The Top 4 Mobile Money Purchases Of The African Youth Has One Recurring ‘Disturbing’ Item

The proliferation of mobile money on the African continent has brought with it a certain change in the spending habits of a select demographic, with the African youth, in particular, showing quite an appetite for digital financial services.

Just recently, GeoPoll which provides research services in emerging markets throughout Africa, Asia, and the Middle East, embarked on a study to examine how Africa’s youth across six countries in sub-Saharan Africa are engaging with financial services. And there were some interesting finds.

In a report titled: “The State of Financial Services in Sub-Saharan Africa” (PDF), GeoPoll laid out findings from an extensive web survey conducted in Nigeria, Ghana, Kenya, Uganda, Tanzania, and Ivory Coast, which saw it gather data from around 400 youth aged between 18 and 35 in each of the six nations.

GeoPoll’s study zeroed in such aspects as spending habits, payment types, income streams, investment decisions, savings patterns, etc., obtained from populations who have access to a mobile phone and basic internet services — typically the target population for mobile money services and retail banks.

Here are the top four mobile money purchases of the Nigerian youth;

- Airtime

- Pay-TV

- Home Internet

- Gambling/Betting

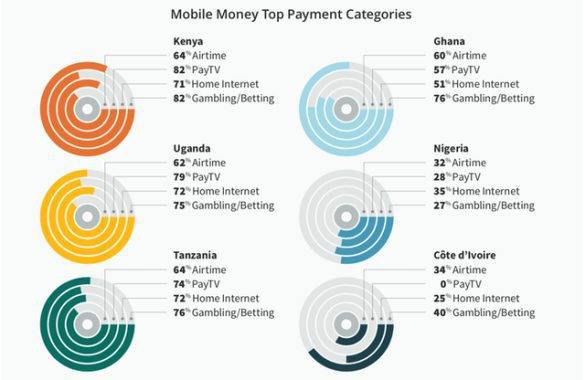

As a matter of fact, in what seems like an odd coincidence, those four items are also the top four mobile money purchases for youths in Kenya, Uganda, Ghana, Ivory Coast, and Tanzania, albeit in slightly differing orders.

GeoPoll found a startling consistency across all six countries, where mobile money has a 28 percent average use rate. Youth in each country spent most of their mobile money on very similar products. Mobile money was the most popular payment method for:

- Gambling – 63 percent of respondents used mobile money for online gambling

- Home Internet – 54 percent of respondents paid for internet access using mobile money

- Mobile phone airtime – 53 percent of respondents logically used mobile money for airtime

- Paid television services – 53 percent of respondents bought premium TV using mobile money

Mobile money was used least as a payment method for non-digital purchases, such as transportation (10 percent), non- alcoholic beverages (12 percent), clothing (13 percent) and groceries (13 percent).

The standout statistic is probably the numbers from gambling which echoes the findings from separate research. This number points to a ‘gambling problem’ among the African youth.

The GeoPoll findings mirror other several reports that point to gambling overall – on and offline – as a real problem across the continent. Sports betting, in particular, is buoyed by gusto for wagering on European football teams and bettors rely almost entirely on mobile money to make bets and collect winnings.

On the African continent, data points to the Kenyan youth as the biggest gamblers with over 12-million betting account holders losing an estimated USD 2 Bn annually. The top 12 sports betting and gambling websites in Kenya have total financial turnover above KES 250 Bn, eclipsing even the national recurrent budget.

Featured Image Courtesy: IFC