Made In China, Branded In Japan – Is Miniso Becoming A Force Or Farce In Africa?

Miniso? Not So ‘Mini’ After All

Since throwing its doors open for business with the launch of its very first store in China back in 2013, Miniso may have subtly wriggled its way into the sub-conscious of the average lifestyle shopper in various world countries as the go-to store for all things chic and cheap.

The Chinese-Japanese brand (whose true identity remains something of a perpetual subject of dispute in some circles), prides itself as a low-cost retailer and variety store chain that finds a turf in the sale of both household and consumer goods, such as fashion accessories, cosmetics, toys, stationery, kitchenware, digital products, food & beverage, and a host of other products.

Granted; all that information hardly signals anything special, nor does it spell some sort of “trailblazing uniqueness” on the part of the brand. However, there is a growing feeling that Miniso is evolving from “copycats” and “also-rans” – as they were initially labeled – into a juggernaut in the retail space. And this evolution is happening at some pace.

If there is anything that can be taken home from its moves in the last few years, that would be the brand’s belief in proliferation – some would even say the company may just take the saying; “the more, the merrier” a little too seriously.

Five years on since Japanese designer, Junya Miyake, and Chinese entrepreneur, Ye Guo Fu, pulled their resources together in concerted efforts which culminated in the establishment of Miniso, it’s been something of a fairytale run.

The company currently lays claim to well over 3000 stores in more than 70 countries across the globe, while it still has lofty ambitions of seeing those figures surge to 10,000 stores in 100 countries by the year 2022.

To fund its expansion in both domestic and global markets, Miniso hinted at preparations for an Initial Public Offering (IPO) in January 2018, and that was before it received RMB 1 Bn (around USD 150 Mn) in strategic investment from the duo of Hillhouse Capital Group and Tencent in September.

Well, those expansion plans would seem like a tall order at face value, as it remains to be seen whether the company’s efforts would yield that much fruit within the stipulated time frame. But it does serve up an indication of the brand’s ambition – something that has been evident since that first store was declared open for business in Guangzhou, China, back in 2013.

Since opening shop, the Chinese-Japanese co-founders have masterminded entries into various parts of Asia, The Americas, Africa, Europe, and even Australia.

For their efforts, Miniso currently operatesistores in several countries, including Japan, South Korea, India, Malaysia, the Philippines, Singapore, Canada, U.S.A, Mexico, Brazil, Colombia, Peru, Russia, Spain, Germany, Italy, South Africa, Nigeria, Egypt, Kenya, and many other countries.

Miniso even got some heat in 2017 when it ventured into what could be considered forbidden territory by opening a store in, Pyongyang, North Korea.

Soon after kicking off operations in the country, the company got some backlash for going against United Nations Security Council Resolution 2321, which prohibits trade with North Korea. To quell the controversy, Miniso had to wash its hands off the retail front which has since been rebranded.

But despite the blip, Miniso has gone on to record remarkable growth since coming into existence. In 2016, its sales revenue was clocked at USD 1.5 Bn and as was gathered from last year’s AGM, that figure has risen well over USD 2 Bn. No mean feat – especially as the brand has been around for just a little over five years.

Japanese, Chinese, or Pseudo-Japanese?

There seems to be a cloud of doubt hovering over the true identity of Miniso. Despite best efforts on the part of the founders to set the records straight, the company’s image seems to be enshrouded in some sort of controversy.

And that’s because Miniso likes to call itself a ‘Japanese brand’ when several indications reflect the company in a totally different light. Due to this, there are some who describe Miniso as, in fact, a Chinese brand masquerading as Japanese. And then, there are those who tartly label the brand as; “made in China, designed to look Japanese.”

The reasons for such opinions are not exactly far-fetched. Miniso hardly has any more ties with Japan than its striking resemblance to some more established Japanese brands and the labels on its products which are written in ‘crude’ Japanese (an unhealthy mix of odd Japanese characters) – like something hurriedly gotten off Baidu Translate.

At the business end of things, it reeks Chinese. For a company that seems bent on playing up its Japanese roots as a selling point, it might be just a little too Chinese. Not only is the company headquartered in China where it also opened its first store, but it also has over a thousand stores in the same country as opposed to just four in Japan. And such numbers are just too hard to ignore.

More so, compared to its aggressive efforts at expansion in other places, its operations in Japan would come across as tepid. And that’s interesting given that it’s hard to think of many other such cases where a company has bigger operations in other places than its supposed base.

Besides covering significant ground in China and even reporting its revenues in Chinese Yuan, the company has no less than 25 stores in India and plans are in the pipeline to grow that number to 800 in the next few of years.

