Uganda, Rwanda & Tanzania Are Merging Their Stock Markets

East African countries have the most expensive stock markets in Africa. But things look as though they are about to change. Uganda, Rwanda and Tanzania are forming a consortium that will electronically unify their stock markets.

Trading As One

The three countries are joining forces on the backs of a World Bank-funded financial project whose goal is to link regional stock markets via electronic means. Uganda, Rwanda and Tanzania are interconnecting their trading systems and hooking them to the EAC Capital Markets Infrastructure’s (CMI) Information Technology platform.

When the project is completed, investors in all 3 countries will be able to buy and sell shares of firms that are listed in any of the nations without having to go through different stockbrokers.

That means, an investor with interest in a Tanzanian company won’t have to specifically do business with a Tanzania-focused stockbroker. Doing business with the same stockbrokers for different countries would, consequently, be a possibility.

This stock market project isn’t a today development. It has been dragged for more than half a decade, delaying mostly as a result of payment dispute with the software provider. The lack of integration between CMI software and the trading systems of the participating countries has also been a potent factor for the backlog.

The East African countries look to removing obstacles on stock trading in regional markets, spur financial/capital activities and give liquidity a much-need boost, especially in underperforming markets.

According to Celestin Rwabukumba, the chairman of the East African Securities Exchange Association (EASEA), everything regarding preparation should be concluded by the end of September (2020). 95 percent of the work “has been done” and the launch “cannot go beyond December (2020)”.

Cost Reduction

A major aim of such a unified stock market is the reduction of the cost and time of trading in shares listed on the separate markets. The Bright Africa 2019 report by RisCura shows that Ugandan stockbrokers take the largest share of stock trading commission in Eastern Africa and even the continent at large. They take 2.28 percent of the value of every transaction they broker.

It was just last year that Uganda and Rwanda blew past Tanzania to become the countries with the highest trading costs. Meanwhile, the top-ranking Kenyan bourse is the cheapest in the region. These costs majorly comprise brokerage commission, clearing and settlement fees, exchange fees and range of other regulatory charges.

In Rwanda, these costs take up about 3.4 per cent of the value of the shares while in Tanzania and Kenya are estimated at 2.7 per cent and 1.4 percent respectively. RisCura’s 2018 edition of the same study put the Dar es Salaam Stock Exchange as the most expensive bourse in the region, trailed by the Uganda Securities Exchange.

By reducing costs, the respective countries would become less sensitive regarding shares and not look to putting their money in cheaper market alternatives. In fact, East African bourses have experienced low trade volumes and increased market liquidity as a result of their expensiveness.

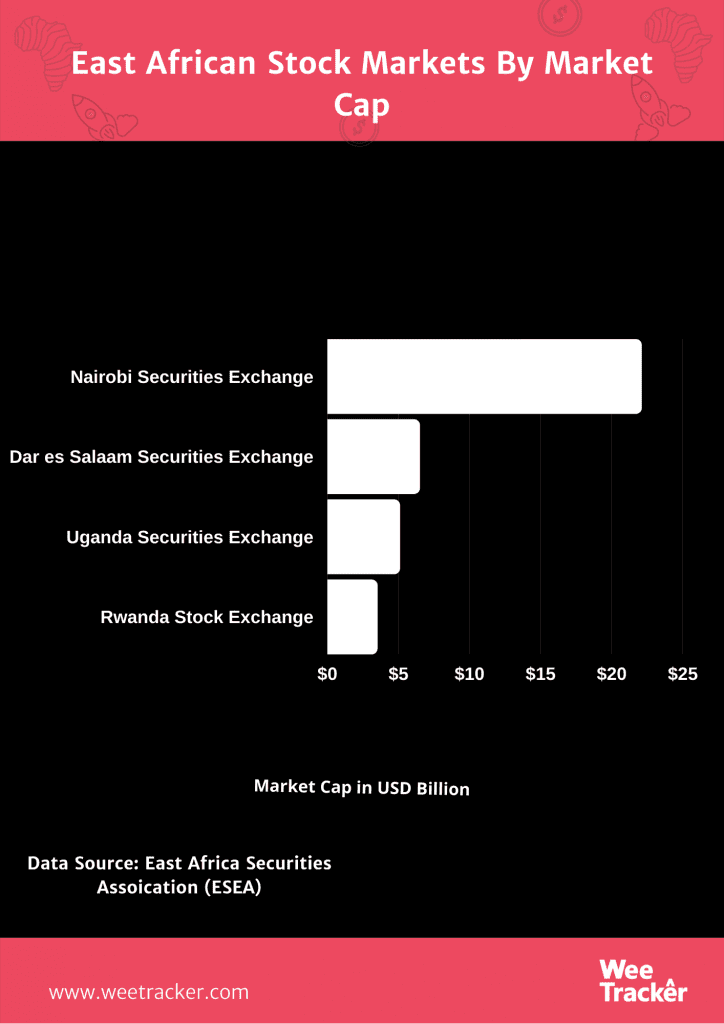

Even though Kenya sits on the largest stock market by market cap—and number of listed firms—in Eastern Africa, the Nairobi Securities Exchange (NSE) was pulled out from the project back in 2015.

Nairobi expressed its dissatisfaction with how Pakistan-based InfoTech Private Ltd—the firm providing the software connecting the trading platforms—was awarded the contract, citing irregularities with the procurement.

Meanwhile, Zimbabwe is racing to launch a new stock exchange. The economically-swayed Southern African country has given license for the operating of the Victoria Falls Stock Exchange (VFEX) The new market will be a wholly-owned subsidiary of the nation’s main bourse, the Zimbabwe Stock Exchange.

Featured Image: Cointelegraph