The Absence Of VCs In Kenya Is Quite Conspicuous Yet Ignored

The “expat bias” that appears to pervade Kenya’s tech startup ecosystem is a touchy subject that is discussed intermittently, probably because it is found to exist but is often discredited as nationalistic sulking.

But in July 2020, the conversation was charged like never before by an article published on WeeTracker titled: “Exposing The Expat Bias & Local Founder Apathy Engulfing Kenya’s Startup Scene.” This article sparked outrage and yielded informed perspectives in equal measure.

In the few weeks that followed, the Kenyan startup scene oozed fire on Twitter and LinkedIn. The black/white founder bias conversation, which can be polarising at times, was a hot topic for weeks.

Many aggrieved homegrown entrepreneurs and local leaders in Kenya’s thriving tech scene amplified the discontentment and distaste around the prevalent funding/funder bias that seems to be skewed in favour of Kenya-based startups founded by foreign nationals. This gathered quite some attention.

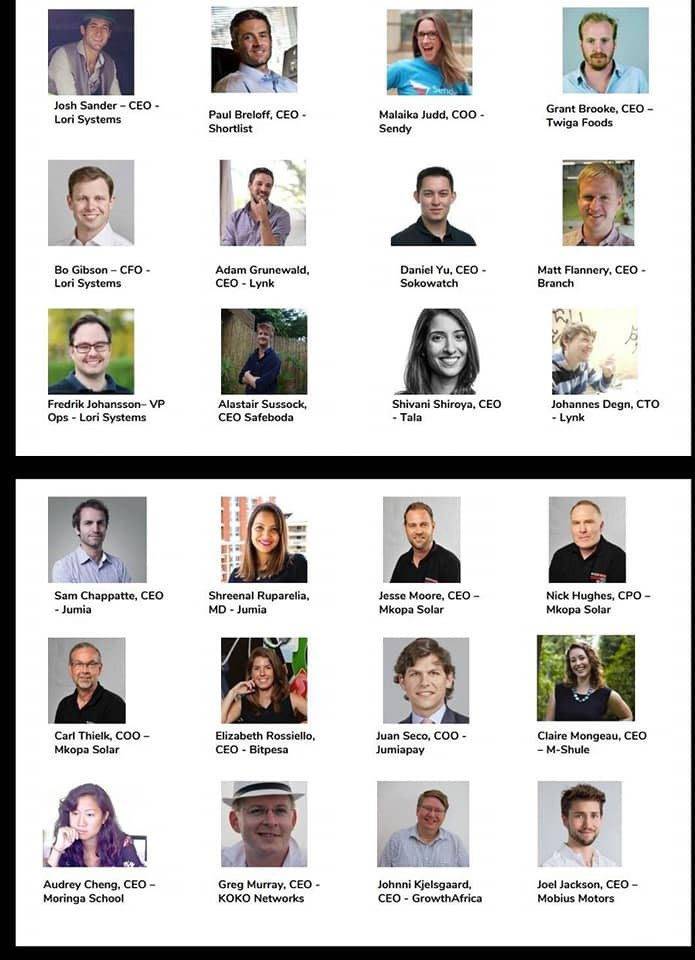

The debate blew up, and the picture above went viral. However, like most conversations that come up in what has come to be known as the “social media age” – where attention spans are becoming shorter than ever – the heated debate eventually fizzled out.

But all through the episode, no one thought to call out the elephant in the room.

If there’s a funding bias in Kenya, why is that?

As cited in the earlier story, expat founders raise much more money than local founders in Kenya. Startups with foreign founders/co-founders are many times more likely to close investment deals.

It appears there’s a deliberate preferential treatment exclusive to foreign founders; it’s kind of a diversity hole, and the locals in the country’s startup ecosystem paint a picture of a startup scene that seems to be rigged against locals.

“Indeed there is and I have seen it first hand over my last 10 years as an entrepreneur. When we are talking about bias here, it’s mainly around foreign – mainly US/Europe based – angel investors/VCs towards startups founded by local African entrepreneurs,” shares Waliaula Makokha, an entrepreneur and investor active in the Kenyan startup ecosystem.

“The exact reasons are up for speculation, but my guess would be VC is more a relationship-based game than we would like to admit,” he adds.

What does the data say?

