Inside Nigeria’s Bizarre Attempt To Tax WhatsApp Messages And Emails

Africa and digital tax

It is not unheard of for African governments to attempt to drag the end users of certain popular digital services and even the platforms themselves into the tax net.

In Uganda, the “Social Media Tax” has been in place since 2018 — it seemed ludicrous until it happened. Now the daily over-the-top (OTT) tax forces Ugandans to pay a daily fee of UGS 200.00 (USD 0.053) before they can access their favourite social media platforms including Facebook, Twitter, Instagram, and even email. And that tax is besides internet subscription costs.

Last September, Kenya was in the news when word got out that the country is looking to tax administrators of WhatsApp groups and Facebook groups. Just two days ago, it was revealed that the Kenya Revenue Authority (KRA) now has its sights on expanding the tax net to include platforms like Netflix, Uber, Google, and even ride-hailing companies.

So it’s not exactly a new thing in these parts. What’s new, however, is the bizarre attempt by Nigeria’s Federal Inland Revenue Service (FIRS) to introduce a sort of tax on specific kinds of message sent over platforms like SMS, WhatsApp and even email.

What’s this new tax?

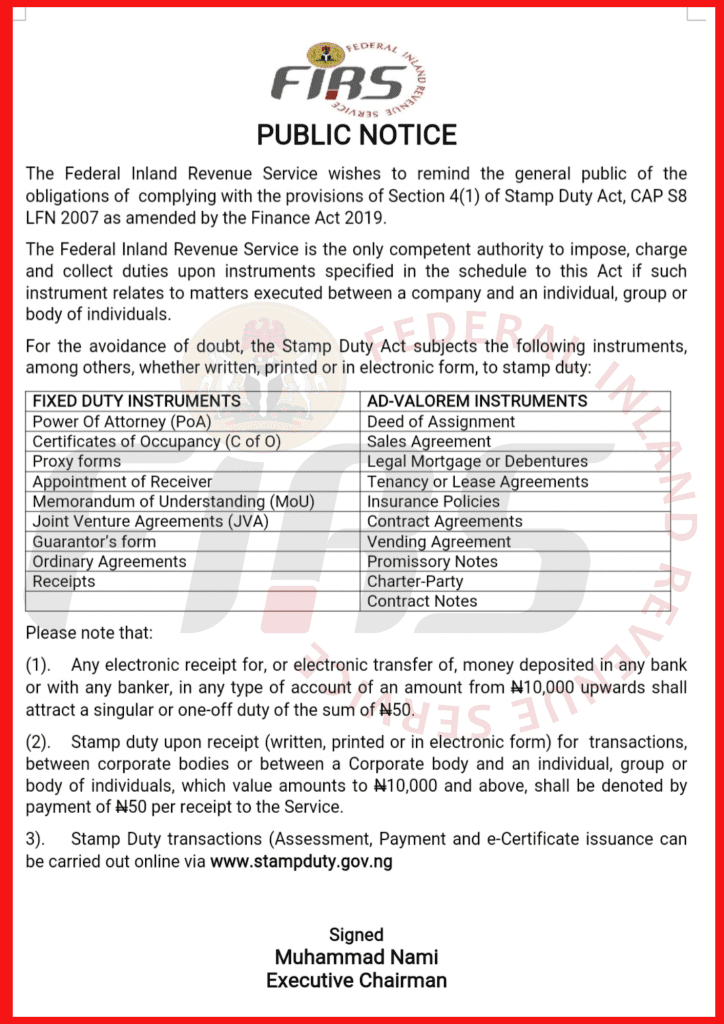

As contained in a recently released circular signed by the Executive Chairman, Muhammad Nami of the FIRS, Nigeria’s top tax body announced a stamp duty on transactions valued at a specific amount. The stamp duty will be attached to electronic messages sent over SMS, email, and WhatsApp that show that money was transferred from someone to another person.

“Any electronic receipt for, or electronic transfer of, money deposited with any bank or with any banker in any type of account of an amount from NGN 10 K upwards shall attract a singular or one-off duty of the sum of NGN 50.00,” a portion of the circular reads.

