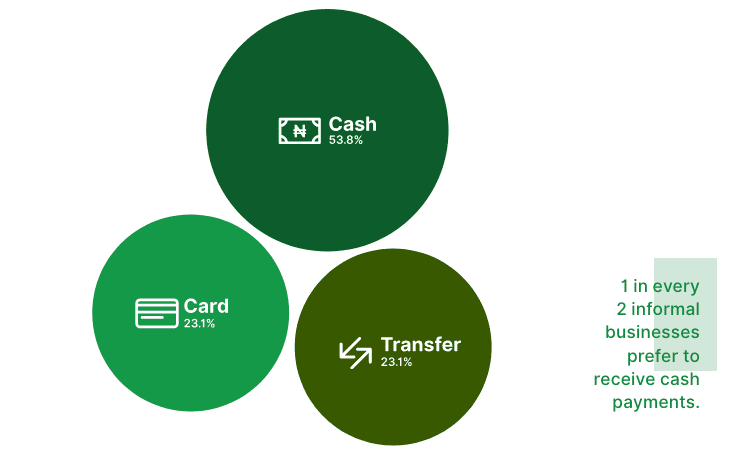

When businesses were asked about their payment preferences, digital methods like cards and transfers emerged as significant players, making up 46.2% of transactions. Interestingly, businesses that preferred transfers also showed a higher tendency for cash usage, highlighting a nuanced transition phase in payment behaviours.

Source: Moniepoint Informal Economy Report

Despite this digital shift, 1 in 2 businesses still expressed a preference for cash payments, citing safety and ease of doing business. For many, cash remains integral for paying for goods and services, even as digital payments continue to gain ground.

However, it’s worth noting that while ‘cash-or-nothing’ has been especially true for small businesses, mainly because of their low income and need for cash flow, this reality has begun to materially change in the last few years with digital payments becoming prominent among previously reluctant groups long impervious to cashless policy initiatives driven by regulators.

The reversal, the report implies, is the unintended consequence of the cash crunch which sparked a dramatic increase in digital payment adoption, maintained even after the policy was nixed.

The Resilience of Fintech

During the crisis, fintech startups demonstrated resilience. Moniepoint, for example, maintained robust business operations, processing an impressive 5.2 billion transactions in 2023, totaling over USD 150 B. This marked a 205% increase from the previous year.

Previously a banking software firm, Moniepoint now operates three distinct products: agency banking, the online payment gateway Monnify, and a newly introduced personal banking service.

“It was important for us to evolve from providing just for agents to include businesses and consumers,” Uwemakpan, Moniepoint’s VP of Marketing, emphasized in an earlier interview. “This evolution allows Moniepoint to close the loop and provide a more reliable service to both businesses and individuals.”

The cash crunch of early 2023 was a challenging period for Nigeria’s financial sector, but it also catalysed change. The crisis underscored the potential and necessity of digital payments, pushing the country towards a more digitised financial future. Fintechs that adapted quickly and strategically emerged stronger.

A Broader Perspective

Moniepoint’s 2024 Informal Economy Report provides a comprehensive overview of Nigeria’s shadow economy, shedding light on the challenges and opportunities within this sector. It combines critical data with expert perspectives to offer a nuanced understanding of the financial landscape.

Here are some other notable highlights:

More than half of the informal economy population is less than 34 years old.

Approximately 90% of businesses in the informal economy make less than NGN 500 K monthly profit.

Women account for 37.1% of people in Nigeria’s informal economy.

51.6% of business owners in the informal sector started a business because they were unemployed.

68.2% state feeding and family expenses as the primary things they spend their money on.

70.7% of businesses get credit from family and friends than from traditional banks and loan platforms.

88.7% of businesses in the informal economy say they pay some form of taxes – usually market levies.

Most of these businesses save their money with a cooperative. Only 1 in 10 of these businesses say they save with a traditional bank.

Businesses in Lagos account for 15.12% of Nigeria’s informal economy.

Retail & General trade, alongside Food & Drinks account for over half of the value of Nigeria’s informal economy.

8 out of 10 businesses have been open for less than 5 years.