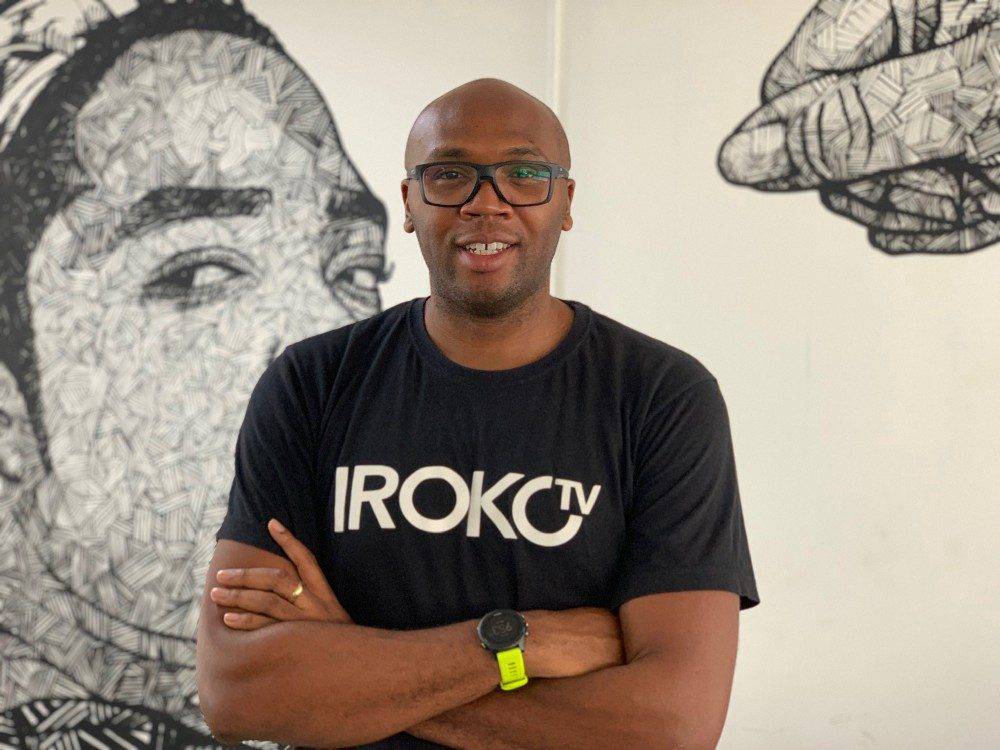

Jason Njoku’s Wife Now Earns More Than Him, But “Man Must Be A Man”

Recently, ROK studios, an incubated media asset of Nigeria’s IrokoTV, got acquired by France-based Canal Plus Group. While the deal’s worth remains an inside knowledge till now, it’s believed to be one of the most significant media transactions in West Africa.

Apparently, IrokoTV boss, as a result of the development, now earns less than his wife. Jason could not help but admit this while pointing out that the sale of ROK is a giant stride for the company as a whole.

According to a recent medium post by Jason Njoku, Irokotv founder, his wife did not sell her shares during the acquisition of ROK. As Vivendi Canal Plus acquired IROKO Ltd’s shares in the ROK Group, Mary Njoku, ROK founder, retains her stake till date.

What Jason describes as a fantastic exit, leaves his wife pocketing more than his reported USD 40 Mn net worth. Going forward, what’s the game like for IrokoTV?

IROKO’s Favorite (Only) Child

ROK was just six years old and needed USD 1 Mn in equity financing and a USD 1.4 Mn debt. The deal, which could be the biggest in Africa, outside South Africa, marks a new beginning for Irokotv, as Jason says he needs to “Crack on to accelerate forward”. Man must be a man.

IrokoTv is arguably the strongest pillar that supported ROK, surviving the initiative for the last three years. The asset was incubated to generating 75 percent of the media group’s 2018 revenue in short order. According to Jason, the cash flow has enabled the entire company to grow its subscription base triple-fold.

“But those days are behind us. Enough of the cash from the sale will be retained in IROKO, so in theory, we don’t actually need to raise further financing anytime soon. We may not raise money at all again before we exit,” Jason says.

Going forward, IrokoTV will continue to focus all its efforts in growing its number of subscribers. Because this is the only KPI (Key Performance Indicator) that truly matters, this development mechanism will be at the expense of cash flow or Ebitda profitability.

“In the absence of the profitable media assets, it feels unrealistic to ask IROKO to buck that trend. 1 million subscribers makes us a tier 1 paid service. Investments in content, product, engineering and most importantly, distribution is required to even remotely stand a chance of reaching this goal.”

No More Kiosks

In a bid to solve distribution issues, the media group will have to scale its outbound efforts successfully. By the end of the year, IrokoTV will need to have 1,000 agents, 2,000 by December 2020 and 2,500 in the same period of the following year.

With more than enough cash to invest in marketing and productivity, the company believes it would yield immediate results from August this year onwards.

On the flip side of this growth strategy, Jason says the firm will have to call wraps on its kiosk programs in four cities – Lagos, Port Harcourt, Abuja and Accra. While the initiatives have done a solid for visibility and customer support, they have proved rather Herculean to scale as the cash and management put in are overbearing.

IrokoTV knows the discontinuation of the kiosks will take its toll on 70 to 100 people who will be folded into the telesales organization at their preference or a discount price.

The company, however, is willing to forgo this to double down on taking its current dealership program from 112 to 500 before the end of 2019. This will then be scaled in Accra and subsequently in entire Ghana to extend content distribution reach.

Going Public In 2022

While the medium post addressed other areas of growth for IrokoTV, one of the most important aspects discussed was the possible London Stock Exchange listing in 2022.

“Once IROKOtv gets to 1m+ subscribers, the intention is to explore a listing on the London Stock Exchange AIM. The target valuation would be anywhere north of USD 100 Mn plus. This will most likely be in 2022, where our revenue would be more than USD 20 Mn with an operating margin of less than USD 1 Mn (or possibly negative).”

Well, paid content in Africa is a crazy difficult market, but IrokoTV is not going to let that be a source of discouragement. “It’s not easy. It’s not for the faint hearted. We have a real opportunity. Mrs Njoku has literally given us a window to go for greatness. Now run and fly through it,” he said.