“Stamp duty upon receipt (written, printed or in electronic form) for transactions between corporate bodies or between a corporate body and an individual, group or body of individuals, which amounts to NGN 10 K and above, shall be denoted by payment of NGN 50.00 per receipt to the service,” it reads further.

The FIRS circular also stated that stamp duties will be paid on “POS receipts, fiscalised device receipts, Automated Teller Machine (ATM) print-outs.”

What does this even mean?

Per the circular issued by the FIRS, the new directive specifically implies that all receipts, either printed or electronically generated, or any form of electronic acknowledgement of money transactions, will attract the stamp duty of NGN 50.00.

The tax body even went on to illustrate its position on the matter with the following example:

“Maybez Ltd’s chief accounting officer, after receiving a cash payment of NGN 500 K from Mr. Tolu on behalf of Maybez Ltd., composed a message which reads: ‘receipt of NGN 500 K is hereby acknowledged’ and sent same to Mr. Tolu via WhatsApp messenger. In this case, the WhatsApp message acknowledging the receipt of NGN 50.00 constitutes a receipt for which stamp duty is payable.”

In simpler terms, the FIRS is, among other things, putting a tax on every message sent via WhatsApp, email or SMS, which acknowledges that a sum of money has changed hands as payment for goods or services — so long as that sum is no less than NGN 10 K (USD 25.88).

There’s just one problem, though, the FIRS neither has a way of tracking these kinds of messages to the best of our knowledge (even if it could, it doesn’t have the permission), nor does it have an automated system for collecting the tax or a way to hold people accountable.

The FIRS expects people to tender details of transactions on its e-stamp duty page if the transaction is above NGN 10 K regardless of the type of account money was paid into.

Simply put, the body is sort of counting on the “goodwill of people.” One would have to receive payment, acknowledge receipt over WhatsApp, for instance, then proceed to the e-stamp duty page separately to declare the transaction, and finally pay the stamp duty.

If they do pay the duty, they would have done right by the FIRS. If they don’t, nothing happens as the FIRS has no way of knowing what happens in the DMs. It’s a bizarre set up by any stretch of the imagination, especially for something as tricky as tax collection. By the way, it’s called “tax collection” and not “tax donation” for a reason.

Where this leaves things

WhatsApp is arguably the most popular social messaging app in Nigeria, if not the most popular app overall.

According to the Media in Africa dossier from Statista, as of December 2017, more than 80 percent of Nigeria’s web traffic came from mobile users.

Also, 63 percent of Nigerian consumers access the internet via smartphones, and social media plays a huge role with 21 percent of users on social media at least once daily. WhatsApp and Facebook are both tied with 41 percent of the online population.

Another report has it that WhatsApp is the most used social media platform in Nigeria — at least 85 percent of Nigeria’s 24 million active social media users are WhatsApp users, according to The Global State of Digital in 2019 report.

WhatsApp is also the platform of choice for many small businesses in Nigeria. Everyday, buyers and sellers connect on the platform and although there are no specific numbers, the sums exchanged could easily run into millions of naira.

With numbers like that, it’s obvious why the FIRS is looking to tap into that revenue stream. The problem, however, is the practicality of how the tax body is going about it.

Platforms like WhatsApp use end-to-end encryption, meaning that messages exchanged can only be accessed by the sender and the recipient of the message. Third-party access is borderline impossible, even WhatsApp itself lacks the clearance.

For SMS and emails, it’s unlikely that the FIRS has the clearance or the capacity to spy on messages exchanged between parties to sift out the “taxable” ones.

PricewaterhouseCoopers (PwC), a global tax consultancy company, has already expressed skepticism at the new development, insisting that practicability and enforcement would be a major problem with the new tax.

“The practical application of this is doubtful and even where the FIRS attempts to enforce this, taxpayers may challenge the FIRS’ definition of the term, as the Act itself does not provide a definition,” PwC said.

Fingers remain crossed as it stands, especially as the idea of the FIRS keeping an eye on protected messages to determine which ones should attract a stamp duty continues to baffle. Plus it remains to be seen how the body would compel Nigerians to visit its e-portal and pay tax on a payment confirmation sent via text.

Featured Image Courtesy: The Conversation