African Startups Mega-Deals: Top 10 Biggest Raises So Far In 2025

Africa’s startup ecosystem is weathering a year of mixed signals. Headline numbers for the first half of 2025 are lower than the highs of 2021–2022, reflecting the global slowdown in venture capital. But behind the aggregate dip and fewer deals, there are still some notable big-ticket raises. The continent is producing “mega-rounds”, especially for Late-stage companies that have proven their business models and revenue potential.

From fintech and proptech to clean energy and health-tech, the continent’s top players have secured multi-million-dollar deals that show both investor confidence and the maturing nature of Africa’s startup ecosystem.

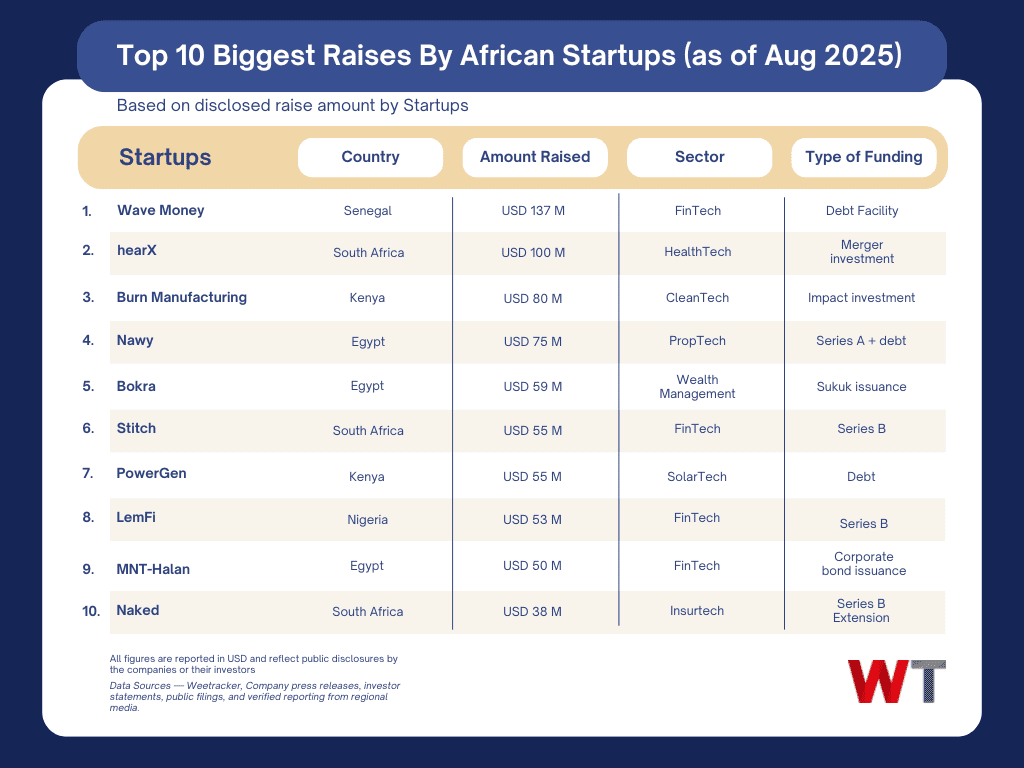

The top ten raises this year have pulled in over USD 700 M combined. Geographically, Egypt leads with four entries (Nawy, Bokra, MNT-Halan, and Wave’s expansion partner capital flows), followed by South Africa and Kenya with three each, and Senegal and Nigeria each landing one.

Sector-wise, fintech remains the most represented sector, but clean energy, health-tech, and proptech have also attracted outsized rounds, showing that investor appetite is broadening beyond payments and lending.

Debt and alternative financing tools like Sukuk and corporate bonds are becoming more common, signalling a maturing funding environment.

Here are the 10 largest raises by African startups in 2025, ranked by deal size.

1. Wave Money (Senegal) — USD 137M Debt Financing

June 2025

Wave Money’s USD 137 M debt raise, led by Rand Merchant Bank with backing from British International Investment, Norfund, and Finnfund, is the largest African startup deal of the year so far. The Senegalese fintech, known for slashing mobile money fees from up to 10% to just 1%, now operates in eight West African countries with 20 million monthly active users. The funds will fuel expansion into Central and East Africa, advancing Wave’s goal of making Africa the first cashless continent.

