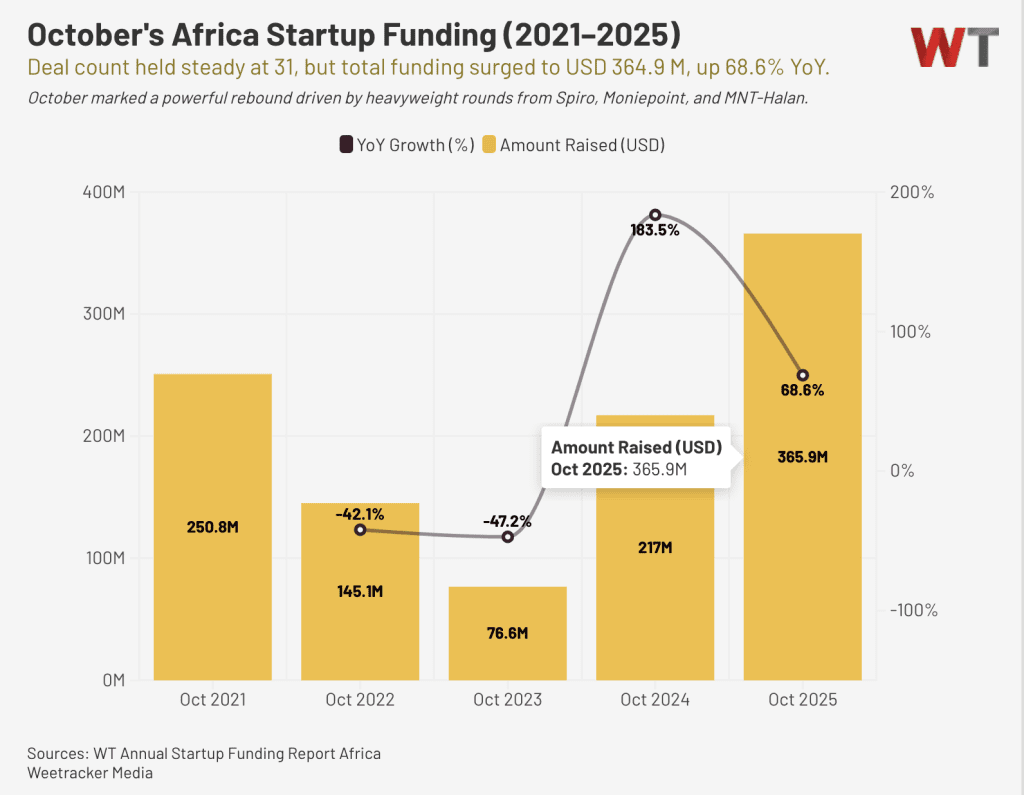

Africa’s Startup Scene Stabilizes As Big Rounds Drive October’s USD 365 M Total

Africa’s startup funding scene maintained its measured rebound in October 2025, continuing the steady rhythm that has defined much of the year.

Across the continent, disclosed funding totaled roughly USD 364.9 M across 31 deals, a year-on-year increase from USD 217 M in October 2024 and a sharp rise from USD 76.6 M in 2023, according to the WT dataset.

That’s more than double September’s USD 163.4 M, with deal volume holding steady. The data signals a market that’s no longer chasing quantity but still finding occasions for very large checks.

While October’s total was buoyed by a few headline rounds, the spread of deals across regions and sectors reflected a market finding its equilibrium after the volatility of the pandemic years. Rather than exuberance, the month told a story of recalibration, investors placing targeted bets on proven operators, infrastructure, and the next wave of early innovation.

Big Rounds Dominated the Month

October’s total was dominated by a few massive financings that would have made headlines anywhere in the world. The largest was Spiro’s USD 100 M Series D, followed by Moniepoint’s USD 90 M Series C and MNT-Halan’s USD 71.4 M securitization, a debt-driven capital event, together defining an active, high-value month.

Mid-sized rounds added depth: Chari’s USD 12 M Series A in Morocco’s embedded finance space, Kuunda’s USD 7.5M Pre-Series A in South Africa, and Malengo’s USD 12.9 M non-dilutive grant in education. Smaller plays, from AI startups like Nanovate and Velents.ai to seed rounds in climate tech and mobility, added texture to the overall picture.

Regional Snapshot

The top five markets, Kenya, Egypt, Nigeria, Morocco, and South Africa, accounted for about 95% of total funding, though the balance within that concentration is improving.

Kenya led the continent, raising USD 136.7 M, driven largely by Spiro’s USD 100 M Series D led by FEDA.

