The Million-Dollar Race To Tap Africa’s Music Streaming Market Is Getting Hotter

Less than a month after Beyonce’s father, Matthew Knowles, made an undisclosed investment in African music streaming platform MePlaylistTM, Apple is finally making a bet on Africa.

Of the 52 new countries Apple plans to expand to, 25 are in Africa. The company has made known its intentions to tap into dozens of new markets in the continent, as well as the Middle East and beyond.

Apple ‘Store’

Prior to this, Apple did not have an actual official presence in Africa, even though there were signs of the tech company in South Africa. Now, it is looking to enter Cameroon, Ivory Coast, Democratic Republic of Congo, Gabon, Libya, Morocco, Rwanda and Zambia.

This comes as part of a global expansion of Apple’s most popular services—App Store, Apple Music and others. The 52-country ambition marks the firm’s most extensive expansion since it grew iTunes Store to India, Russia and over 50 other countries back in 2012.

App Store is the oil well of Apple’s revenues. The company keeps a 15 to 30 percent cut of its sales on the service. But there’s no doubt that the African smartphone market is large enough to justify the outlay needed for official Apple stores.

Many of the millions of smartphone users use Android due to the relative affordability of the OS in the market. Apple’s supposed store in South Africa was reportedly relinquished in 1999.

Apple has focused on growing sales from its services segment, which totaled 17.8 percent of its USD 260.1 Bn in revenue in its most recent fiscal year. Consumers have slowed in upgrading their smartphones.

Streaming Hitch

Apple Music is set to make a foray into an additional 9 African countries, including the ones aforementioned. The 60 million-track service will be launching in: Algeria, Angola, Benin, Chad, Liberia, Madagascar, Malawi, Mali, Mauritania, Mozambique, Namibia, Republic of the Congo, Senegal, Seychelles, Sierra Leone, Tanzania and Tunisia.

Africa is a place where global music streaming services experience slow growth. One obvious reason is the cost of data in different countries, which hampers the explosion of streaming as users are unwilling to burn bundles fast.

While Spotify-like Boomplay and the likes are in operation, there’s a low penetration of streaming giants. Another reason is the relatively high price of their offers compare to local streamers.

Everywhere in the region—excluding South Africa—the digital music market remains dominated by ringback tones (RBTs). However, the penetration of smartphones, the deployment of mobile broadband and the reduction in internet data costs make things seem set to change.

Telecom operators are realizing that their revenues are increasingly dependent on data, and no longer on voice. As such, the door to negotiations, previously closed to content providers, now seems to be opening.

Since many years, the continent’s telecos have been significant partners of the music industry, selling ringtones and taking more than 50 percent of digital revenues generated by streaming subscriptions.

Market Share

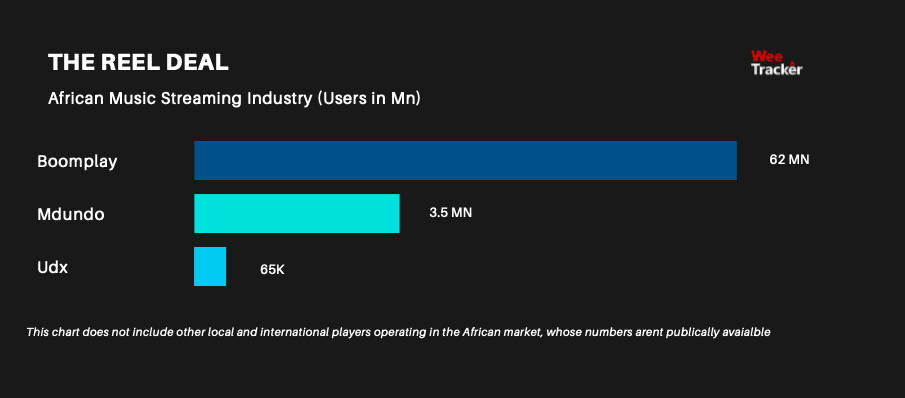

In spite of being a USD 19.1 Bn global industry, the music streaming market in Africa is substantially untapped. In as much as Boomplay gets new subscribers on a daily basis, competitors like Spotify, Tidal and now Apple Music are struggling to leverage on the region’s potential—thanks to many challenges.

Some music streaming platforms have shut down over the years, while the ones that remain continue to strive to break even. Well, Africans are not fully ready to pay for music. This is one of the reasons Iroko TV founder, Jason Njoku, lost USD 5 Mn in the Nigerian music industry through Iroking.

But as the industry starts to shed some challenges, services are rising to the occasion. In April, Tencent Music revealed that it had 644 million mobile monthly active users of its online music services, including 39.9 million who were paying.

Apple is not the only company eyeing the continent. Tencent-owned Joox, which is already available in South Africa, is planning to expand into key African markets. But this is not the only company Apple will have to contend with.

With a recent USD 20 Mn funding, Chinese Transsnet-owned Boomplay can be said to be a major dominator in the space. Adding 2 million new subscribers monthly, the firm is positioning itself become not only a music streaming service, but we aim to be the number one player in the whole music ecosystem for African music.

Bigger Fish

The growth of Boomplay has been enabled by the devices where it is preinstalled, smartphones made by Transsion—Africa top-selling phone maker. Adding to it’s wide range of local music, it has a litany of international tracks via deals with large record labels like Universal Music and Warner Music.

Apple’s coming is waited on by the reality that Android phones are the most-used in Africa. A tiny fraction of the continent’s 1.2 billion people deemed affluent and trendy use the company’s iPhones. But again, paying for music isn’t something Africans embrace.

Across sub-Saharan Africa, 60 percent of the population is under the age of 25, according to UN data. More than 400 million people have mobile phone subscriptions in sub-Saharan Africa and this is expected to grow to 690 million by 2025, according to GSMA.

According to Statistica, revenue from music sales in Nigeria is expected to grow to USD 44 Mn in 2023 from USD 26 Mn in 2014. The monetisation of music is also growing in East Africa, where Kenya-based distribution and streaming service Mdundo had 2.5 million active monthly subscribers paying USD 1.90 per month in 2019.

Apple Music happens to be the most successful music streaming service in the United States as of early 2018, with 49.5 million users accessing the platform each month.

Image: Africa Plus