Are SA Telcos Barking Up The Wrong Tree By Taking A Belated Stab At Fintech?

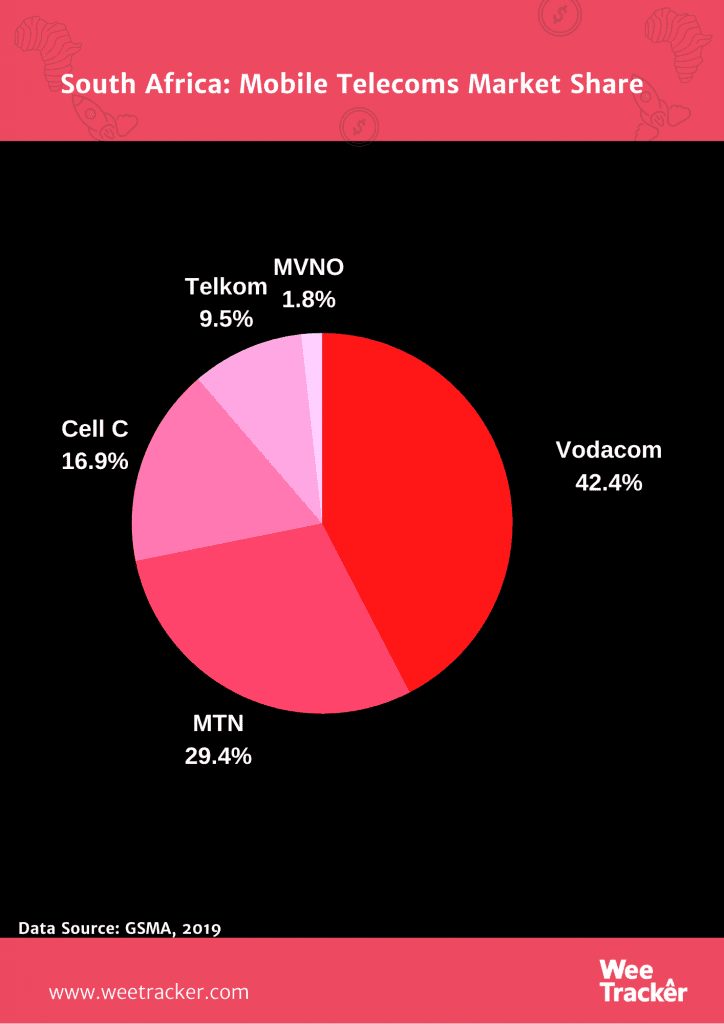

Between Vodacom, MTN, and Telkom SA, there are at least three South African telcos that are making fresh bets on the country’s peculiar financial services sector.

These mobile network operators (MNOs) are taking a stab at fintech in an attempt to take advantage of a scarcely-available opportunity to further digitise financial services in South Africa, as a way of tapping into new revenue streams.

But they may have arrived several years too late, plus this is a project that has ended in disappointment before. Ten years ago, Vodacom set out to do a Safaricom in South Africa with M-Pesa. The attempt was an exercise in futility.

The reason? Well, there has been quite a number of explanations, but the most common one is that the M-Pesa mobile money service was built for Kenya and not South Africa. In other words, M-Pesa was ill-suited to the needs of the peculiar South African market.

