Africa’s Startup Funding Jumps 430% In September Comeback, Rises 29% YoY

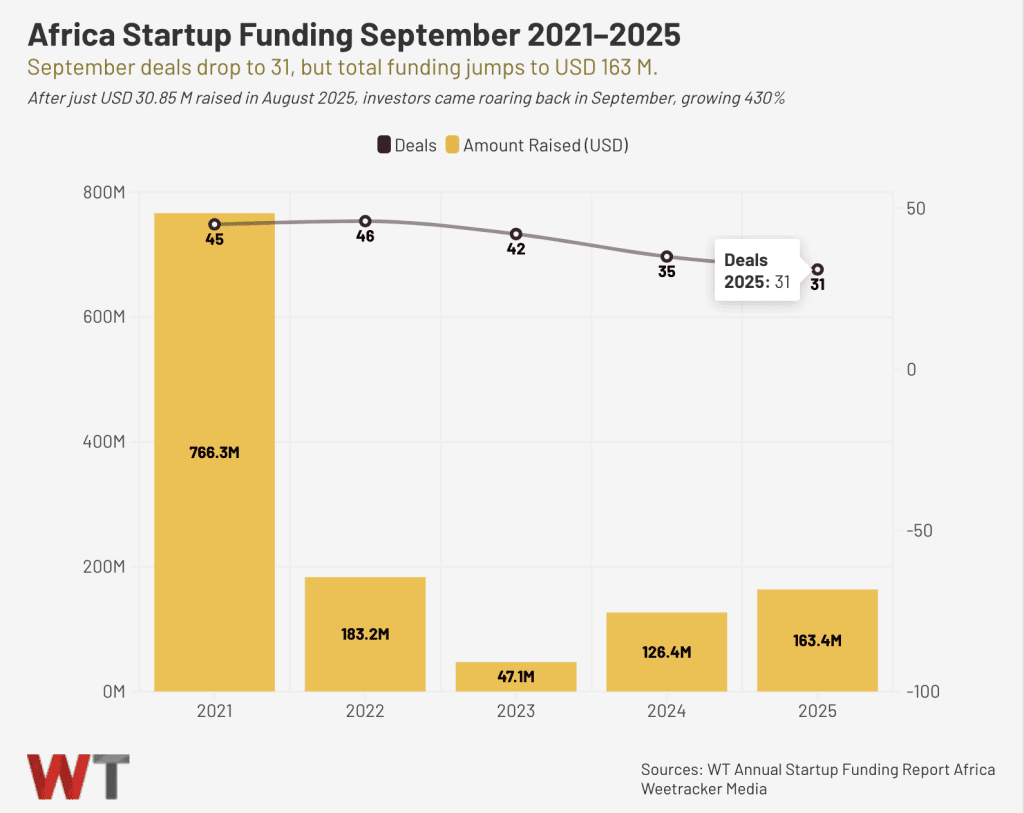

After a sluggish mid-year, September 2025 felt like someone turned the lights back on across Africa’s startup ecosystem. Investors who had been sitting on the sidelines came out swinging, backing 31 startups to the tune of USD 163.4 M, according to WT Annual Startup Funding data.

This figure marks a strong 430% month-on-month increase from the mere USD 30.85M raised in August across 11 deals, suggesting that investor appetite, though tempered, is seeking a significant return.

The year-on-year figure reinforces the trend. The month’s performance also marks a 29% year-on-year increase from USD 126.4 M in September 2024. Although the number of deals fell slightly from 35 to 31, signaling a concentration of capital in fewer, more mature companies.

It wasn’t the frenzied cash rush of the pandemic boom years, when startups on the continent raised a record USD 766.3 M across 45 deals, riding a global wave of cheap money and big bets on digital inclusion. Yet, the performance was significant, showing clear signs of market stabilization and recovery from the September 2023 slump, when funding cratered to USD 47.1 M as global uncertainty forced investors to pull back.

Regional and Sectoral Performance

Looking at regional performance, familiar names remain the gravitational centers of capital. South Africa led September’s activity, pulling in USD 64.5 M, roughly two-fifths of the continent’s total.

Nigeria followed with USD 44.2 M, while Kenya, Egypt, and Rwanda rounded out the top five with USD 22.4 M, USD 15.5 M, and USD 7 M, respectively. Together, these five countries accounted for nearly all of the month’s funding, underscoring how Africa’s venture geography, while expanding, remains top-heavy.

Sectorally, Mobility and logistics startups drove the month’s biggest wins, pulling USD 40.5 M in total. South Africa’s Ctrack led the pack with a USD 23.4 M growth-stage round, proof that logistics infrastructure is still one of Africa’s most bankable bets.

Close behind were SaaS and data players, raising USD 28.1 M in total. Companies like Contactable in South Africa and Intella in Egypt raised major double-digit rounds riding the AI and digital identity wave.

On the other hand, Fintech, once the continent’s undisputed magnet for venture capital, saw a muted performance. It drew USD 27.7 M in September, led by Nigeria’s Kredete, which raised USD 22 M to expand its credit infrastructure network. The sector still commands attention, but it’s sharing the stage now.

Beyond the big three, the consumer goods and agritech segments are also quietly asserting themselves. South Africa’s Pura Beverage Company secured USD 14 M, a rare bright spot for local manufacturing, while African agritech players scooped up USD 21.9 M, much of it tied to sustainability and food security initiatives.

Investors Double Down on Equity and Mature Bets

Beneath the numbers, equity funding took a decisive lead, accounting for 14 of the 31 deals and the vast majority of the capital raised. Debt funding played a smaller but meaningful role, featuring in five rounds, while 2 hybrid deals combined both debt and equity. The remaining activity came from 7 prize-based rounds alongside three undisclosed deals.

Overall, the September funding snapshot shows a broader maturation of Africa’s venture landscape. More than half of the deals(17) were growth-stage rather than seed or pre-seed, a definitive signal that capital is consolidating around proven operators instead of early-stage startups.

That’s both good and bad news. The upside: more solid companies, fewer flameouts. The downside: early-stage founders are feeling the chill, especially in smaller markets like Africa’s that can’t yet show scale.

Still, USD 163 M in one month is nothing to sneeze at, especially in a global funding climate where risk capital remains cautious. For an ecosystem that has been slowly shaking off two years of investor caution, the uptick suggests that confidence is returning gradually.