Traditional Banks Charge Way Too Much Fees, But There Could Be A Solution

The bane of traditional bank charges is not new to many Nigerians and Africans. Aside from the hassle of visiting branches to get account updates and request for ATMs, the infrastructure itself has time and again proved porous. Bank accounts have been breached, and hackers have carted away with sums of customers’ money in situations banks would rather not take responsibility for. Is Kudabank the answer?

The Problem

An investigation reveals that 4 leading banks in Nigeria generated NGN 24.3 Bn from account maintenance charged on their customers’ accounts, between January and June 2019. It represented an increase of about 19.8 per cent from NGN 20.39 Bn generated within the same timeframe last year.

Monthly, some traditional banks charge their customers NGN 50 with, regardless of whether or not they use ATM cards. Some others deduct as much as NGN 1,000 every year for maintaining people’s savings accounts.

Last year, the country’s Senate implored the Central Bank of Nigeria to suspend the deduction of card maintenance fees. The banking committee of the upper legislative also received a mandate to investigate the deduction in comparison with what obtained in other countries.

Their large customer base possibly prompts the way some banks earn from maintenance fees. For instance, the merger between Access Bank Plc and Diamond Bank Plc this year aided Access Bank a 96.15 per cent increase on account maintenance fees. It recorded a shift from NGN 3.14 Bn in the first 6 months of 2018 to NGN 6.16 Bn in the same stretch of 2019. The bank, in defence, says the bulk of the cash was made from charges to maintain current accounts.

On the global front, the financial services market is experiencing a tectonic shift. The change has given rise to a new wave of opportunities and challenges, from which Nigeria is not exempted. The post-crisis regulatory frameworks have been gradually settling into place.

As such, financial institutions have been trying to adjust their business models to stay in the game. Nevertheless, customers have decried having to deal with high charges from traditional banks that are reliant on fee income.

Kudabank, The Solution?

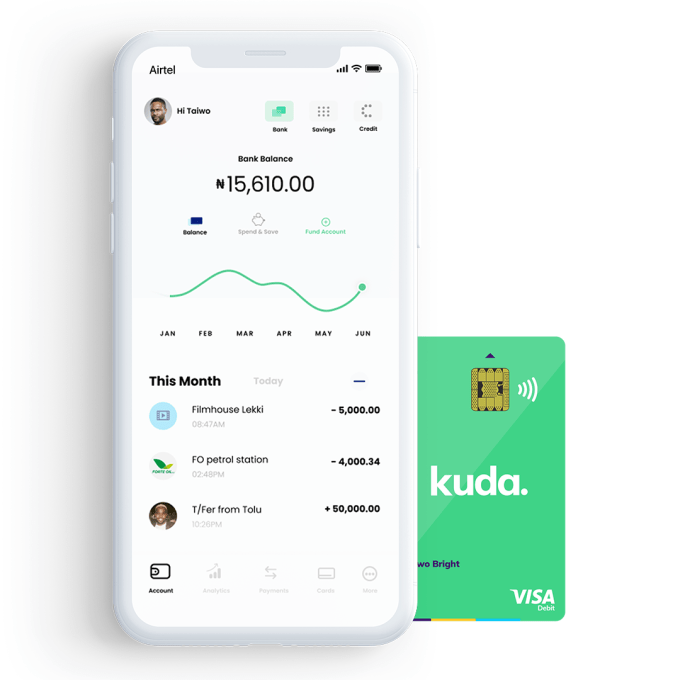

Granted, the average Nigerian bank earns more than 20 per cent of its income from bank fees and charges. But there’s a startup that is not just following the practice but taking things online – Kuda or Kudabank.

The fintech runs a digital-only platform that enables its customers to have bank accounts without having to visit a branch. In an email to WeeTracker, Babs Ogundeyi, co-founder and CEO of Kudabank, said that the company sees challenges as an avenue to introduce a fresh perspective on banking in Africa.

“We’re using technology to build a new kind of bank that empowers our members, de-emphasizes fees, prioritizes great customer service and helps them get ahead by making managing money easy, affordable and accessible, and finally provides a genuine alternative choice to the traditional banks. As a fully licensed bank, we control the banking value chain. This means we can control the experience for the customer better and also allows us to be more innovative with our product offerings”.

