Jumia Has Gone From eCommerce To Full-Blown Logistics Overnight

Jumia forays into logistics big-time

Africa’s largest e-tailer, Jumia, appears to have spun its in-house logistics arm into an entity that will now cater to other needs besides Jumia’s.

In addition to handling deliveries for the e-commerce platform, Jumia logistics has now morphed into a full-blown logistics service overnight; one that is open to external clients, which include individuals and businesses.

Currently, the now-expanded service is available in Kenya where customers have the option of dropping off their parcels at Jumia drop off centres in Nairobi or have the company collect from their locations through business-to-customer (B2C) and business-to-business (B2B) type deliveries. Not unlike what is on offer from startups like Sendy, Lori Systems, and others.

“Businesses across the country are re-examining their costs, especially during COVID-19. For many, logistics is a major cost driver and headache to manage,” Jumia Kenya CEO, Sam Chappatte, said in a statement.

”At the request of our partners, we are opening up our logistics arm for B2B and B2C deliveries, with the hope that we can provide a better quality of service, at lower cost,” he added.

Digging into Jumia’s play in logistics

The demand for e-logistics, offline delivery services, and online commerce has been on the rise since COVID-19 happened. Jumia appears to be getting in on the act and taking on the competition with its strong logistics network.

“In 2019, we processed 20 million packages and we were able to achieve 25 percent deliveries in rural areas through a network of over 6,500 direct agents and 3,000 warehouse operators,” Jumia Nigeria CEO and Executive Vice President Marketplace at Jumia Group, Massimiliano Spalazzi, had revealed when the company first hinted at opening up its logistics network in February.

“What this means is that we can accomplish even greater success by opening up our logistics services to the public. We have the right infrastructure, people, partnerships, and technology required to help third parties and partners solve logistics and marketing challenges,” he had added.

Jumia claims its logistics network in Kenya is a collaboration of dozens of logistics entrepreneurs across the country from big players like POSTA and Wells Fargo to many small players.

“Through this network, we have access to thousands of bikes, vans and hundreds of pick up stations,” said Chappatte.

“We have piloted this program over the last months, and believe the service is relevant for both medium and large businesses to reach fragmented customers, or for smaller businesses or individuals to do social commerce selling,” he added.

How does this fit into Jumia’s plans?

Before now, Jumia’s logistics service exclusively supported its e-commerce platform and food delivery business, Jumia Food. By virtue of this new development, Jumia is essentially becoming as much of a logistics firm as it is an e-commerce company.

This change in tact is in keeping with recent trends that have seen the e-tailer increasingly look beyond its core e-commerce business for revenue generation and loss reduction.

In the last 10 months, Jumia has exited several underperforming markets and tweaked its services. In addition to spinning its in-house payment platform, Jumia Pay, into a proper fintech product, Jumia has since given up its Jumia Travel vertical to Travelstart, and moves have been made for Kenya’s ads space and the micro-lending segment in Nigeria as part of restructuring efforts.

More than a year ago, Jumia pulled off a historic Initial Public Offering (IPO) on the New York Stock Exchange (NYSE). The company’s share price was trading well above the USD 14.50 opening price until a report by Citron Research, a firm owned by known short-seller, Andrew Left, alleged wrongdoings within Jumia.

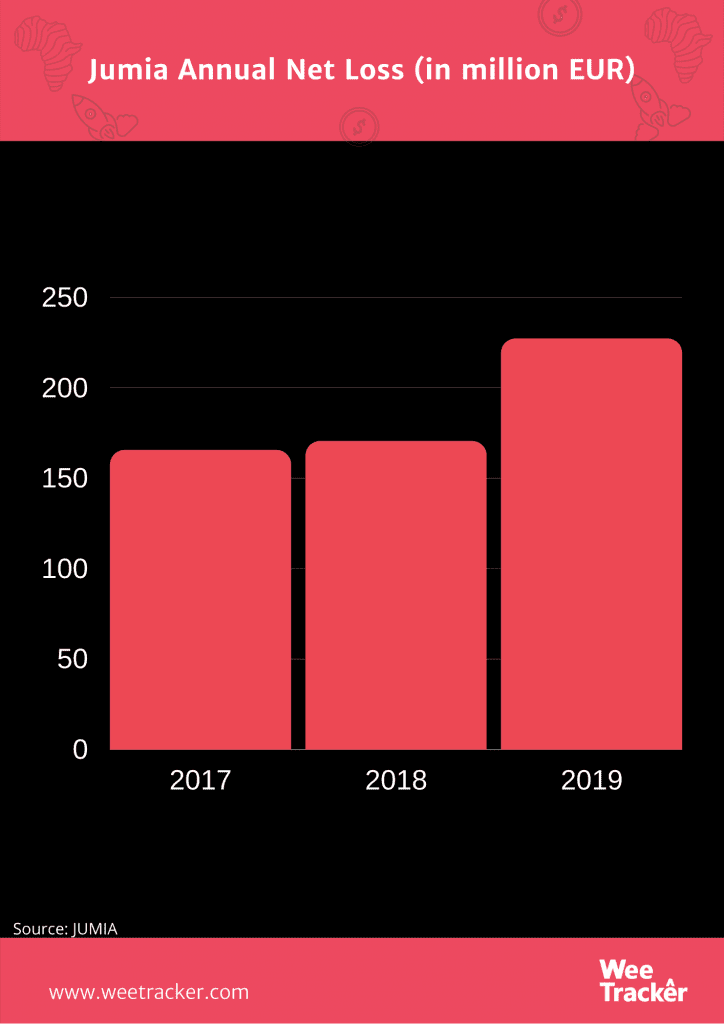

Those allegations crashed Jumia’s share price and invited lawsuits, and things have never quite been the same. Jumia shares currently trade at around USD 5.60, the company has since lost its billion-dollar valuation, and amid huge losses, the e-tailer closed its businesses in Cameroon, Tanzania, and Rwanda last year.

In early April, Jumia’s parent company, Germany-based Rocket Internet, made it known that it had sold its stake in Jumia and, by extension, severed ties with the company. But in that same month, Jumia announced its presence in South Africa despite packing it up in 3 countries the previous year.

Jumia’s latest move for external B2B/B2C logistics could be thought of as the company’s most recent effort to stay nimble, find new revenue sources, and arrest mounting losses.

When its losses reached USD 1 Bn n Q2 2019, Jumia Group CEO, Sacha Poignonnec, as well as CFO, Antoine Maillet-Mezeray, stressed the need to diversify Jumia’s revenue streams and restructure the business into a multi-faceted endeavour, given the difficult nature of scaling e-commerce in African markets.

Since then, Jumia has wielded the axe where it deemed fit and watered the plants where the company thought it reasonable. In Jumia’s last two financial results, there were signs that suggested the new approach might just pay off.

Featured Image Courtesy: MarketingEdgeMagazine