X-raying The Call That Crushed South African eCommerce During Lockdown

eCommerce was blocked in SA when it was needed the most

Unlike most other countries of identical economic standing where online commerce is proving a saviour and booming, South Africa inexplicably put a leash on e-commerce and stifled the sector at arguably its most opportune time. It was a leash so tight, it almost choked the life out of e-commerce platforms in the country.

The result? Huge revenue losses, several lost jobs, potentially, and a number of enterprises that would have been getting an autopsy and might even still do despite yesterday’s update that the e-commerce leash is now off.

Due to the COVID-19 pandemic, South Africa has been caught between total and partial lockdown since March 27, allowing only essential services to operate while barring non-essential services. And e-commerce platforms have been caught up in the regulatory tightrope.

Before yesterday’s revised lockdown directive gave the green light to e-commerce platforms to resume the sale of all goods (except alcohol and tobacco products) for the first time in nearly 8 weeks, online retailers were prohibited from selling or delivering any non-essential goods during the lockdown.

This had forced many e-commerce platforms operating in the country to basically become suppliers of toiletries, sanitary products, food, baby products, and healthcare products.

Last month, South Africa’s biggest e-tailer, Takealot, said it had seen its revenue decline by as much as 80 to 90 percent since the lockdown took effect due to the restrictions on e-commerce.

The Naspers-backed company had also claimed that it was seeing only 15 percent of its usual sales volume and USD 20 Mn had been lost in the first 3 weeks of the lockdown. There were concerns that a sizeable portion of the 2,000+ employees on its payroll may have to be cut loose.

In a more recent interview with eNCA, Takealot’s CEO, Kim Reid, revealed even more concerning numbers.

As Reid said, prior to the restrictions, Takealot had approximately 3,000 business which sold their products through the Takealot marketplace, using its distribution network, payment mechanisms, and marketing.

When the lockdown took effect towards the end of March, the number of shops dropped to 500 because of e-commerce restrictions. Easing the lockdown ever-so-slightly to Level 4 made little difference as the CEO revealed that up to a thousand of Takealot’s marketplace sellers have not sold a single item since the lockdown started.

Additionally, most of the sellers which are selling products are only trading at between 10 percent to 15 percent of their previous revenue, Reid said.

Why take his word? Takealot is not only the dominant e-commerce player in South Africa but is also the repository of the best insight into the South African e-commerce market as it runs its own online platforms and operates a marketplace to enable smaller online shops.

Why stifle a blossoming sector?

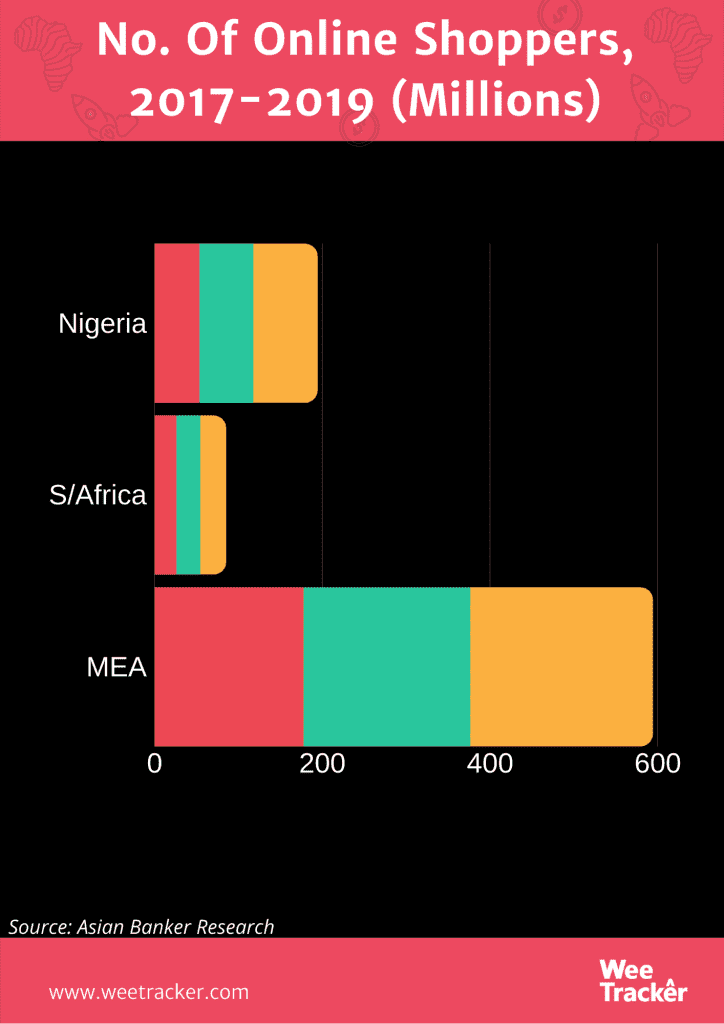

South Africa’s e-commerce market is worth approximately USD 3 Bn, second only to Nigeria on the African continent in terms of both the number of shoppers and revenue. But when it comes to online spending in Africa, South Africa is unmatched.

Recently released data shows that, across the continent, South African shoppers spent an average of USD 109.00 on online purchases on consumer goods — the most among African countries — in 2019.

Globally, South Africa is the 35th largest market for e-commerce, even ahead of New Zealand. With an increase of 14 percent, the South African eCommerce market contributed significantly to the worldwide growth rate of 13 percent in 2019.

According to a report by the United Nations Industrial Development Organisation (UNIDO), in 2017, online sales in South Africa amounted to USD 680 Mn and this figure is expected to shoot up to USD 1.23 Bn by 2021. Currently, though, e-commerce accounts for only 1 percent of total retail sales in South Africa.