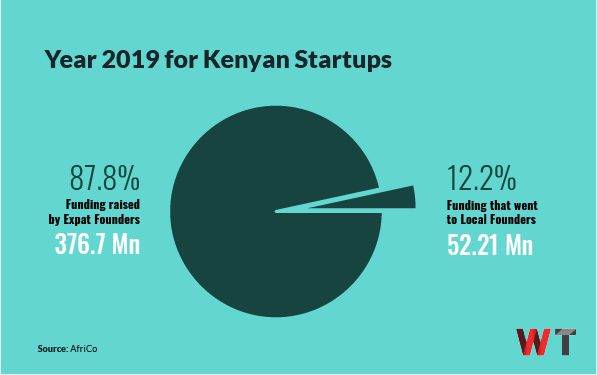

As per data gathered from AfriCo, Kenya-based startups with foreign founders/co-founders were the recipients of 87.8 percent of the total funding raised by startups operating in Kenya in 2019. This amounts to USD 376.7 Mn out of USD 428.91 Mn.

In fact, some of the most-funded startups in Kenya almost always have at least one foreign (usually white) co-founder. Cellulant and Wananchi are perhaps the only genuine exceptions. Such foreign founder dominance is not the case in any of the most active startup hubs in Africa, besides Kenya.

To illustrate, 96 South African startups announced investment rounds totalling USD 67.34 Mn in 2019. In the West, 97 Nigerian startups raised approximately USD 663.24 Mn in funding. Meanwhile, as earlier mentioned, Kenyan startups raised a total of USD 428.91 Mn in 72 deals in disclosed rounds recorded in 2019.

Nothing too strange about the data above, right? After including one more data point, the picture becomes clearer, and the problem begins to seem like a two-headed issue, as opposed to the widely-discussed singular point that is local founder apathy, thought to be responsible for the bias towards expats.

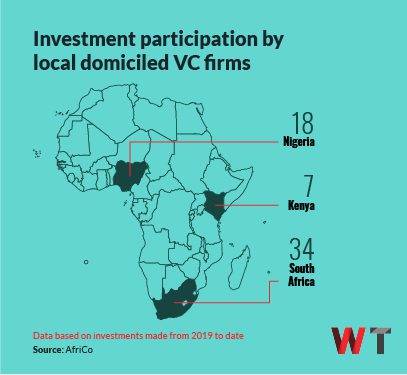

Out of the 96 rounds in South Africa 2019, 53 were led by local South African venture capital (VC) firms. In Nigeria, a total of 21 local VCs participated in funding rounds.

As per AfriCo, only 7 Kenya domiciled/Kenyan led venture capital funds disclosed investments in Kenyan startups since 2019. All other investments were led or co-sponsored by foreign venture capital firms.

Little wonder that of the 72 startup funding deals disclosed in Kenya that year, 42.4 percent of those involved startups founded by expatriates. A year prior, startups founded by foreigners accounted for 52.2 percent of the total number of startup funding deals disclosed in Kenya.

Waliaula explains, “Considering these investors are mostly foreign; you can guess whom they are most likely to invest in with their eye on managing the risk of their portfolio. That said, if you want to invest in Nigeria (their huge market making it even more lucrative), you have no choice but to invest in local entrepreneurs because the foreign ones are few and far between.”

Simply put, Kenya does have a problem, but it cuts deeper than the funders’ preference for expat-founded startups. It can’t be ignored that there’s just not enough local funders, investors, and VCs in Kenya.

The paucity or even near-absence of local funders seems to be one of the biggest factors fuelling the so-called funding bias that has engulfed Kenya’s startup scene.

“There is a lack of local venture capitalists in Kenya. There are too many Kenyan companies who are very strong, but don’t fit any VC investors’ mandates and so struggle to raise capital. We need more investors who are able to take early-stage risk and invest over multiple rounds”, says Niraj Varia, Partner at Novastar Ventures, a local Venture capital fund based out of Nairobi.

“Local investors do exist, but their mindsets are not VC-centric, and they are still stuck in the traditional value creation mindset of investing in property and lifestyle businesses. On the other hand, the mentality of Kenya HNIs is still around why should I invest USD 2 Mn in a startup when I can buy apartments and start collecting rent as soon as immediately,” he adds.

Kenya is one of the most interesting destinations for entrepreneurship in Africa. AfriCo records a total of 1,373 startups that are currently operational in the country. But despite boasting unique potential and immense qualities that have seen its tech scene earn the “Silicon Savannah” moniker, it appears Kenya’s tech ecosystem still has a long way to go.

As Niraj reckons, “Kenya is seeing activity, just not enough of it. The main reason is a lack of exits; this discourages local investors and reduces the valuations they are willing to pay, which makes them unattractive investors to aspiring entrepreneurs.

“There are also no tax incentives to make these early-stage investments, which further reduces local investors’ willingness to take risks,” he adds.

What puts the Kenyan ecosystem in this tight spot?

The dynamics at play in key startup hubs across sub-Saharan Africa are key to understanding the variations in investment patterns in different locales.