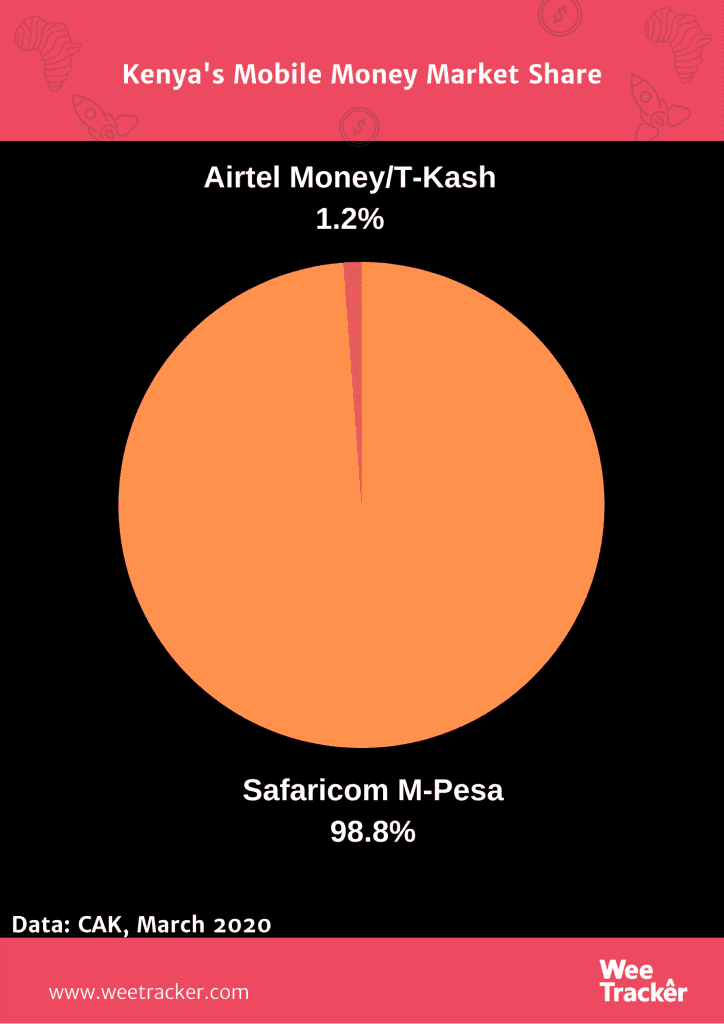

How so? M-Pesa has thrived in countries like Kenya, Tanzania, Lesotho, Mozambique, and the Democratic Republic of Congo, where a large percentage of the population has always been unbanked and thus excluded from formal financial services.

It’s no secret that the M-Pesa mobile money helped push financial inclusion to 83 percent in Kenya, thanks to the failure of banks to capture a large demographic of low-income earners in the country’s financial system.

In places where mobile money platforms like M-Pesa have boomed, the service offered the first link to not just technology (mobile phones) but also formal financial transactions for the previously unserved/underserved.

But it’s a different ball game in South Africa where history suggests that banks are on top of things. The country’s banking sector is by far the most advanced in sub-Saharan Africa, boasting 34 banks with a collective balance sheet of USD 325.6 Bn, according to the South African Reserve Bank.

Furthermore, about 80 percent of South African adults have bank accounts, according to a survey done by technology research body, FinMark. Indeed, there are widely cited but untested claims that there is a bank, branch, or ATM within a 20 kilometre (12-mile) radius in any urban or rural settlement in South Africa.

As a matter of fact, the country has the most technologically advanced, financially liquid, and accessible banking system on the continent with big names like ABSA, Standard Bank, Nedbank, Investec, and FNB, bossing the territory. There are also fast-rising digital banks like Discovery Bank and Tyme.

Thus, the task of propagating digital financial services tailored for the unbanked and underbanked in South Africa is quite tricky, given that it comes off as an attempt to fix something that isn’t quite broken. Only a mere 7 percent are in the financial exclusion bracket.

But that 7 percent represents a market of 11 million potential customers and it appears this is a hill South African telcos want to climb. No less than three MNOs in South Africa is currently pursuing the target of harnessing the power of mobile technology to serve up competing financial services.

In a press release dated July 20, Vodacom revealed that it is rolling out a super-app packed full with offerings, from “paying for your morning coffee, listening to a podcast on business management, sending money to your family, paying your utility bills, shopping online for everything from clothes, to groceries to electronics, checking on your business point of sales transactions and ordering new stock – all through the same, easy-to-use, super-app, from the convenience of your smartphone.”

Similarly, Telkom SA recently announced plans to roll out financial services. In early August, the telco unveiled a funeral insurance service for customers. Then, a few weeks later, Telkom partnered with Fundrr, a lending startup, to offer loans to small businesses on Telkom’s Yellow Pages classifieds listing website.

Africa’s largest telco, MTN, also looks to be fancying its chances of pursuing fintech, and its messaging platform, Ayoba, which claims 1 million users, has the looks of a super app in the making.

After becoming the dominant force in Ghana’s mobile money space and launching fintech services in its biggest market, Nigeria, MTN has its eyes on the financial services sector in its home country, South Africa.

With mobile penetration at 89 percent in South Africa as of 2018 and smartphone penetration at 91 percent by some estimates, it sure looks like there is a fintech opportunity for the country’s telcos. It’s just that it’s a very tricky endeavour, seeing the nature of the market and the fact that similar attempts have flopped in the past.

Featured Image Courtesy: InvestocracyNews