Digital Lending Platforms: Why We Need Them And How They Enhance Our Economic Growth

Much has been said about online lending platforms and their effect on consumers. Clearly, some of the concerns expressed are an indicator of some negative consumer experiences even though the continued growth in uptake confirms the high need for the service as well as a significantly higher positive experience by most consumers.

The digital credit revolution continues to grow because of the many benefits that come with it. Now more than ever, tech-savvy, low-income earners and the unbanked population have access to credit. Startups have easier access to small loans to grow their businesses, a challenge which entrepreneurs have grappled with for a long time.

Easier access to credit has been a key priority to ease financial constraints that hinder small business growth critical for improving incomes and mitigating poverty.

Digital loans have made it easy to access emergency funds, which are mostly needed to ensure urgent situations do not get out of hand.

Digital lending platforms offer their loans at higher market prices compared to loans offered by banks but considering that the loan amounts are quite small, the small business borrowers are riskier; the loans are unsecured, and they do not have the comfort of verifying borrowers personally, it’s only fair for them to charge at slightly

higher prices.

Also, given the fact that most of the digital lending platforms are private non-banking institutions who source their funding from private investors and not deposits as banks do, it makes sense for them to charge more because of the higher cost of funds they have to bear.

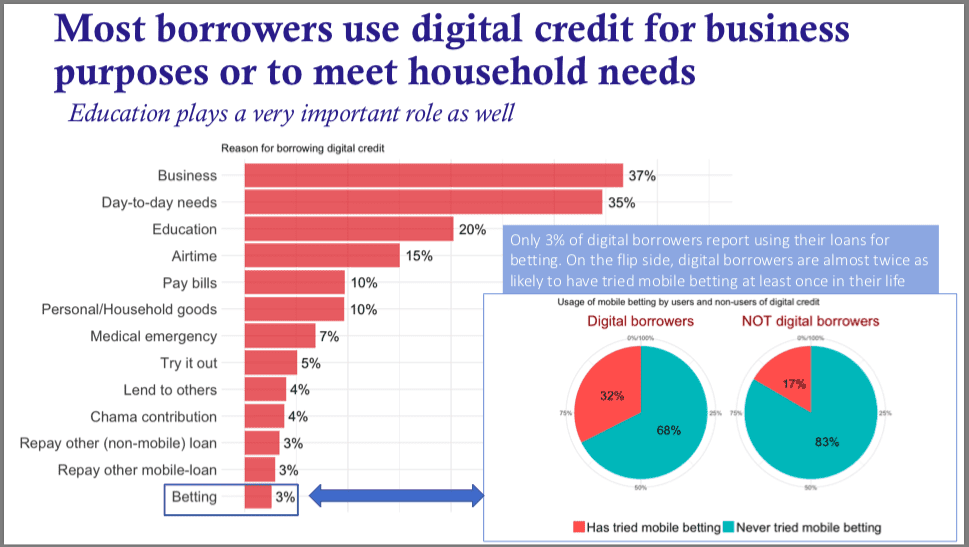

While digital loans are normally short-term loans which are mostly used by borrowers for smaller projects like paying bills and buying foodstuffs, traditional/bank loans are usually used for bigger projects like buying cars or property construction or purchase.

“We should bear in mind that digital loans have a completely different purpose and usability than the bank loans for instance” – says Robert Masinde, a chairperson One Robert Masinde, the Chairman and Founding Member at Digital Lenders Association of Kenya (DLAK) and the CEO Zenka finance.

He also adds, “The digital loan amounts oscillate around 40 USD, whereas banks offer loans at the level of c.a. 3,000 USD. Digital loans are hassle-free, given in a customer-friendly manner and issued instantly.”

Banking institutions that have ventured into digital lending have an advantage because they source the money they lend from the public or other banks. But for the private non-bank lenders who fully depend on investors’ money to lend, their costs are higher because they have to cater for higher costs of funds, operational costs and risk to offer the unsecured loans.

The mobile lending space has metamorphosized the credit lending landscape making it easier and more convenient to access loans. Digital lending has experienced tremendous growth and continues to grow mostly as a result of the friendly policy environment.

The recent calls by lawmakers to have online mobile lending platforms regulated by re-introducing the Money Lenders Act that was repealed in 1984, may end up doing more harm for the Kenyan economy since the lending industry is providing financial access to millions of Kenyans and small business owners who do not qualify for bank loans.

It has already been demonstrated in various case studies that price controls rarely achieve the intended objective of increasing credit access.

On the contrary, it ends up creating scarcity and restricted access pushing the same intended beneficiaries of the controls into the black market where they end up paying much more than before the controls were put in place.

A case in hand is the Kenyan banking interest rate capping law introduced in 2016 with the intention of reducing the cost of credit and therefore improving credit access for the small and medium-sized businesses. 3 years later the results prove that the opposite effect is what has been achieved.

With interest rate caps most banks in Kenya reduced their credit supply based on risk criteria such that in the end the SMEs have been completely excluded from credit access which some of them could access easily prior to the interest rate caps.

Expanding access to credit is one of the foundations for improving financial development.

Financial inclusion is key to not only personal development but also national growth.

Financial inclusion is important. Ensuring the safety and security of using mobile lending platforms is equally key.

Safety- regulators, central banks and professional Digital Lenders as well need to play a role in providing borrowers with financial literacy and awareness so that digital financial products are better understood by users.

Many borrowers may not make informed decisions due to limited financial literacy. It is thus important that regulators ensure consumers have the requisite knowledge before taking up these easy loans.

It is also up to the lender to share information about their terms and conditions to enable consumers to know the loan comes with obligations and timelines of payment failure to which there is a penalty. Also, the lender should always ensure whoever they are lending is capable of paying. After all, it’s the lender’s capital at risk.

Consumers should also be cautioned against taking up huge loans which they may not be able to pay back.

Truth be told if used responsibly, mobile loans can boost business and boost growth at different levels.

Inappropriate or disproportionate regulations from the government will hurt the mobile lending space, which is making financial services available to those who would normally not have access.

Masinde emphasizes “The impact of the financial education is unquestionable. Better educated and financially aware clients appreciate the advantages of short-term loans, and at the same time can avoid their possible drawbacks.

European markets’ statistics prove that passing the in-app financial tests by the clients results approximately in the 30% improvement in their loan’s repayment, reducing the risk of over-indebtedness.”

He reiterated that education is an issue adding, “Therefore major digital lenders in Kenya are taking steps to increase the customers’ financial awareness and knowledge. Tala is an excellent example of such an approach. The brand has recently launched a mobile learning platform called Enlighten, providing customers with inspiring financial tips, thus helping them to make better economic decisions and to deal with everyday challenges. Undoubtedly, education is the most effective measure in improving the financial literacy and financial inclusion of Kenyans.”

Introducing regulations that are not well thought through may take away from millions of Kenyans the only means they have to access finances and will end up hurting them as opposed to bringing good.

Thus, building responsible digital financial practices to protect consumers and to improve their understanding of digital financial products will be much more beneficial to the consumers than simply imposing stringent rules and legislation that may disadvantage and eventually destroy the thriving digital lending sector.