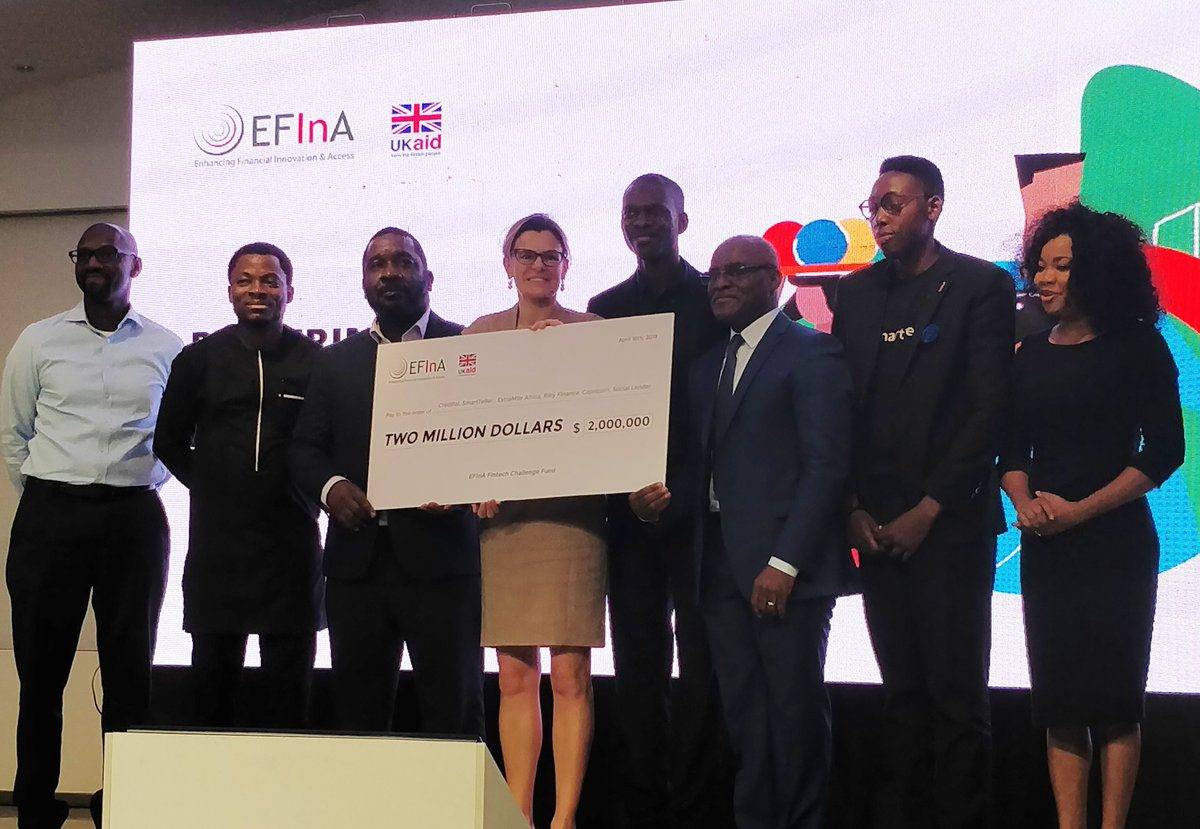

6 Nigerian Fin-techs Win USD 2 Mn Grants At EFInA Financial Inclusion Conference

The UK’s Enhancing Financial Innovation & Access (EFInA) held a financial services conference recently. The event titled ‘Powering Financial Inclusion Through Fin-tech‘ was held at the ZoneTech park in Gbagada, Lagos.

The EFInA fintech conference gave grants to a few fin-techs for displaying impressive “quality & creativity” with their products. Startups under the growth stage category: Social Lender, Riby Finance, and Capricorn Digital won between USD 200K and USD 500K grants while those under the startup category: CredPal, Extramile Africa and SmartTeller won USD 50K to USD 200K.

According to EFInA, these companies have built and are working to grow solutions to improve financial inclusion among low-income earners in Nigeria.

The event brought together some of the biggest players in the fin-tech industry, it focused on the financial inclusion and what can be done to improve it.

Financial inclusion today is a big deal. Statistics show that over 36 percent of Nigerians lack access to basic financial services. And millions of others with banking services are getting access to less financial services offerings than they should.

Financial inclusion is key to ensure that economic growth performance is inclusive and sustained. Over the past few years, Sub-Saharan Africa has recorded impressive growth in financial inclusion. Basically, it has been driven by mobile money and agent banking.

East Africa region has proven to be the star performer in regards to evolution of digital financial services. West Africa on the other hand, is the new growth market. Banks in this sub-region are continuously liaising with mobile money operators to offer accessible and convenient services.

Worthy to mention, Stephen Ambore, head of Digital Financial Services at the CBN spoke and he highlighted the role of the banking regulator in improving financial inclusion. “There’s a commitment from the CBN to increase the number of financially included people from 48% to 83% by 2020,” he said further noting that there are rules and regulations that still hinder fin-techs from fully thriving.

Dayo Ademola gave an overview of the Nigerian fin-tech landscape, their business concerns and the strategic partners helping them attain their objectives.

Dayo Koleowo, a partner at Microtration took to the stage afterwards notably pointed out the need to provide a unified identity system necessary to support the growth of fin-techs.

Featured Image Courtesy: technext.ng