Despite Huge Debt Pile, Zimbabwe Gets USD 250 Mn From Afreximbank

The Zimbabwe-Afreximbank relationship appears to have once again yielded something fruitful. Afreximbank—a pan-African multilateral trade finance institution—has granted a three-year USD 250 Mn credit facility to the Southern African nation, Bloomberg Africa reports.

This funding comes at a time when Zimbabwe looks assailed on all sides. From its diplomatic spat with the United States to the economic quagmire it is currently in and the uncertainty of the country’s progress in the face of Covid-19, there are many hopes that the country could outlive the multi-faceted crisis.

Behind The Curtain…

Zimbabwe is one of the few African countries whose debt pile has made IMF turn a blind eye on lending money, even in the tough times of the coronavirus pandemic. Other African nations whose debts are not entirely unsustainable are unable to get loans from the IMF—plus the World Bank Group. Like Zambia—a neighboring African country whose debt problem has it in the Bretton Woods institution’s bad borrowing books—Zimbabwe isn’t among economies that have been earmarked as beneficiaries of the IMF’s half a billion dollars in packages.

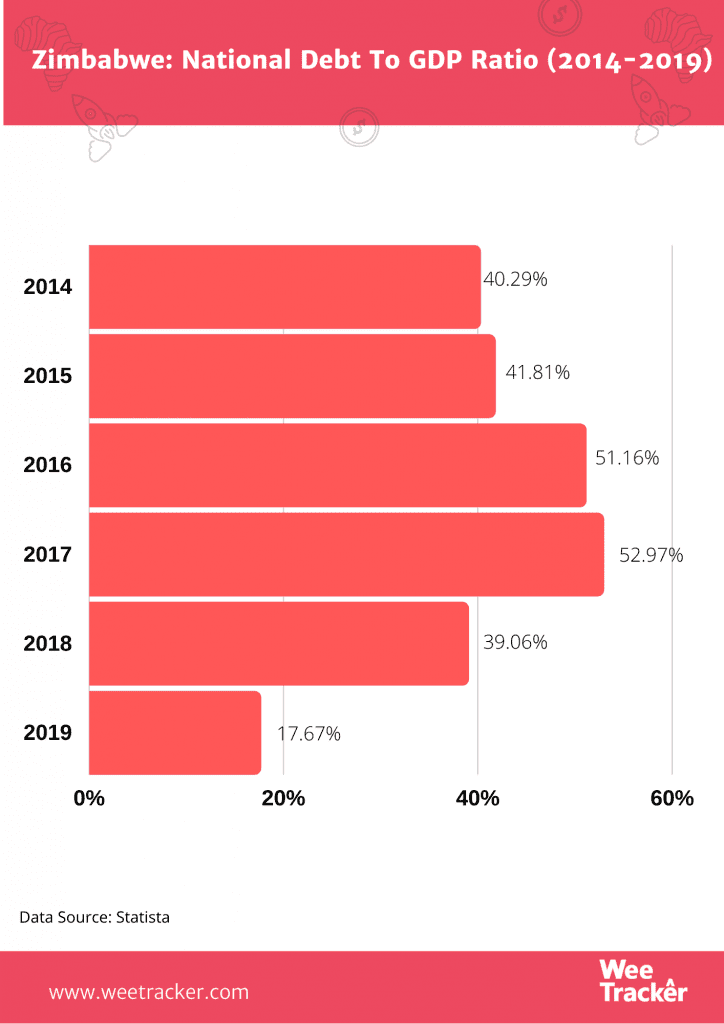

The country, which has become the poster child for hyperinflation, currency devaluation, and mobile money cataclysm in Africa, is currently grappling with USD 2.2 Bn debt. It owes this amount to international financial institutions, such as the World Bank and the African Development Bank (AfDB). Nevertheless, Harare, the nation’s capital, has cleared its outstanding position of USD 107.9 Mn with the IMF, as of October 2016. Technically, still, the Emmerson Mnangagwa-led nation remains ineligible to receive relief funds.

Because multilateral lenders are a no-go, Zimbabwe resorted to other means to raise funds needed to battle the coronavirus pandemic’s economic effects. For instance, it secured USD 200 Mn in treasury bill auctions in early June (2020). According to the country’s finance minister, Mthuli Ncube, the government aims to raise as much as ZW$ 1 Bn, as it will also source funds from insurance and pension funds.

Through The Backdoor?

The Zimbabwe-Afreximbank seemingly quiet friendship is not entirely unheard of. In fact, there have been worries about the financial institution’s support for the country, since Zimbabwe is more or less on the economic blacklist of a couple of multilateral lenders. Before now, the nations used its minerals as collateral to secure money from the bank, a threat to future negotiations with foreign creditors to restructure its USD 8.8 Bn debt.

Being unable to get funds from the IMF and the likes is a problem that has been around since 1999. So, for the past 5 years, Zimbabwe has been leaning on the financial shoulders of the African Export and Import Bank, which was created in 1993 under the auspices of the African Development Bank. Even with mineral-backed loans, the country yet faced repeated dollar crunches, leading to a shortage in everything from fuel to food and medics.

The Reserve Bank of Zimbabwe, the country’s apex bank, borrowed USD 985 Mn from African lenders in 2018, a year after which is secured USD 500 Mn from international banks whose names remain under wraps till now. According to speculations, the money came from the Afreximbank. That particular loan comprises USD 1 Mn in finance-bridging, while some of it was used to buy fuel and make token payments to South Africa and Mozambique for past electricity imports.

Now In The Open

It is no longer news that Zimbabwe’s economy could be at its worst ever. Presently, the country’s stock exchange, alongside mobile money platforms, has been ordered to close operations. The government’s opinion is that these two financial verticals are responsible for the hyperinflation and currency devaluation that is wreaking havoc on the country’s economy. Nonetheless, the situation is yet to be rectified, as fingers are crossed against the government’s next step.

In March 2019, the Afreximbank stepped in with a USD 1.5 Mn donation to support relief for another of Zimbabwe’s problems, a tropical cyclone known as Idai. The natural occurrence has, indeed, devastated not only Zimbabwe but also South Africa and Mozambique. Although much needed for similar crises, there remains no official statement regarding what the new USD 250 Mn facility would be used for.

It is unclear how Zimbabwe accessed these funds, just as it isn’t common knowledge whether the Zimbabwe-Afreximbank relationship would be brought to question because of the nation’s debt problems. Recall that David Malpass, World Bank President, once blamed other lenders/financial institutions for lending African countries too much, contributing to unsustainable debt.

Featured Image: Blackpast