CBK Warns Against Unregulated Forex Dealers; Outlines Characteristics Kenyans Should Look Out For In Unscrupulous Bureaus

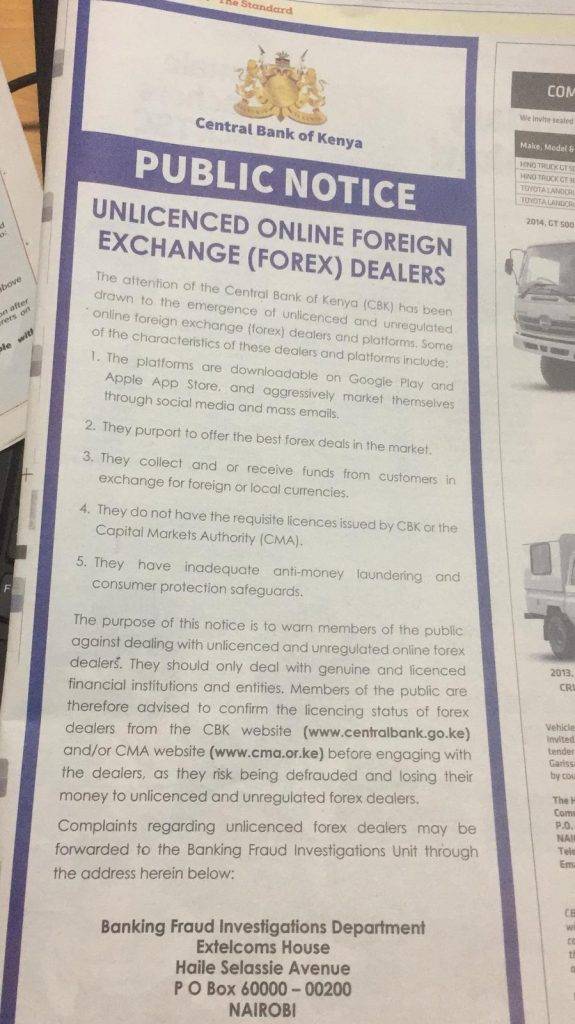

The Central Bank of Kenya has issued a stern warning to Kenyans against the many mushrooming unlicensed foreign exchange dealers in the country.

In a statement, the CBK’s Banking Fraud Investigations Department said that many Kenyans risk being conned by the unlicensed and unregulated online forex dealers.

“We urge members of the public to confirm the licensing status of forex dealers from CBK website before engaging with the dealers, as they risk being defrauded and losing money,” the regulator said.

CBK noted that such dealers lack the requisite licenses issued by CBK or Capital Markets Authority further advising Citizens to check the licensing status of forex dealers from the CBK websites to confirm authenticity.

Other characteristics which Kenyans should look out for in the fake forex dealers include claims to offer best forex deals in the market and collecting and or receiving funds from customers in exchange for foreign or local currencies.

“The platforms are downloadable on Google Play and Apple App store, and aggressively market themselves through social media and mass emails,” CBK further stated.

CMA Chief Executive Paul Muthaura said he had identified many entities/individuals carrying on the unlicensed business of an online foreign exchange broker or a money manager.

“The Capital Markets Authority (CMA) has issued only one license to EGM Securities Limited) to operate as a Non – Dealing Online Foreign Exchange Broker,” he clarified.

In 2018, Tanzania under the leadership of President John Pombe Magufuli launched a crackdown on foreign exchange bureaus as part of the wider plan to get rid of black-market currency trading and money laundering.

The Central Bank tightened currency controls with new regulations on foreign exchange bureaus.

“There have been an increase in illegal foreign exchange bureaus and money laundering activities that have been conducted through foreign exchange bureaus,” the country’s central bank Governor Forens Luoga said.

Featured Image Courtesy: BusinessdailyAfrica.com