Deal Street

African Startup Funding Tracker

USD 219,803,999+

*Data updated daily at 18:00 EAT

After completing a Series A extension round that took its total raised funding to more than USD 20 Mn in 2018, Flutterwave — one of Africa’s top fintech players — has today announced a USD 35 Mn Series B round sponsored by a consortium of strategic investors.

The round was co-led by Greycroft & eVentures with additional participation from CRE Venture Capital, FIS, VISA, and Green Visor.

Founded in 2016 by current CEO, Olugbenga “GB” Agboola, and erstwhile CEO and co-founder of Andela, Iyinoluwa “E” Aboyeji, Flutterwave has excelled at connecting the African continent to the world at large by providing the easiest and most reliable payment solutions for businesses around the globe.

To date, Flutterwave has processed 100 million transactions valued at over USD 5.4 Bn for global leaders including Uber and Booking.com.

“We’re helping businesses in Africa and globally accept payment and to scale by being the payment technology that connects Africa to the world,” says Flutterwave founder and CEO, Olugbenga “GB” Agboola.

“We have built a technology infrastructure that is steadily being recognized as the bridge to connect the payment system. We are excited to be working with our newest commercial partners, Visa and FIS, and investors to build the dominant payments platform in Africa.”

With the latest round of funding, Flutterwave will continue to provide innovative solutions to businesses that want to facilitate payments seamlessly. The company’s core offering provides a frictionless payment solution for merchants, banks, and consumers and simplifies how payments are made and accepted.

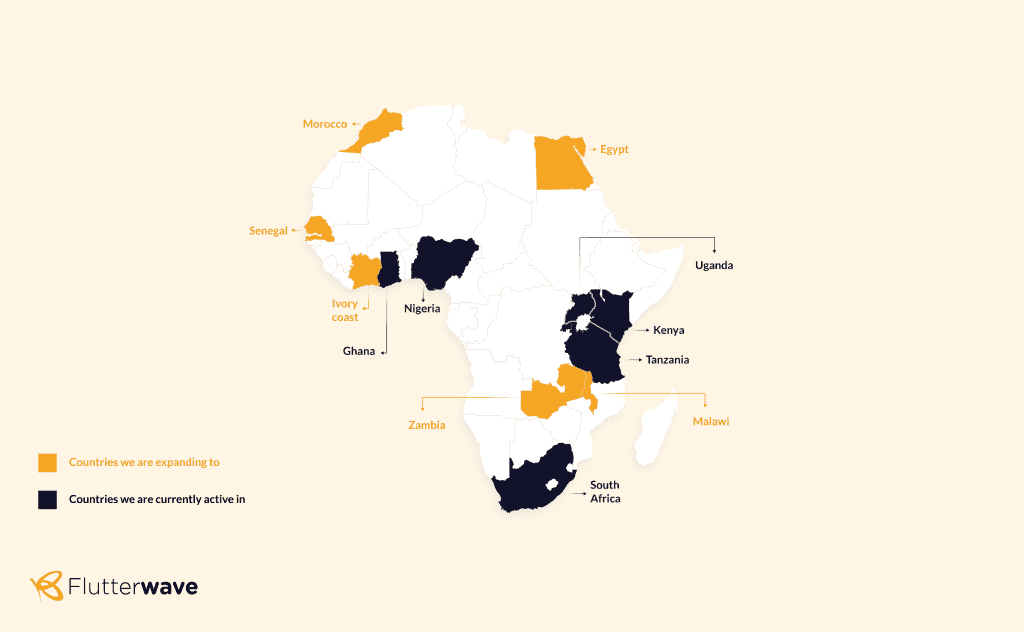

The new funding will be used to support its expansion across Francophone and North Africa as part of its mission to connect Africa to the world as well as drive efforts to boost market share in existing markets.

“Commerce across the African continent is quickly moving online. Flutterwave is powering this transition by introducing modern payment infrastructure to Africa’s merchants while also creating the ability for global companies to reach over 1 billion African customers,” says Will Szczerbiak, Principle at Greycroft.

“We have supported the company since investing in their 2016 seed and are excited to lead the Series B after seeing over 500% revenue growth in 2019.”

On the back of the latest round of funding, Flutterwave has signed commercial agreements with Visa and FIS. The agreement with FIS will allow the global financial technology provider to offer the Flutterwave solution as part of Worldpay from FIS payment solutions to its merchant clients in Africa. Flutterwave graduated from the FIS FinTech Accelerator program in 2016.

Furthermore, the company’s new partnership with Visa aims to scale its consumer payments, service, Barter, through Visa’s QR code payments, card issuance, and global payment processing channels – enabling efficient service delivery to over 85,000 businesses already using Flutterwave and rapidly growing Barter’s base users.

The partnership increases access to digital commerce for African consumers and connects them to the rest of the world with Visa virtual card.

“GB and his colleagues have not only identified but continue to successfully and thoughtfully execute upon, a once in a generation opportunity in commerce and payments for the emerging markets of Africa,” says Joe Saunders, a member of the Company’s board and the former CEO of Visa. “We’re excited to continue to lend our support to this exceptional team of founders.”

Flutterwave currently has an active presence in ten African countries, including Nigeria, Ghana, Kenya, and South Africa. The company has enabled customers in these countries to build customizable payment applications through its APIs.

Paid Members Are Reading

-

December 22, 2025

The Full Basket: How Naivas CEO Andreas von Paleske Stocks Up For Success -

December 5, 2025

African Workers Feel Both Delight & Dread Using AI For Work & Fearing Being Replaced -

November 21, 2025

Nigeria’s Top Telcos Struggle To Sell Mobile Money In Crowded Market