Two weeks back, the Lagos-based startup closed a USD 1.6 Mn pre-seed round. Babs says the company will use the money to expand its product offerings. Along the line, Kudabank will incorporate consumer savings, rewards, and peer-to-peer payments as part of its digital financial offerings. Currently, the company is rapidly hiring across various teams and buildings out its developer base as it plans to launch out of beta in the last quarter of 2019.

Ogundeyi was formerly the founder of classifieds publication Motortrader. Before founding Kuda, he worked in a financial advisory role with the Nigeria government. He joined hands with Musty Mustapha, a former Stanbic Bank software developer, to found the company. The Managing Director of Tolaram Group alongside other angel investors availed Kuda it’s USD 1.6 Mn pre-seed.

The ‘How’

Ogundeyi tells WeeTracker that Kuda’s digital-first approach and focus on zero fees banking offers a genuine alternative choice for African consumers. “With Kuda, our members get an intuitive mobile-first experience that is quick to set up, a world-class app and services that work seamlessly to make their lives easier,” he said.

The all-online platform provides the company with a competitive advantage. The startup is able to offer the majority of the products and banking services that consumers get from traditional banks but via a tech stack.

Needfully, this helps the Lagos and London-based firm offer those same products faster and at a better cost than conventional banks. The online bank does not spend money maintaining branches and running complex operations like other financial institutions. So doing, the fintech can pass its savings to customers in the form of zero fees.

However, to scale in Nigeria and add a couple of physical infrastructure to its online model, Kudabank is partnering with the big boy banks. It currently has correspondent relationships with three of Nigeria’s largest financial institutions – Access Bank, Zenith Bank, and GTBank. Notwithstanding, these banks are not investors but partners.

The partnership will allow Kudabank customers to use these traditional banks infrastructure if need be. ATMs can be used to deposit and withdraw cash into and from their bank accounts. All of these come with no fees. Kuda has also received a license from the Central Bank of Nigeria.

Why It’s Needed

Compared to other African countries, Nigeria has been somewhat dragging its feet to convert digital payments. A 2018 Enhancing Financial Inclusion and Access (EFInA) report, however, shows that the banked population in Nigeria is up from 36.9 million in 2016 to 39.5 million in 2018. The same survey also reveals that affordability and institutional exclusion are the biggest obstacles to having a bank account in the country.

In a conversation with WeeTracker, Shalom Dickson – Lead Visionary at Paperloops (fintech) and Lead Solutions Designer at internovent – said that the everyday customer feels that the default relationship between banks and the public has been akin to an authoritarian emperor and his followers.

“It’s like a black box whose mysterious operations are only known to insiders. It’s important, however, to note that banks do not choose to be evil overlords but they are due to the complex nature of conventional money management itself,” Shalom underlined.

“However, modern financial technology, relying less on cash, eliminates most of the issues especially around complicated operations and mysterious charges. Kuda, although reportedly being the first to tackle mainstream banking head-on with a microfinance license, will not be the last.

“The secret to cutting cost is in how much can be digitized and automated, and they’re doing just that. It doesn’t take a prophet to see how this will revolutionize the operations and appeal of banking as we know it,” Shalom concluded.

Going Forward

Kudabank says it will offer checking accounts with no monthly fees. Its debit cards are also free, compared to the NGN 1,000 charged by most Nigerian banks. The startup also plans to offer consumer savings and P2P (person to person) options on its online platform when it launches out of beta.

The app allows customers to open a bank account in five minutes. The KYC (know your customer) process is swift and customers can start using it forthwith. A handful of traditional banks have adopted this method, but it is yet to reach perfection. One still has to visit a branch and stand in long queues to get all the vitals working.

It’s only a matter of time before other startups like Kuda emerge into the Nigerian technology space. The country’s 190 million people and impressive mobile phone penetration make the market ripe.

Regardless of the growing niche market, digital banks need to work hard to cement their place in the financial landscape. They must find a way to secure their place in the financial landscape or else run the risk of obsolescence – ironic as that is.

The outcome, for the consumer, is likely to a blend of digital and traditional banking. The two will work hand in hand to provide financial products, access to markets, and account services across the spectrum of fiat and cryptocurrency.

Image Courtesy: Mobile World Live