Throw that in with its efforts in Africa, Europe, The Americas, and other parts of Asia in recent times and its claims to Japan is really put in doubt. There are even indications that the brand clings to Japan as a way of taking advantage of consumer sentiments in China.

Despite their checkered history with their Oriental neighbors, there’s an unspoken tendency for the Chinese to regard Japanese products as superior. And that may weigh in.

When Strait Times spoke to the co-founders of Miniso in 2016, they did offer some explanation for the apparent discrepancy.

“It is funny how the strategic partnership and high performance of Miniso in China have overshadowed the business in Japan,” says Miyake. “I do wish to see Miniso become more successful in Japan, but I find it even more exciting to share the Japanese design philosophy with people around the world.”

They also told Strait Times that their first priority is to globalise the brand as they see greater business potential in other countries, but they will “always look out for opportunities to grow the Japanese market.”

The co-founders attributed the larger number of stores in China and a number of other countries when compared to its “Japanese base” to the high saturation rate of similar products in the Japanese domestic market.

That said, it could be surmised that Miniso has a greater presence in other places than it does in Japan because the country’s market already has too many of its kind. And that only supplies more flak.

Copycats Or Top Dogs?

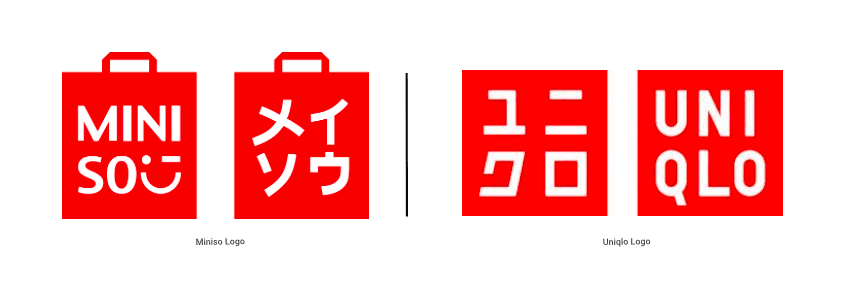

Miniso has also come under fire for some of its obvious similarities with some established Japanese brands. Some even refer to it as a copycat; a Chinese knock-off of the Japanese brands; Uniqlo, Muji, and Daiso.

And more than just pointing fingers, Miniso’s logo does have an uncanny resemblance to Uniqlo’s. Furthermore, its name seems to combine the Chinese characters for Muji, Uniqlo, and Daiso. There are similarities with Muji in the layout of its stores and lineup of its products, and its price points seem to have taken a cue from the 100-yen store, Daiso.

While all these may well be down to coincidence – and some coincidence for that matter – it does explain the name-calling by those who appear to be disillusioned by the position of the brand. As expected, the brand has relentlessly distanced itself from such claims.

In any case, Miniso has been a relative success since its inception. Although its financial information is limited – as would be expected from a privately-held company – several indications suggest that the company is growing rapidly and is well on course to achieving fourfold expansion in the next few years.

That is to say, what may have begun as an awkward mix of a trio of Japanese concepts has somewhat morphed into a brand with its own identity – one that appears to have gotten on the soft side of millions of consumers for filling a price chasm left unaddressed by the older, core Japanese brands that it (Miniso) is said to be imitating. And that might just be as close to a win as one can get these days.

Well, Miniso may well be a knock-off, but it does deserve some credit for having adapted and refined certain elements of a successful global business model and deployed them to telling effect in a number of local markets. And it won’t be the first time a brand went from also-ran to industry behemoth by playing that card.

The African ‘Collection’

Once Miniso had gotten some sort of foothold in parts of Asia, while also making successful entries into a number of markets in Australia, Europe, and The Americas, a move for Africa was always on the cards.

With the exit of brands such as Mango, River Island, and Topshop creating holes in the South African retail space, it came as no surprise when Miniso unveiled its very first African outlet at Menlyn Park Shopping Centre, in Pretoria, South Africa, back in August 2017.

That was the first of the 16 Miniso stores in the country currently and more is expected to follow as there are talks of taking the store count to 200 in the next couple of years. If this is achieved, it could go some way towards knocking a sizeable chunk off South Africa’s worrying unemployment statistics.

“We are providing jobs for the people of South Africa and through our growth plan for the country, we are aiming to create many more jobs,” says Alex Mo, CEO MIniso South Africa. “Unemployment in South Africa is a huge problem and as an international company, we believe that it is our duty to give back to the nation,” he adds.

Miniso touched down on Africa’s most populous black nation some two months after the launch in SA. In what was no ordinary launch, it announced its presence in Nigeria’s commercial hub, Lagos, with the simultaneous opening of three stores in three different malls across the city.

