Africa’s Largest Bank Is Getting Sucked Into A Pandemic-Shaped Hole

A COVID-shaped cloud hovers over Africa’s largest bank

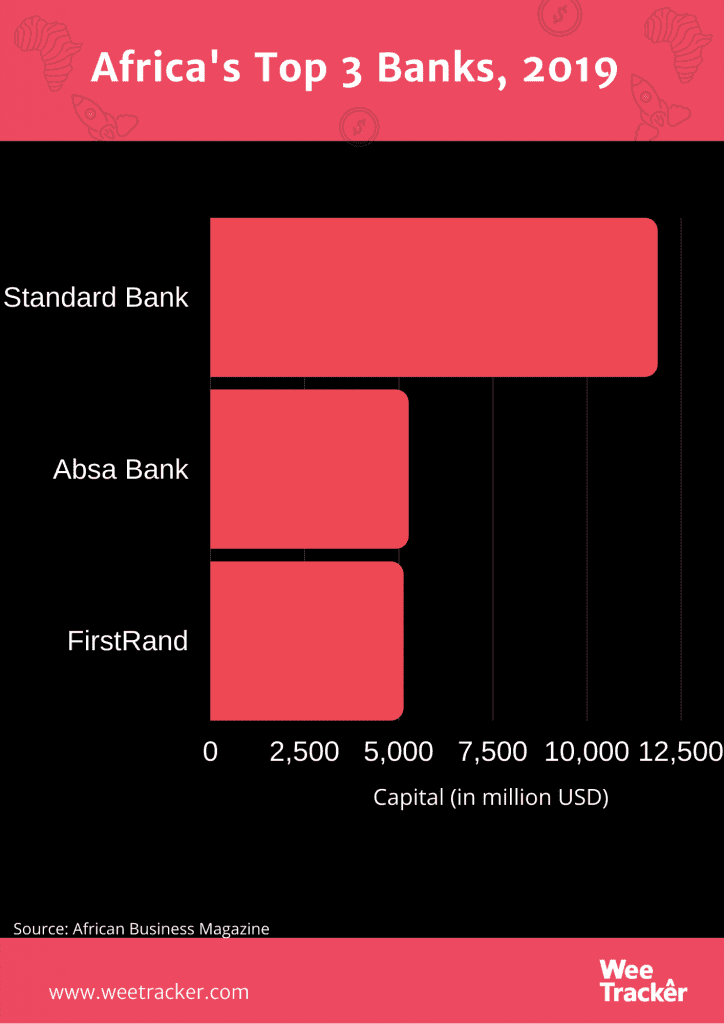

In April 2020, Standard Bank Group Ltd. — by far the largest bank in Africa in terms of tier 1 capital — announced that it had taken a beating. That month, the bank reported its financial results for the first quarter of the year, and the impact of the pandemic was clearly felt.

Standard Bank said its first-quarter net income declined 27 percent as it braced for a spike in loan defaults. The loan defaults surge came as measures to contain the coronavirus shrunk personal income and dealt a blow to businesses.

The decline may have been expected as the disruptions to finances and financial services, since the COVID-19 outbreak, have been quite significant.

However, even as lockdown measures are starting to ease globally and industries have begun to return to some degree of normalcy, the lender is not expecting that the malaise suffered will let up anytime soon.

Standard Bank expects first-half earnings to compress by more than 20 percent this year as the fallout of the coronavirus pandemic rocks Africa’s largest lender.

Per a statement released on Monday, the bank anticipates headline earnings per share and earnings per share to be lower than the 837.4 cents and of 827.0 cents reported a year earlier.

The lender also said it would issue a further trading statement with more specific guidance ranges once it achieves reasonable certainty regarding the depth and extent of the decline.

Not the best of times for Africa’s top lender

South Africa’s Standard Bank Group, the top-ranking bank in Africa, is far ahead of even the continent’s second-placed bank, Absa Bank, in terms of tier 1 capital. However, the lender’s track record of impressive growth over the years has slowed somewhat in recent times.

Standard Bank’s soaring growth of previous years turned into a decline as capital fell back 10 percent from USD 13.2 Bn at the end of 2017 to USD 11.9 Bn a year later – though it still represented a gain in rand.

The bank’s total assets fell by a similar amount to USD 147.7 Bn and net profit was down to USD 2.3 Bn. However, Standard Bank remains on a growth path despite the difficulties in South Africa’s banking and economic environment, which were existing even before COVID-19.

The continued growth trajectory is also partly beefed up by earnings outside South Africa – Standard Bank has operations in 20 countries across Africa. Last year, it beat its strong return on equity (ROE) performance, scoring an impressive ROE of 19.1 percent in 2019.

The factors behind the expected slump

In Sub-Saharan Africa, the human impact of the COVID-19 pandemic is growing. Standard Bank warned that this would likely affect its earnings, as the outlook for the twelve-month period ending 31 December 2020 (FY20) continues to deteriorate.

The lender reiterated that in Africa regions (the group’s African operations outside South Africa), the lockdown period has averaged 37 days. But in South Africa, various forms of restrictions have been in place for more than 60 days.

“While the economic data is likely to take some time to catch up, the toll of the lockdowns is starting to emerge,” a part of the statement reads.

More specifically, the bank attributes the forecasted decline to the lockdowns which negatively impacted sales, disbursements, and transaction activity levels.

The bank’s deeds offices and dealerships were closed in April, this put mortgage disbursements on hold and shrank VAF disbursements by more than 70 percent compared to March.

Additionally, the bank has seen ATM and branch volumes plunge 38 percent and 61 percent respectively.

Although there are signs that activity is starting to pick up (May was particularly encouraging), the bank is not overly optimistic that things will get anywhere near they were before the lockdown anytime soon.

Featured Image Courtesy: CentreForEnvironmentalRights