Branch Cumulatively Loans Kenya USD 10 Mn After Recent USD 5 Mn Issuance

San Francisco-based digital lender Branch has announced its commercial paper issuance of KES 500 Mn USD (USD 4,922,000) in Kenya.

The latest commercial paper follows a KES 350 Mn (USD 3,444,204) issuance that was announced in 2018, which was preceded by KES 200 Mn (USD 1,968,116) in 2017. This third and largest issuance which has been arranged by Barium Capital brings the entire commercial paper to a little over KES 1 Bn (9,840,583). The investment will be used to expand the firm’s services in Kenya.

Branch had recorded a series of strides in the African landscape. Starting from its trade launch in 2015, it has grown by means of efforts made in Kenya, among which are internet penetration which has enabled users to access financial assistance using smartphones.

In competition with Tala, Okash and the likes, Branch offers micro-lending services in Nigeria, Tanzania, and Mexico. As part of this latest announcement, the firm revealed its intentions to expand into India this year.

Daniel Szlapak, Head of Global Operations for Branch, expressed excitement the firm draws from serving millions of Kenyans and easing them into essential financial service access. “ The huge growth and success in the Kenyan market have positioned Branch for strong global operation”, he said.

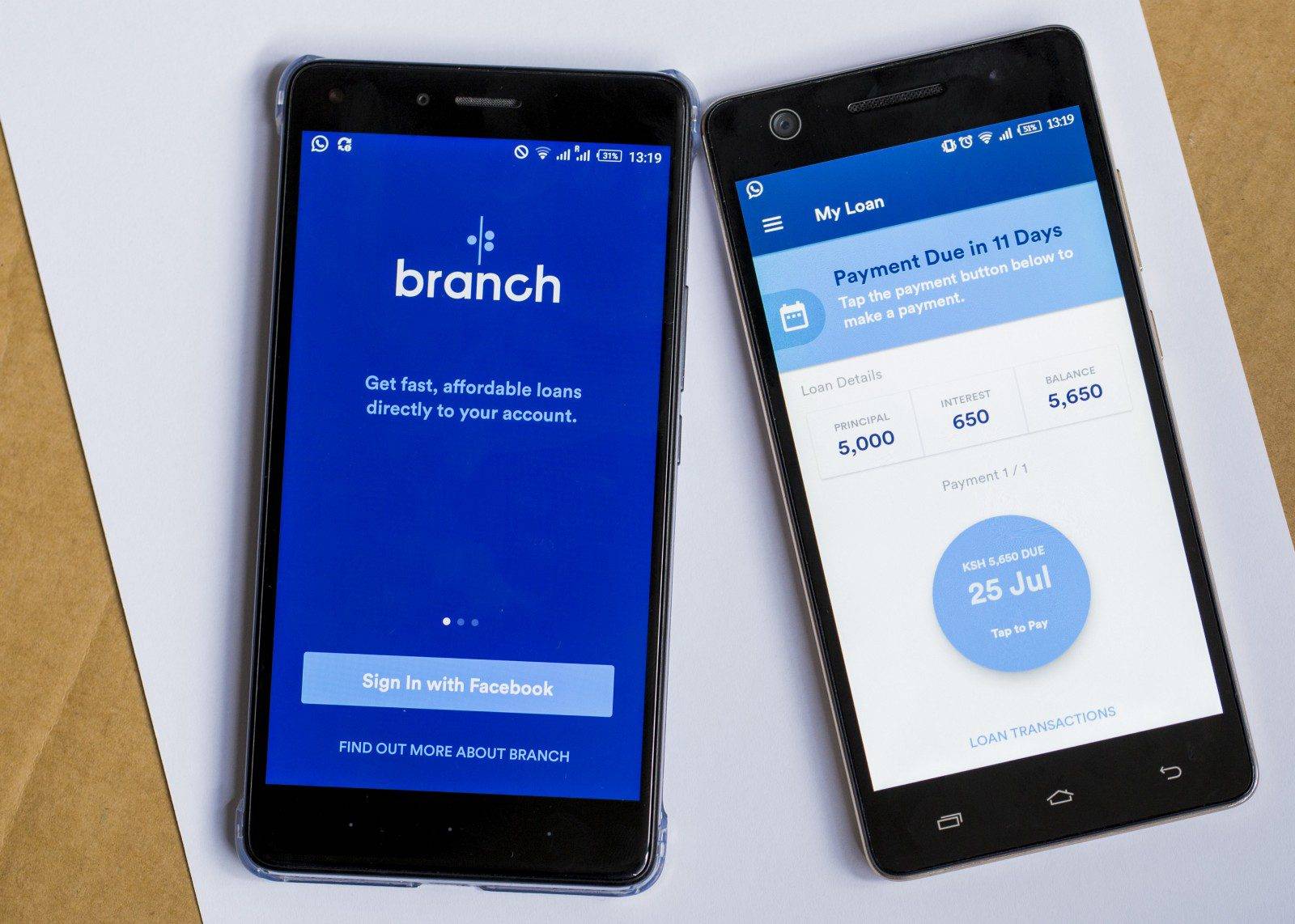

Branch offers M-Pesa loans of up to KES 50,000 (USD 491.64) via an Android application that can be installed from Google Play Store. The lending decisions are made by a proprietary credit score calculated by analyzing more than 2,000 data points on the phones of applicants. New borrowers begin with a loan up to KES 1,000 (USD 10), after which they can increase their credit limit based on their repayment performances per previous loans.

December 2015, Branch became the first African company to raise money from U.S-based VC fund Andreessen Horowitz who has Facebook and AirBnB included in its portfolio. The round was reported to have been USD 9.2 Mn. To date, the mobile-based financial services firm has raised more than KES 1 Bn in equity and debt financing.

Featured Image: Branch International Via Medium