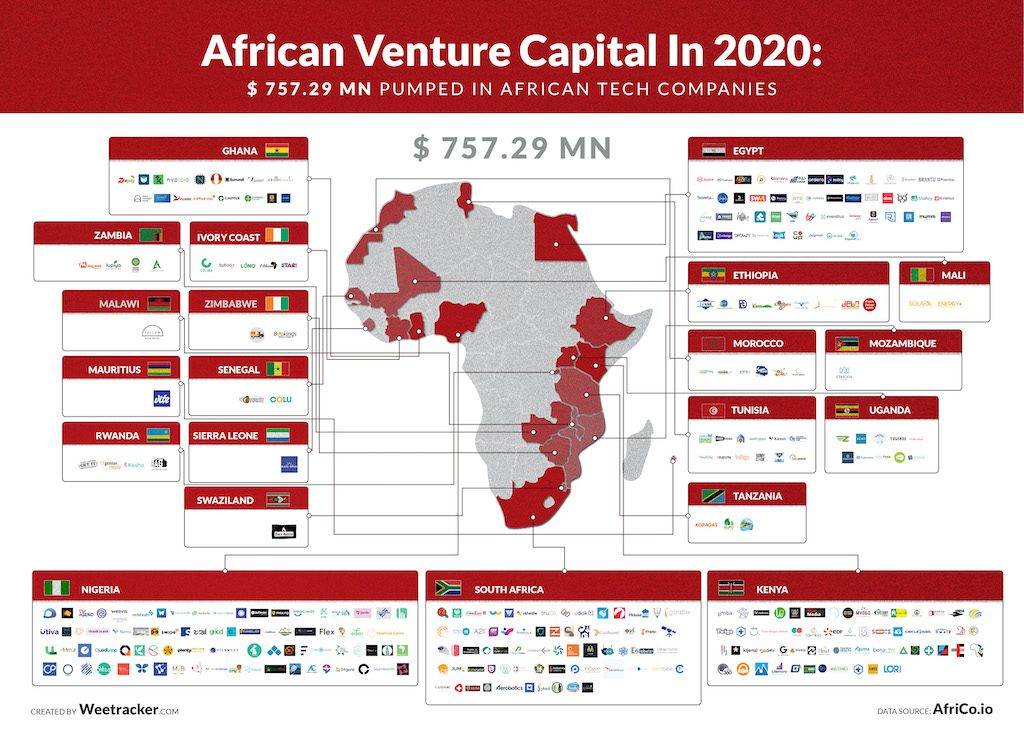

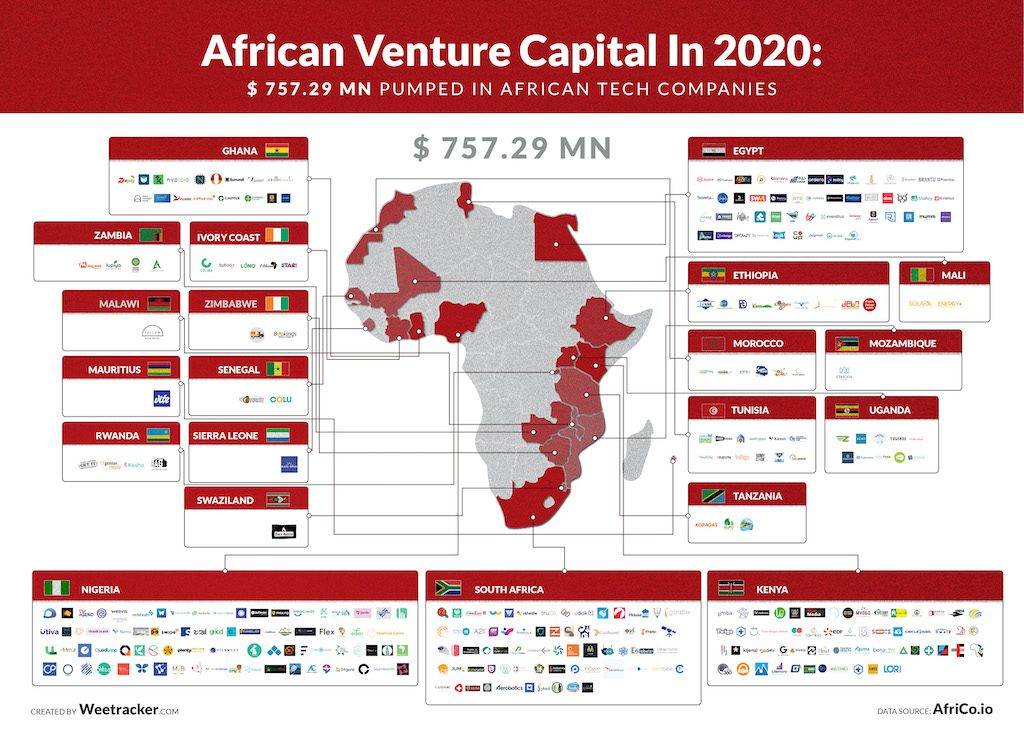

African Venture Capital Stands At USD 757.29 Mn In 2020 – AfriCo & WeeTracker Report

With the unexpected pandemic, 2020 was an unforgiving year for everyone, especially the lockdown periods. Given the status of the spread of coronavirus across Africa and other major investing economies, the future seemed a bit grim for VC investments. With all the uncertainties clouding the African startup ecosystem, it achieved enough to end up on a very good note. The last two years, 2018 and 2019, were extremely positive for the startups headquartered or operating in the continent, and the momentum did not break even in a harsh year like 2020.

2018 went down as a monumental year in the history of the African startup ecosystem. A total of USD 725.6 Mn was invested across 458 deals in African tech companies. The number was a 300% gigantic leap in the total funding amount and over 127% increase in the number of deals compared to the state of venture capital in 2017 in Africa.

The graph never went down post-2018, and venture investments broke all the previous records in Africa to register USD 1.340 Bn in investments through 427 deals in equity and debt financing in 2019.

The year 2020 may not reflect a billion dollars but a positive note, i.e. more deals. Compared to the previous 2018 & 2019 years, there were more venture capital deals in 2020.

Highlights – 2020

African tech companies secured USD 757.29 Mn in 478 deals in 2020. WeeTracker’s data has been quoted globally. Hence, for clarity of readers, the deals included are both disclosed and privately disclosed to us and includes equity, debt, acceleration/incubation, prizes & grants. The number doesn’t include private equity investments into traditional/non-tech businesses and M&As across tech & non-tech industries (data till 28 December 2020).

M&A’s, however, are a key indicator of any startup economy’s health. Exits are now, more than ever, visible and in sight. A big wave of exuberance in the ecosystem came late in November from the colossal acquisition of Nigerian fintech company Paystack by global payments company, Stripe. Speculations are that the acquisition was ~ USD 200 MN. PayStack had raised USD 11.6 Mn in total at the time of acquisition with 23 investors participating, to sum up, that amount. The