2. hearX (South Africa) — USD 100M Merger Investment

April 2025

In one of South Africa’s biggest tech mergers, Pretoria-based hearX joined forces with U.S. hearing aid maker Eargo to form LXE Hearing. The USD 100 M deal, backed by Patient Square Capital, combines hearX’s mobile-based hearing technology with Eargo’s direct-to-consumer expertise, creating a global leader in affordable hearing health solutions. The merged company is set to expand access to hearing care for millions worldwide.

3. Burn Manufacturing (Kenya) — USD 80M Impact Investment

June 2025

Kenya’s Burn Manufacturing secured USD 80 M from the Trade and Development Bank Group to expand its clean cooking solutions into Mozambique, the DRC, and Zambia. Known for its energy-efficient, IoT-enabled cookstoves, Burn plans to reach over 429,000 households, reduce deforestation, and generate carbon credits to subsidise costs for consumers. The deal highlights Africa’s growing role in climate-aligned investments.

4. Nawy (Egypt) — USD 75 M (Equity + Debt)

May 2025

Egyptian proptech startup Nawy raised USD 75 M, USD 52 M in Series A equity led by Partech and USD 23 M in debt financing. Originally a listings platform, Nawy now offers mortgage financing (Nawy Now), fractional ownership (Nawy Shares), and property management (Nawy Unlocked), alongside tools used by more than 3,000 brokerages. across the MENA region. With over USD 1.4 B in annual GMV, the company is targeting Saudi Arabia, Morocco, and the UAE for its next growth phase.

5. Bokra (Egypt) — USD 59 M Sukuk Issuance

April 2025

Egyptian fintech wealth management firm Bokra raised USD 59 M (EGP 3 B) through a Sharia-compliant Mudarabah Sukuk for Aman Holding’s finance arm. Bokra’s platform allows customers to invest in Sharia-compliant products, including real estate, gold, and debt instruments. The seven-year issuance, rated +BBB by MERIS, was made to support Bokra’s expansion into new MENA markets and broaden its portfolio, which includes real estate, gold, and debt instruments.

6. Stitch (South Africa) — USD 55 M Series B

April 2025

Cape Town-based payments company Stitch raised USD 55 M to scale its unified payments API for African businesses. The round included USD 4.2 M from Raba Partnership and follows a series of strategic expansions, including its January acquisition of Exipay to enter the in-person payments market.

Stitch’s platform allows businesses to manage transactions seamlessly across multiple financial institutions through a single API. That means merchants can offer diverse payment methods like bank transfers, cards, and mobile wallets, without juggling multiple integrations.

7. PowerGen (Kenya) — USD 55 M Renewable Energy Funding

January 2025

Tied in sixth place with Stitch, PowerGen secured USD 55 M to install 120 MW of renewable energy projects, including mini-grids and industrial solar solutions. PowerGen specialises in solar-powered mini-grids and commercial/industrial renewable energy systems, targeting underserved communities and businesses. The investment, led by PIDG and backed by AfDB, ElectriFI, and IFU, is expected to connect an additional one million people to reliable electricity over the next five years.

8. LemFi (Nigeria) — USD 53 M Series B

January 2025

LemFi, a Nigerian-born fintech, is on a mission to make remittances faster and cheaper for diaspora communities. Its USD 53 M Series B, led by Highland Europe with participation from Y Combinator and others, brings its total funding to USD 85 M in just four years.

Founded in 2020, LemFi now processes USD 1 B in monthly payments across 47 countries. The funds are expected to support licensing and expansion in Europe and Asia, strengthening its global play for diaspora-focused financial services.

9. MNT-Halan (Egypt) — USD 50 M Corporate Bond

May 14, 2025

Egypt’s first fintech unicorn, MNT-Halan, raised USD 50 M via a corporate bond—Egypt’s largest public debt issuance by a startup to date. The fund focused on funding its lending portfolio and digital banking services for unbanked communities. MNT-Halan’s ecosystem offers micro and small business lending, payments, consumer finance, and e-commerce. By turning to bonds instead of equity, the company has secured non-dilutive capital to fund its lending portfolio and expansion.

10. Naked (South Africa) — USD 38 M Series B2

January 2025

Digital insurer Naked closed a USD 38 M Series B extension led by BlueOrchard. Its fully automated platform offers car, home, and item-specific coverage, with surplus premiums donated to charity. It employs a “Naked Difference” model that reinvests unclaimed premiums into customer-selected charities, removing the traditional incentive for insurers to deny claims. The fresh capital was raised to help meet regulatory capital requirements while funding product expansion and growth across South Africa and beyond.

Of the top 10 raises, nearly half were debt or alternative financing, ranging from issuances to corporate bonds, indicating that the continent’s most established players are tapping into more sophisticated capital markets.