That figure is a long way off from the top e-commerce markets (U.S., U.K, and China) but it also represents a huge growth potential. Indeed, over the course of the last few years, South African e-commerce has witnessed a growth of over 20 percent annually.

Furthermore, as stated in the report, other studies suggest that the country’s online retail segment is expected to grow to ZAR 18 Bn (USD 971.9 Mn at current rates) by 2021, but will remain a very small proportion of the overall retail market in South Africa, projected to be ZAR 1.5 Tn (USD 80.9 Bn).

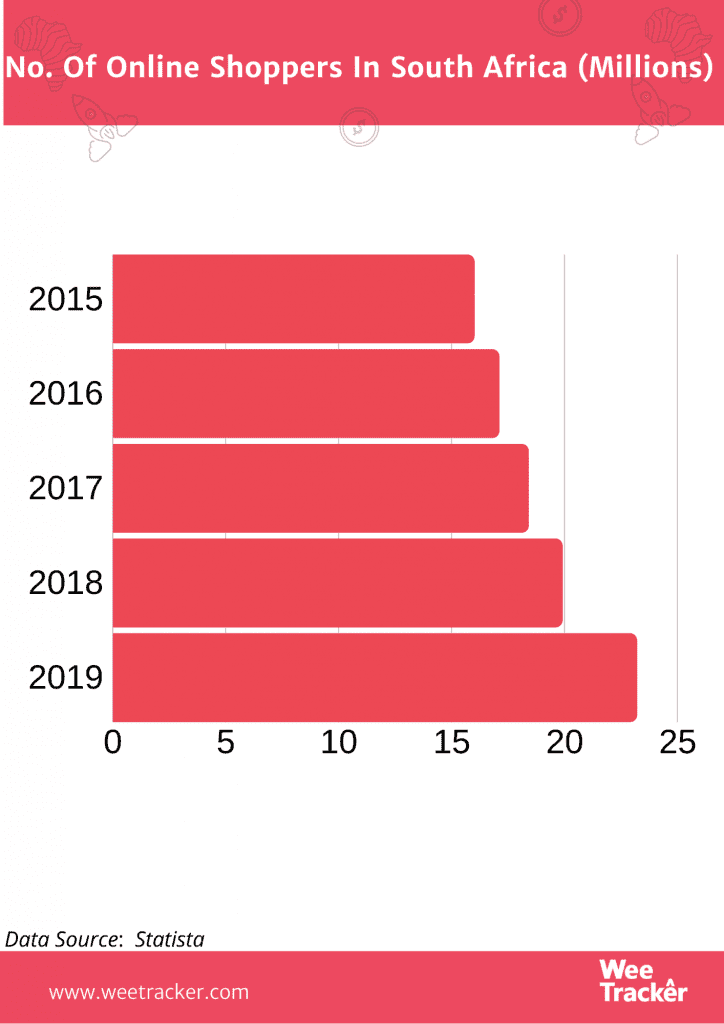

More so, there are currently over 20 million e-commerce users in South Africa, with an additional 6.36 million users expected to be shopping online by 2021 and spending a predicted average of USD 189.47 online.

Currently, there are over 30 online commerce platforms in South Africa and e-commerce penetration stands at 34.8 percent.

So, what was the rationale for restricting e-commerce during the lockdown knowing that it solves trade problems and checks all the boxes when it comes to social distancing and self-isolation?

Well, South Africa’s Minister for Trade and Industry, Ebrahim Patel, said the call to restrict e-commerce was made with “fairness” in mind. Patel was of the view that giving a pass to online retailers would be “unfair” to physical shops.

“If we open up any one category, let’s say e-commerce, unavoidably there’s enormous pressure to do the same for physical stores,” the Minister had stated.

How the stakeholders responded

Although clarity on the phased removal of the restrictions on online shopping platforms eventually came in late Thursday, May 15, several groups have been mounting pressure on the government to not only allow unfettered e-commerce but also lift the lockdown entirely.

Before now, the explanations from the Minister had particularly sparked outrage. In the earlier mentioned interview, Reid had implied that the argument of the Trade Minister is exasperating and hollow.

“South Africa is the only country in the world where e-commerce is not being used to support social distancing measures,” he had said.

“The World Trade Organisation said e-commerce increases competition and enables businesses. There is no competition issue here.”

He had also rebuffed the argument that there will be too many vehicles on the road as equally frustrating and unfounded.

“E-commerce should be trading at 100 percent capacity right now, if not more. If you look at other countries, e-commerce has increased substantially during this time.”

Similarly, Andrew Smith, co-founder of online retailer, Yuppiechef, had expressed his frustrations at the reasoning backing the decision to stifle e-commerce.

“Why should we not let it [e-commerce] carry on? There’s nothing about this lockdown that is fair!… It’s a very safe way to get goods to people,” he had been quoted as saying.

Meanwhile, Cas Coovadia, CEO of Business for South Africa, had said e-commerce should be opened up “totally” with immediate effect.

Allowing people to do their shopping online not only helps e-commerce companies but will also kickstart courier services and economic activity, he had explained.

Additionally, SARS commissioner, Edward Kieswetter, had supported the call to unshackle online commerce, stating that e-commerce holds great potential for South Africa and should be opened up.

Kieswetter had opined that many people think of e-commerce as a virtual economy – but it opens a full value-chain of economic activity.

While it’s unclear whether these calls had any direct influence on the newly announced changes to Level 4 regulations that now permit business activities in the retail space and e-commerce, it is quite obvious that South African e-commerce has finally caught a break.

Although, at this point, some damage may have already been done and it’s kind of a general feeling that the correction took too long. Some would say a correction should have never been necessary because the e-commerce restrictions should never have happened in the first place.

Featured Image Courtesy: TheConversation