Global Streaming Giants Had Big Plans For Africa—Now, It’s Complicated

The recent revelations from industry leaders about Netflix’s decision to scale back its Nigerian originals have thrown Africa’s streaming landscape into uncertainty, stirring concerns about the future of global players on the continent.

While the company declined to comment on reports of its reduced investment and a spokesperson did tell WT, “We are not exiting Nigeria and will continue to invest in Nigerian stories to delight our members,” this measured assurance lies a more complex reality — one marked by strategic retrenchment, intensifying competition, and shifting market dynamics.

When Netflix entered Africa in 2016, it painted a picture of boundless potential. The continent’s vast population, growing internet access, and thriving creative industries seemed primed for success. Since then, Netflix has invested USD 175 M in South Africa, Nigeria, and Kenya, producing global hits like The Black Book, its most successful African film to date.

But producing premium African content has proven more expensive and logistically challenging than anticipated. Netflix’s pullback reflects this reality. High production costs, currency volatility, and a fragmented digital payments ecosystem complicate business. In Nigeria, for instance, currency volatility and an inflation crisis make production costs unsustainable, even with international backing.

From Expansion to Recalibration

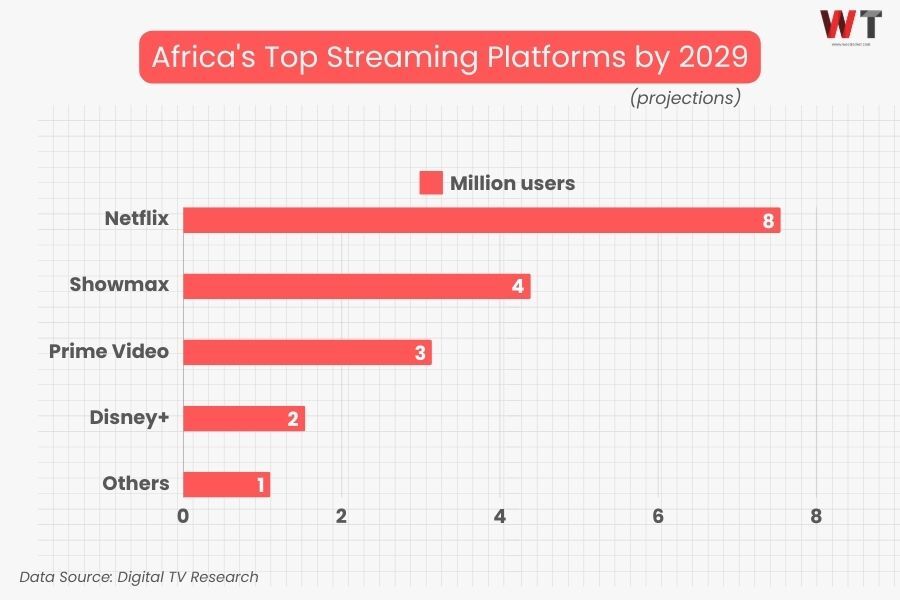

Netflix isn’t alone. Amazon Prime Video, which made a high-profile entry into Nigeria and South Africa with titles like Gangs of Lagos, has also scaled back its local content push, shelving several anticipated projects. Both companies had bold ambitions to capture Africa’s youthful, mobile-driven market of half a billion internet users, with Africa’s video-on-demand market expected to reach 18 million subscribers by 2029.

Their aggressive expansion however ran into persistent hurdles: rising production costs, economic instability, and fragmented systems. These realities have tempered the initial euphoria that Africa could become the next frontier for global streaming dominance.

Meanwhile, South Africa-based Showmax has taken a different route — one that’s proving more resilient. As the streaming arm of MultiChoice, Africa’s largest content producer, Showmax draws from a deep well of local expertise and has seen strong growth; reporting a 30% increase in paying subscribers in its latest financials.

It follows MultiChoice’s commitment of USD 1 B last year—half its entertainment budget—towards creating over 6,500 hours of content in 22 languages for streaming. By blending this localised approach with global-quality productions, Showmax has grown its subscriber base by 26% annually over the past four years, emerging as a formidable regional competitor.

This adaptability contrasts the struggles of early players such as IROKOtv and some telecom-backed platforms that faltered. Vodacom’s Video Play, MTN’s VU, and Zimbabwe’s Kwese TV all shuttered despite hefty investments. Cell C’s Black also fizzled out after the platform burned through USD 80 M with little traction. Struggling to license premium content or produce originals, they found themselves unable to compete with Netflix’s global catalogue or Showmax’s local hits.

The Plot Thickens

Amid this corporate reshuffling, local filmmakers have also forged an unexpected lifeline in YouTube. Locked out of high-budget streaming deals and battling piracy in the DVD market, creators are pivoting to the platform to rack up views and earn dollars.

YouTube has, for one, evolved from a backup option into a thriving ecosystem for Nollywood creators. Channels like Libra TV and ApataTV+ now operate as de facto streaming services, reports Rest of World, boasting millions of subscribers and hundreds of millions of views. “We procure movies and also do profit-sharing with our producers,” said ApataTV+ founder Olusola Akinyemi. Libra TV’s success mirrors this model, with over 550,000 subscribers and 100 million views.

However, YouTube isn’t a guaranteed payday. Ad revenue can be inconsistent, prompting many filmmakers to target higher-paying audiences in the U.S. and U.K. Still, for budget-conscious creators, it remains the most accessible global platform.

Africa’s streaming market, once viewed as an untapped goldmine, has proven far more complex and the landscape today reflects a dynamic push-and-pull between local realities and global ambitions. Initial hype about millions of internet users and a fast-growing youth population has given way to tempered expectations and forced recalibrations.

The next chapter will likely be defined by selective investments, tighter production criteria, and deeper partnerships. Africa’s streaming wars are far from over, but it appears the rules are changing.