Kenya, Nigeria, and South Africa, for a considerable amount of time, have been the top startup investment destinations on the continent, raking in the bulk of venture capital. But the individual ecosystems seem to be wired very differently.

The South African corner boasts a close-knit circle of startup funders and support organisations. Also, a handful of venture capitalists and angel networks are able to fulfill the investment needs of the country’s technology startups, especially at the early stages.

On the other hand, startup support organisations like Silicon Cape, Simodisa and the Southern African Venture Capital and Private Equity Association (SAVCA) are assisting local startups and funders, connecting the local ecosystem and building for South Africa.

In fact, South Africa is the only country in sub-Saharan Africa where indigenous “fund of funds” are being launched and supported by large corporates, and even the government itself.

One such example is the SA SME Fund; a fund of funds backed by more than 50 large South African corporates with a corpus of more than USD 100 Mn. The fund has actively invested in many seed, pre-seed, and Series A VC funds and is directly helping the startup economy to grow in South Africa.

The existence of the Section 12J legislation, as implemented by the government, is also quite instrumental in pushing the needle in terms of locally-sourced investments.

Unlike South Africa, the Nigerian startup ecosystem is an open playground for many diaspora Nigerians who are rushing back to Nigeria to grab a share of the burgeoning startup scene.

Besides that, many fund managers and investors have launched funds exclusively for Nigerian startups, even if the fund is based out of the United States. And beyond that, the country’s vibrant tech scene is well-connected and is able to mobilise, such that local tech founders are democratising startup investments by setting up rolling funds.

Think Future Collective and Nkali Fund, they are the first of their kind in Africa, initiated by successful Nigerian founders of (now) big startups looking to accelerate the tech wave in the continent’s most populous country.

Furthermore, early supporters and venture builders like CcHub have helped form a bubbly ecosystem and also built a healthy amount of hype around it.

Another interesting factor at play in the Nigerian startup ecosystem is the ever-increasing support of gigantic global corporates, including the likes of Facebook, Google, has fueled investments in Nigerian startups. This is either directly through their startup initiatives or in partnership with entities like CcHub.

On its part, being an expat-friendly country, Kenya has seen a surge in the number of startups over recent years, and unlike, say, Nigeria, where expat-run startups are almost non-existent, foreign founders are well represented in Kenya.

Looking at AfriCo data, Kenya had a total of 952 active startups in 2018, and the number jumped to 1,373 in 2020.

A 50 percent jump in 24 months is remarkable but unlike South Africa and Nigeria – where locally-domiciled or local fund manager-led funds weigh in with a healthy amount of backing for local startups – Kenyan startups seem to rely heavily on capital from overseas investors since local backers are few and far between.

And that’s because foreign capital seems to have quite an affinity for foreign founders, even when it makes little business sense.

“I remember a case where an investor faced with two entrepreneurs building the same product in Kenya, ended up investing in a foreign entrepreneur who had little or no knowledge of the local terrain against a local entrepreneur who was born and brought up here,” says Waliaula.

There’s a good chance that stories like that will remain a recurring theme in the Kenyan tech startup ecosystem if the underlying fundamental issue that is feeding the manifested problem is not addressed.

Is change coming?

The Kenyan authorities seem to be well aware of the situation in the country, and it appears they are taking steps to tilt the balance and sort of level the playing field.

In August 2020, Kenya’s new National Information Communication and Technology (ICT) Policy was published in the Kenya Gazette. And one of the biggest talking points in the new policy is the provision that redefines ICT company ownership requirements in Kenya.

Part of Kenya’s new national ICT policy seeks to compel foreign companies doing business in the country’s ICT sector to cede no less than 30 percent shareholding to Kenyans.

In other words, Kenyan individuals or corporations must own at least a third of any tech venture rooted in Kenya, lest such companies will not be licensed to operate in the country.

On a similar note, Kenya’s Startup Bill 2020, which has been published in the Kenya Gazette and is currently being pushed through parliament, has a provision that proposes majority Kenyan ownership for startups operating in the country.

These developments seem like measures that are being pushed to even the odds for both local and foreign founders in Kenya. But like most things, they come with pros and cons.

While such measures may foster increased local participation, it could also brew an unwanted by-product: the shrinking of the foreign capital, which essentially fuels the Kenyan startup ecosystem at present.

This might hurt Kenya’s attempt to restructure its startup scene to function more like those of other key African startup hubs like South Africa, Nigeria, and even Egypt, at least in terms of the source and destination of startup funding.

Will Kenya be able to catch up or has the train left the station? Perhaps that’s another tale that time alone can tell.

Edited by: Nzekwe Henry