South African Insurtech Startup Click2Sure Secures Investment From Greenlight

Click2Sure; a South African insurtech startup that was the creation of two former Naspers executives, has secured investment of an undisclosed amount from Greenlight Capital Re; a Nasdaq-listed company.

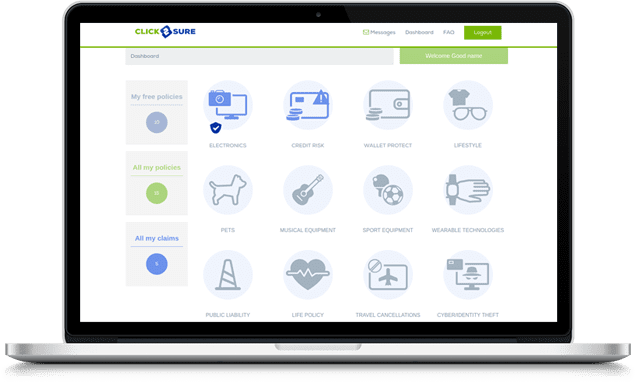

The duo of former Naspers CTO, Jacques van Niekerk and former Groupon South Africa CEO, Daniel Guasco, are the Co-Founders of the insurtech company which prides itself as a full-stack digital insurance platform. The funding received is expected to facilitate the global expansion of the business.

Greenlight Re Innovations; an arm of Greenlight Capital Re, is the medium through which the investment is being made. Such factors as the modular and scalable cloud-based technology that is served up by Click2Sure, as well as the experience of founders, are thought to have factored in significantly in the investment agreement. The platform’s technology can be considered as having the potential to cause disruptions in the traditional face-to-face network, call center, and server-based industries.

Before they pulled resources together to create Click2Sure, both men can be said to have forged stellar careers in the private sector. Van Niekerk is known to have served as CTO in a number of South African eCommerce companies including Takealot and Mr. Delivery. He also had a stint at Prodigy Finance. On his part, Guasco enjoyed a spell at online buying website, Twangoo, before going on to call the shots at Groupon in South Africa.

Having come into existence last year, Click2Sure were selected alongside three other fintech companies in the maiden edition of the AlphaCode Accelerator program. The startup is also known to have such brands as Takealot, Uber, Guardrisk, Xiaomi, PriceCheck, and Hyperli as part of its clientele.

The latest investment in Click2Sure is coming in the wake of two other similar deals announced by Greenlight Re Innovations; an initiative that was birthed in March this year with the vision of seeking out technology and innovation opportunities that have connections with the reinsurance of the insurance market.