Jumia Looks To Africa’s Digital Lending Market – Now Offers Quick, Personal Loans On Android

African e-tailer, Jumia, is now offering quick, small, digital, personal loans — not unlike full-blown lending platforms like FairMoney, PalmCredit, Renmoney, Branch, Tala, etc — in what appears to be an effort to arrest the cash haemorrhage that has plagued its e-commerce business by pursuing growth across other verticals.

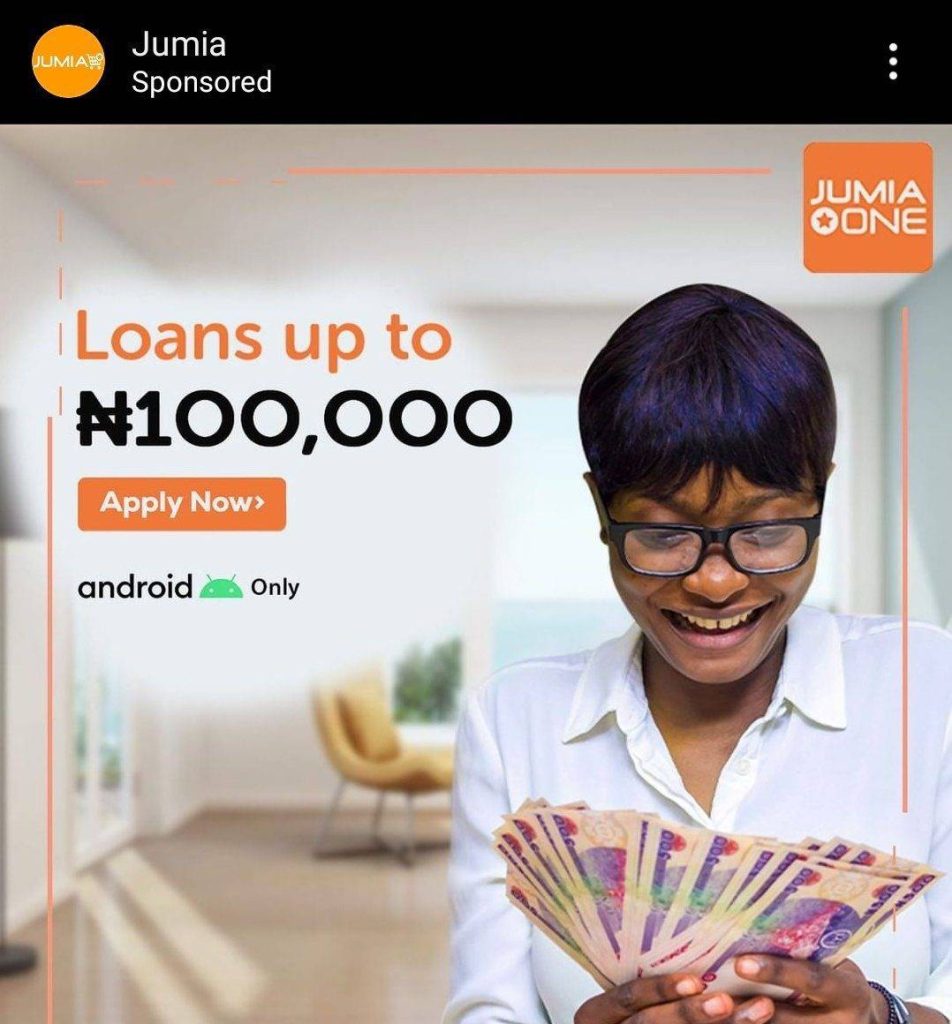

In Nigeria, at least, Jumia is now serving up quick loans of up to NGN 100 K via its lifestyle app, Jumia One (which is, in many ways, its very own super app), and the curious bit is that the lending option is only available to Android users at the moment even though the Jumia One app is available to both Android and iOS users.

Through the Jumia One app, Jumia is promising easy access to instant micro-loans without collateral and with competitive interest rates and repayment plans, much like regular payday lenders.

Before now, Jumia Lending has been the only loan platform on Jumia, targeted at verified merchants on the e-commerce platform as well as small businesses across Africa.

But now, Jumia is extending its loan service to quick personal loans targeted at individuals who use the Jumia One Android app. And this may have been happening since last year.

In December 2019, QuickCheck, a micro-lending mobile platform that provides collateral-free loans in emerging markets, announced partnerships with Jumia and PayAttitude.

As highlighted by QuickCheck’s CEO, Fabiano Di Tomaso, QuickCheck had been the only credit provider for Jumia customers subscribed to the Jumia One app for the previous six months before the partnership was announced.

Jumia One was launched by Jumia in 2018 as the go-to app for everything, basically. The lifestyle app which currently has over a million downloads on Play Store enables consumers to buy airtime, pay bills, order food, book hotels, arrange flights, book cab rides, stake bets, and access all Jumia services in one place.

Now it seems QuickCheck’s partnership with Jumia has a lot to do with providing their (Jumia) customers with access to loans, through its (Quickcheck) own credit-scoring algorithm used for the underwriting of borrowers. QuickCheck’s affiliation with Jumia is to enable customers to easily take loans on a mobile app they are already actively using.

Following from last week when the company’s first full-year financials since going public reflected widening losses and dipping sales despite increased revenues and users, Jumia can be expected to pursue other growth channels as it scales back on e-commerce, and the digital lending play looks like its newest move targeted at the active digital lending space in Africa.

As it attempts to plot a path to profitability, Jumia has already closed shop in Tanzania, Cameroon, and Rwanda while also trimming its staff base in Kenya and offloading its Jumia Travel vertical to Travelstart.

Early this year, we reported that Jumia Kenya is venturing into the advertising business and there’s been talk of Jumia transforming its promising in-house payment product, Jumia Pay, into a standalone fintech product capable of tapping into Africa’s blossoming fintech market.