UTU Technologies, On Using Artificial Intelligence To Create Trust Online

In any business, trust is a driver of customer loyalty and is what keeps them coming back. In the physical world, trust is easier to establish. This is not the case online yet it is necessary for any online business to make profits. But how do online users establish this trust?

Many online users rely on reviews and ratings posted by individuals unknown to them, to gauge the reliability of services and products. They serve as a powerful-decision making tool for online consumers.

Statistics show, 91 per cent of consumers read reviews before making a purchase. It also takes consumers to read an average of 10 reviews before trusting a business.

Much as these reviews are trusted, they are susceptible to abuse and manipulation and might not be an accurate representation of how other users feel about a product or service. So rampant are these fake reviews, that around 79 per cent of consumers have come across fake reviews.

“Economic incentives online on trust are perverse and corrupted. The ones that exist are for the manipulation of trust, ” says Jason Eisen, founder and CEO of UTU Technologies.

If consumers had a better option apart from reviews and ratings, they would trust a recommendation they get from somebody in their network in order to make a sensitive decision as opposed to what they would read online. A dated study by Nielsen Global had shown 92 per cent of consumers trusted recommendations from family and friends, more than they did other forms of advertising.

UTU Technologies aims to disrupt this space and has built Trust Engine Infrastructure which digitizes and optimizes trust.

Birth of UTU Technologies, the company that sells trust

Before ride-hailing startups penetrated the Kenyan market, passengers would have a reliable driver or rider saved in their contact list who would provide their service on demand. When Jason Eisen came to Kenya, he faced transportation challenges within Nairobi city. Having used convenient modes of transport before, he started MaraMoja Taxis in 2013, a ride-hailing platform that banks on trust to deliver transportation services. The platform uses Trust Infrastructure As a Service (TIAS) to help its users book taxis within the city through recommendations from other users on its platform.

Leveraging technology, MaraMoja Taxis used the concept of passengers saving contacts of their reliable riders to localize its offering. Its application mines data from a user’s contact list, which is used to recommend drivers through social connections. The passenger therefore and the driver develop trust in a way, since they share a connection. This also helps users feel safe.

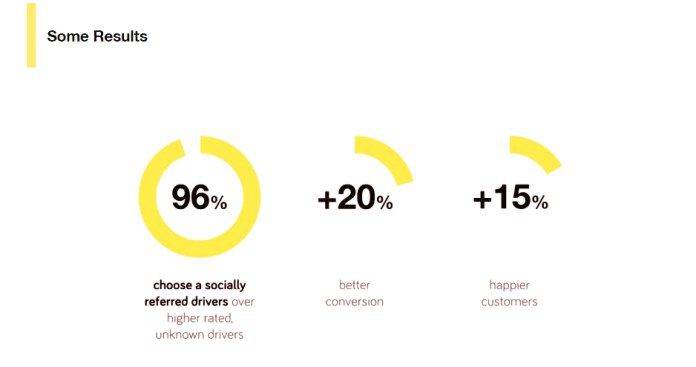

Over 100 000 connections have been established on their platform in Nairobi alone, with 96 per cent of consumers preferring socially-recommended drivers over highly-rated drivers, on its platform.

Adopting TIAS helped the company incredibly improve key metrics, such as acquisition, conversion, customer satisfaction, viral acquisition and retention rates. With time, Jason noticed the need for TIAS in various other sectors. Entrepreneurs from various sectors were approaching him on using this trust system in their operations and he saw a window for optimizing trust using artificial intelligence (AI).

Subsequently, UTU technologies was founded. One of the few artificial intelligence startups in the continent, UTU uses AI to model trust. Through its Trust API, it offers personalized recommendations for trusted service providers.

It’s machine-learning algorithm that is based around the real human experience of trust can be integrated in various sectors, so far having worked with players in mobility and financial inclusion startups such as Jamborow, an AI driven financial platform solving the problems of financial inclusion in West and East Africa.

Most recently, UTU announced a partnership with Graychain, a Hong-Kong based company that produces credit scores for cryptocurrency. Through the partnership, Graychain would leverage UTU’s trust engine to create a credit scoring ecosystem for crypto.

“There’s almost no sector where trust is not important”

UTU has also specifically worked with peer-to-peer lending systems to increase trust and reduce risk. It is working with insurance companies to develop socially powered insurance products, telecoms to understand peoples networks better and help build better calling packages, talent-tech, proptech, dating apps, online professional marketplaces, healthtech, due diligence platforms, e-commerce and many other platforms.

UTU also tokenizes the acquisition of users and data. Users enter data in the system which is accessed by the company at the user’s discretion. The more data shared in the system, the more tokens one gets. These tokens can be used to make endorsements of service providers. For instance one can endorse a nanny with 50 tokens, driver with 20 tokens etc. Other users gauge their services using the tokens earned by the service providers and make decisions based on that.

User privacy

UTU also believes users should be in total control of their data and has in place privacy reservation mechanisms to help users protect their data. Through blockchain, it creates safe, private data refuges to let people securely store and govern access to their data.

This is also the same with MaraMoja Taxis, which requires a users permission for the app download and for accessing the users contact lists. Contents of the list are also encrypted via blockchain allowing users to granularly control their data in a user-friendly manner.

Feature photo courtesy: CIO