acquisition by Stripe has raised eyebrows of VCs across the globe and have boosted the confidence of early-stage investors in Africa of betting more bravely than ever in local tech solutions. Local M&A transactions have also started to happen in the continent, which will mean more liquidity for early & micro investors in the near term. See more on the M&A scene as AfriCo team charts it out for us and you.

Among the top deals in 2020 across Africa, companies at growth stage packed the top 5 positions. South Africa’s Jumo secured USD 55 Mn, early this year. In 2018, the scale-up had secured USD 67.5 Mn and featured in the top-funded companies. With the Twiga deal as an exception in October, most of the large size deals were mostly closed in the first quarter. The Kenya based supply chain company’s investment comes in the form of a fund from IFC & KCB. Vezeeta, a very popular name from Egypt secured USD 40 Mn in Series D in February; the same startup had raised USD 10 Mn in 2018.

The new entry to the usual list of startups securing big rounds this year is a Stellenbosch based venture Skynamo. The startup is building a CRM product that can be touted as ‘Salesforce’ for Africa. More on this as well in the next articles

The investors are getting braver

It appears that the investors are getting to know the African potential even better. In 2020, over 450 investors participated in venture financing rounds across Africa. For most of the year, the investors were active, and the continent had approx 40 deals (disclosed) a month. The confident moves and risk appetites were reflected in increased seed rounds of 97 deals. The figures although are lower than last year’s 129 deals, but with the pandemic backdrop, the numbers are quite encouraging.

Leading countries and industries in 2020

Nothing out of the usual happened when it comes to analysing investments country-wise. 129 Nigerian companies raised venture capital followed by 90 Kenyan and 83 South African companies.

Financial Services, Healthcare and eCommerce were industries with maximum investment in terms of amount & number of deals among the industries. Jumo, Flutterwave and Chipper Cash formed a big chunk of investments under the fintech category.

Note: In our following articles, we would be covering the country and industry-wise information on the venture deals & investments.