Egypt followed with USD 101.4 M, led by MNT-Halan’s USD 71.4 M securitization and Tagaddod’s USD 26.3 M Series A in climate tech. Smaller rounds from SehaTech (USD 1.1 M), Velents.ai (USD 1.5 M), and Sabika (USD 100 K) highlighted diversification in healthtech and AI.

Nigeria ranked third with USD 93 M, almost entirely from Moniepoint’s USD 90 M Series C, which brought its total Series C to USD 200 M. Rana Energy’s USD 3 M pre-seed was the only other fund added to the mix.

Morocco in fourth place, secured USD 12.23 M, led by Chari’s USD 12 M Series A, backed by Verod-Kepple Africa Ventures and Plug and Play. Early-stage rounds from Hypeo AI (USD 200 K) and Sand to Green (USD 29 K grant) added diversity.

South Africa followed with USD 10.41 M, led by Kuunda’s USD 7.5 M Pre-Series A and Locstat’s USD 2.9 M Pre-Series A, alongside SeaH4’s USD 12 K grant in climate tech.

Other active markets included Côte d’Ivoire and Tunisia, contributing a combined USD 30 M through rounds by ANKA (USD 5 M), Julaya (USD 1.4 M), and PAYDAY (USD 3 M).

Even smaller ecosystems, Gabon, Mali, and Botswana, recorded activity through grants and micro-rounds, showing how innovation is spreading beyond traditional hubs.

Fintech, Energy, and Mobility

Fintech continued to dominate, pulling in over USD 180 M, nearly half of October’s total. But the mix is changing, from consumer wallets to enterprise payments, embedded finance, and digital banking for small businesses.

Moniepoint’s USD 90 M raise underscored this shift, alongside MNT-Halan’s USD 71.4 M securitization, Chari’s USD 12 M, and Kuunda’s USD 7.5 M. Smaller fintech rounds from Julaya (USD 1.4 M) and Sabika (USD 100 K) reflected early-stage activity across regions.

Mobility and logistics followed, led by Spiro’s USD 100 M Series D and Enzi Mobility’s USD 3.5 M, highlighting growing investor confidence in electric transport and fleet management.

Energy and climate tech also held strong, led by Tagaddod’s USD 26.3 M Series A and Rana Energy’s USD 3 M pre-seed, with smaller sustainability-focused awards to SeaH4, Proverdy, Synnefa, and Sand to Green.

AI and data infrastructure quietly expanded through smaller rounds: Velents.ai (USD 1.5 M), Nanovate (USD 1 M), and Hypeo AI (USD 200 K). Healthtech and edtech saw steady interest via SehaTech (USD 1.1 M) and Malengo (USD 12.9 M grant).

Equity Dominates, But Alternative Capital Rises

Equity remained the backbone, powering about 70% of total deals, including Spiro, Moniepoint, and Chari.

Debt and blended instruments represented roughly 20%, led by MNT-Halan’s USD 71.4 M securitization and Julaya’s hybrid round. The remaining 10% came from non-dilutive funding, such as Malengo’s USD 12.9 M grant and Synnefa’s USD 300 K IoT grant.

The growing mix of equity, debt, and grant capital reflects a maturing ecosystem, one aligning funding structures with stage and cash flow realities.

Who Wrote the Checks

October saw strong participation from development finance institutions, regional growth funds, and strategic investors. Major backers included IFC, Proparco, Bpifrance, LeapFrog Investments, FMO, and Microsoft’s PRIF II fund. Active African funds such as E3 Capital, A15, Plus VC, and Verod-Kepple Africa Ventures also featured prominently.

Local angel syndicates and corporate accelerators, including MINT Incubator and Microsoft Africa Transformation Office, played a key role at the early stage. Programs like Madica and Techstars continued to back startups in emerging corridors like Tunisia and Nigeria.

A Market Finding Its Rhythm

By the end of October, Africa’s USD 365.9 M in total funding reaffirmed the continent’s ability to sustain steady inflows despite global caution. The presence of a few very large deals, Spiro’s USD 100.0 M, Moniepoint’s USD 90.0 M, and MNT-Halan’s USD 71.4 M, pushed the month’s total well above prior months.

But while the market remains top-heavy, the broader base of early-stage activity and grant funding continues to underpin long-term resilience.

October told a twofold story: investors are consolidating around proven operators while selectively seeding the next generation. For founders and ecosystem builders, that’s a healthier, more sustainable landscape to grow in.