SA’s Largest Independent Card Payments Provider Is Laying Off Staff & Cutting Pay

One of South Africa’s most recognised fintech startups, Yoco, is downsizing significantly in an attempt to survive the cash crunch triggered by the economic impact of the coronavirus pandemic.

Yoco, which currently claims over 150 employees on its payroll, has issued a statement declaring that it is adjusting its team size in light of the current economic realities.

The company said it is making the difficult call based on “the painful reality that a significant adjustment to its personnel costs is required” for the business to be able to steer through this testing period and keep its mandate of “serving small businesses during this pandemic and after.”

Although Yoco wouldn’t immediately confirm the exact number of employees that will be affected by the layoff, nor would the startup reveal which departments will be most rocked by the looming retrenchment, one of the company’s co-founders did tell WeeTracker that both staff base and paychecks will be trimmed during the exercise.

“We are still in the process of working through the final numbers to adjust the personnel costs,” said Carl Wazen, Yoco’s co-founder and Chief Business Officer. “It includes a host of measures that will impact headcount and remuneration to adapt to the new conditions.”

In the company’s earlier statement, it was mentioned that Yoco’s entire leadership team has already agreed to reduce their salaries.

Since the COVID-19 outbreak spiraled out of control and became a global pandemic that has pretty much forced the world to shut down, Yoco claims it has been innovating so as to be able to continue supporting small businesses during what is a torrid time.

With South Africa among many countries that announced a full lockdown, the Cape Town-based fintech company, which helps small businesses accept card payments and manage their day to day activities, had adjusted to the times.

First, Yoco had launched a suite of new online payment products, designed to help small businesses transact remotely. And then the startup rolled out an online directory, Support Small, to help small businesses be more visible and find new customers online. All these, while operating entirely remotely.

While those measures have helped, the reality is that the COVID-19 pandemic continues to have a profound impact on the economies of nations, and its repercussions are expected to last long after the virus is gone. Yoco said this impact has extended to the startup and the 75,000+ merchants on its network.

“Consequently, this requires us to take some urgent and difficult decisions on how we operate and manage costs. It is essential to ensure that we can continue serving small businesses during this pandemic and after. Over the past weeks, we have scrutinised every expense and explored various alternatives to achieve this objective,” Yoco’s CEO, Katlego Maphai, said in a statement.

“As a result of this exercise, we came to terms with the painful reality that a significant adjustment to our personnel costs is required. The entire leadership team has already agreed to reduce their salaries. The next primary imperative is the adjustment of our team size.”

“We have chosen to act early and take these difficult measures to secure the best possible outcomes for those who will be parting ways with us,” he added.

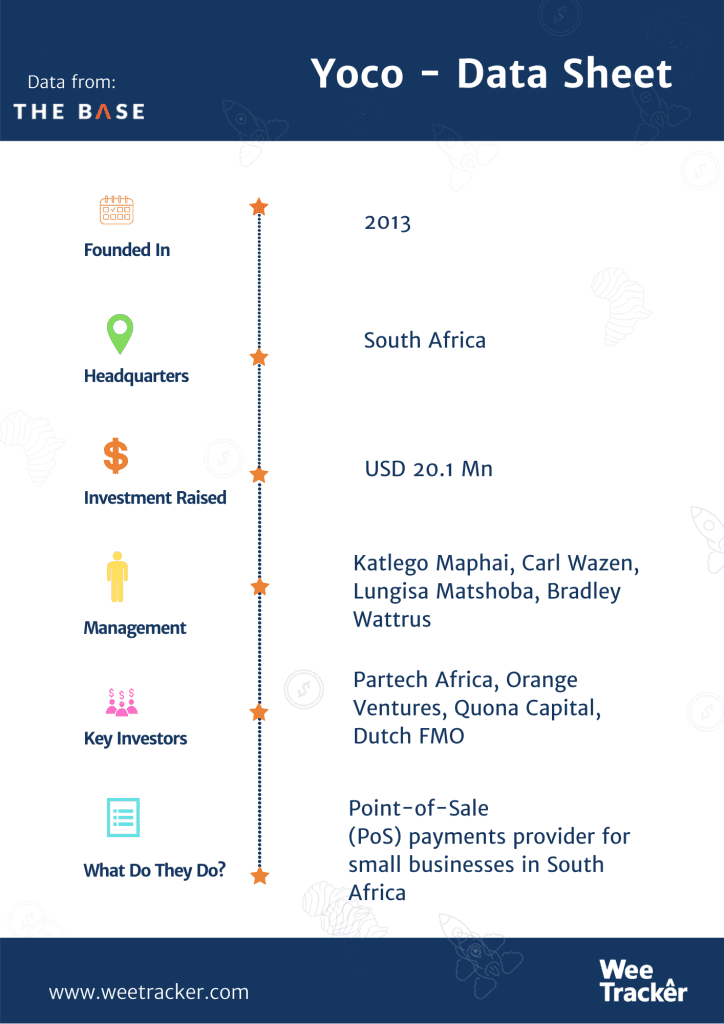

Yoco has been operating in South Africa for seven years now. Founded by a quartet of friends; Maphai, Wazen, Lungisa Matshoba (Yoco’s CTO), and Bradley Wattrus (Yoco’s CFO), the startup serves as an open commerce platform that makes it a lot easier for small businesses to receive payments.

Since launching its first product in late 2015, a card reader that connects with a merchant’s smartphone or tablet, the company claims to have grown its base to over 75,000 South African small businesses, 75 percent of which had never accepted cards previously.

At one point, the company said it was adding more than 1,500 new merchants every month, making it South Africa’s largest and fastest-growing independent card payments provider by “number of merchants.”

Yoco has raised over USD 20 Mn in up to four funding rounds, with the most recent being the USD 16 Mn Series B round closed in 2018, led by Partech Ventures. Among the startup’s other backers are Quona Capital, CRE Venture Capital, Orange, Dutch FMO, and some others. In 2017, Yoco was selected by CB Insights as one of the top 250 fintech companies globally.

With this development, Yoco becomes one of the first ‘high-profile’ African tech startups to have publicly announced the decision to cut some employees loose in an attempt to survive what is a testing time.

Layoffs, salary cuts, and furloughs are among the survival measures being taken by startups at this time. By ripping the band-aid early, Yoco is hoping to weather the storm. According to the startup, further details on severance benefits and support will be relayed subsequently.