Since then, Miniso has opened a total of 11 stores across Nigeria and the opening of a further 200 stores is being targeted by the end of this year. Last year, the company rolled out a retail franchise model which is tipped to become one of the most profitable ventures in Nigeria’s business segment, as entrepreneurs and investors can now own Miniso stores with minimal hassle.

Miniso debuted in East Africa in December 2017 with the opening of its first variety store at Village Market, in Nairobi, Kenya. A second store was opened in Thika Road Mall (TRM) a few weeks later, and two others followed at The Hub Karen and The Junction Mall.

Currently, there are no less than 17 Miniso stores in Kenya. The brand has since spread its tentacles to other East African countries like Uganda and Tanzania, while also expanding its presence to Egypt, Morocco, Madagascar, and Mauritius.

Although the company keeps a tight lid on its earnings in Africa, there are indications of progress, as well as huge potential for growth.

As the continent is experiencing meaningful development in the social economy and rapid urbanization, the consumer group is expanding and purchasing power has never been higher. Thus, the huge growth potential of the African retail market.

In addition, with the current African population sitting at well over 1 billion and rising, and the continent’s

And Miniso seems poised to capitalize on the growing influx and circulation of capital, as well as the shift in consumption patterns amongst working-class Africans, with its offer of variety and luxury that comes on the cheap but does not compromise on quality.

Ergo, its big plans for Africa, where it plans to soon begin to source raw materials for its products, as well as create thousands of job opportunities

Pulling The Weight Or Just Talking A Big Game?

Much of Miniso’s success could be attributed to its market strategy which according to asset management company, AllianceBernstein, “fills a price-point niche that was neglected by the Japanese brands that it is imitating.”

A key feature of that strategy has involved replicating its stores in various markets across the globe, and with over 3,000 stores spread across more than 70 nations and regions at the last count, the brand seems to have covered a lot of ground on that front.

Throw that in with the most recent figures on its bottom lines and it does look like Miniso is holding its own quite well, especially as it is still a relatively young brand.

To further its simultaneous, rapid proliferation in different markets, the company recently set for itself a rather steep target of raising its numbers to 10,000 stores in 100 countries with a sales volume of RMB 100 Bn (approximately USD 15 Bn) in the next three years. Quite a reach, even for bigger brands.

While Miniso has undoubtedly cruised through a steady trajectory of growth in the last five years, and even though it likes to tether its claim to success to an expansion rate of 80-100 stores monthly (figures that are not exactly undebatable), there’s a feeling that the brand might just trip over itself with its lofty ambition.

The problem with telling everyone you’ll hit the bullseye from a mile away is that when you don’t, it won’t matter how much ground you covered, it will be about how far off you were. And in the case of Miniso, we might just be talking about a miss by some distance.

So far, the company has done pretty well but when its progress is juxtaposed with its bold statements in the past, it does seem like a charade – some cheap publicity/marketing stunt on their part.

Granted; a Miniso store is opening in some corner of the world every other day – which is some feat on its own – but perhaps the company could do without setting itself up for a fall by drumming up ‘big plans’ in the wake of every other store opening.

Take, for instance, its opening in South Africa back in 2017; Miniso had just entered the African market and what followed were brazen proclamations of opening 50 more stores in the country within the same year. And then, there were talks of opening 200 stores the following year, as well as some very impressive employment projections.

Well, that wouldn’t cause much of a stir until it hits home that there are no more than 16 Miniso stores in South Africa at present. Not exactly a bad figure, but nowhere near what was talked up. And that takes away the gloss.

A similar drama played out when Miniso arrived in Nigeria. The brand made quite an entrance and created a buzz by opening three stores simultaneously in Lagos, and there was little doubt when it talked about opening hundreds more and employing thousands in the coming months.

At present, there are 11 Miniso stores across Nigeria and that should seem like a respectable figure had the brand not talked up some rather ambitious numbers, including a very recent one which hints at the opening of some 200 additional stores in Nigeria by the end of this year – a tall order. It’s pretty much the same story in other parts of Africa and the rest of the world where Miniso has presence.

And then, there are those targets mentioned in last year’s AGM. If anything can be picked up from past showings, it would be that those numbers should not be taken too seriously.

No doubt, the market outlook for Miniso is quite encouraging, especially in parts of Africa where consumer habits/preferences are changing as purchasing power is rising. But it might be in the brand’s best interest to not get ahead of itself by going overboard with outlandish targets.

Sure, it might be suggestive of a ‘strong belief’ in their brand, but then many people ‘strongly believed’ the world would come to an end at the turn of the millennium and yet, here we are.