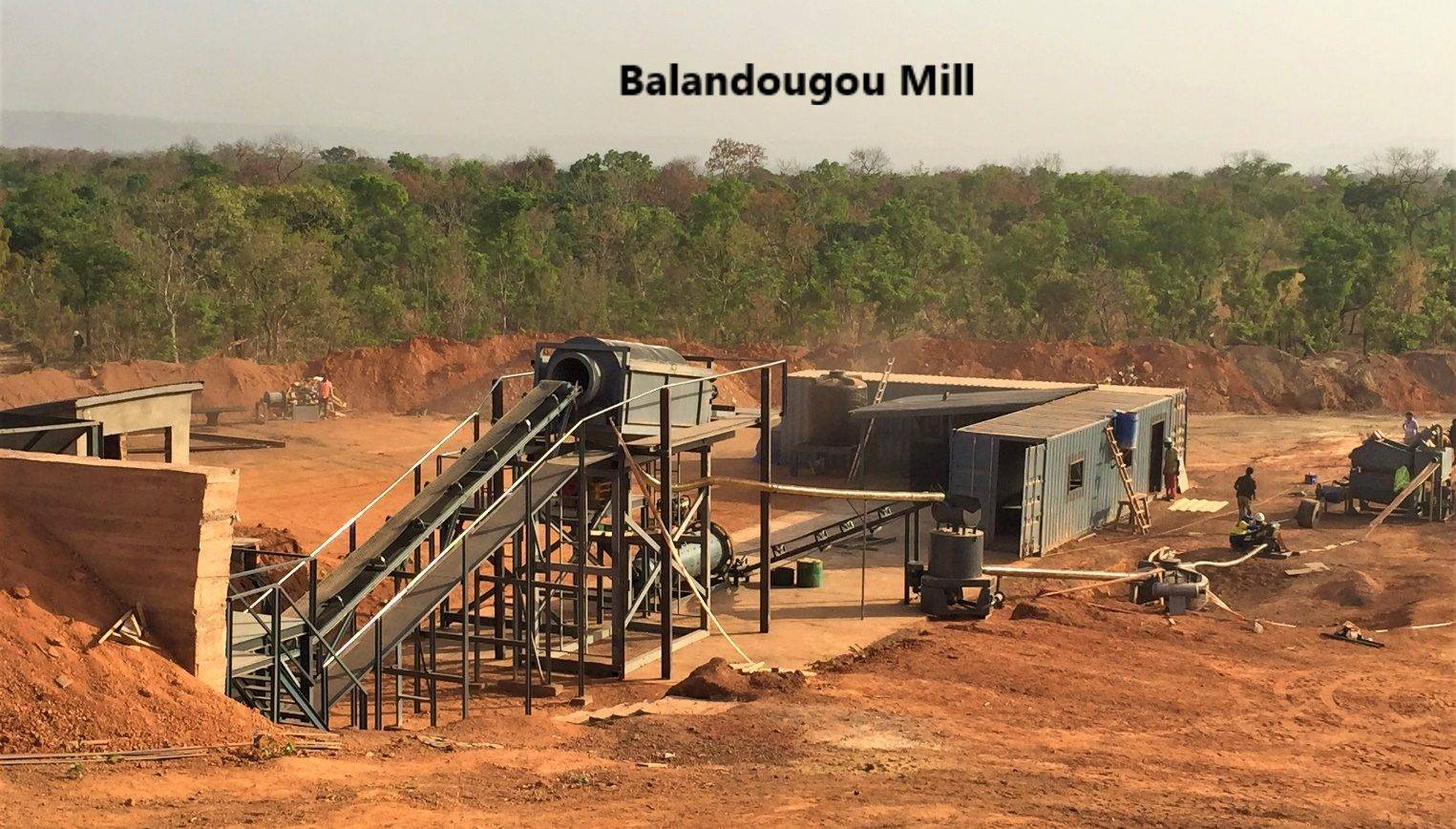

Stellar AfricaGold Sells Guinea Balandoughou Gold Project To Sudan’s Rida Mining For USD 5 Mn

Stellar AfricaGold Inc., a developer and consolidator of gold projects in West Africa, has sold the entirety of its Guinea Balandougou Gold Project to Khartoum-based Rida Mining Ltd. for USD 5,120,000.

An inital USD 3.85 Mn has been paid to the Canadian company for the sale which included the 7 kmsq Balandougou semi-industrial exploitation permit.

The sale also involves all related plant and equipment, two Guinea subsidiary companies holding adjacent exploration permits pending totaling at an approximation of 15 kmsq. According to a statement, the two minority partners of Stellar own 80 percent and 20 percent respectively, on the gold project.

The money pad to Stellar is in the form of intercorporate exploration and development expense recovery. The proceeds of the deal will be paid in installments, USD 1.8 Mn on closing and the rest of the cash will be tendered in three phases to end on January 15, 2021.

Selling Balandoughou signals the closure of one journey for Stellar, as well as the start of another. Per a statement from the company’s CEO and President, John Cumming, “Management is refocusing Stellar on mineral resource exploration and is actively evaluating several potential acquisition opportunities.

The closing of the Balandougou transaction with Rida Mining will strengthen Stellar financially enabling management to begin examining and acquiring promising exploration opportunities in North and West Africa. Future acquisitions will be announced as decisions are taken,” he added.

With the sale, the Vancouver-headquartered gold mining company is looking to bring more people to its board of directors. Stellar is considering the addition of experts from the United Kingdom and European equity financing, and African mineral exploration. While no decisions have been made, advanced discussions are being held with qualified candidates.

Stellar AfricGold is on a mission to acquire, explore, and promote new mineral exploration projects in the northern and western parts of African jurisdictions to create wealth for stakeholders.

The sale of its significant project is complete as regards due diligence but remains subject to a number of closing conditions. Guinea will have to issue governmental approvals, and Stellar shareholders will also have to give the green light at the October 17, 2019 Annual General Meeting.

The transaction was originated and is being facilitated by the African Bureau of Mining Consultants. The Casablanca-based consultancy firm will receive a finder’s fee and consultancy fee to be paid from the proceeds of the transaction.

Africa’s gold mine production was 522,000 kilograms/1,148,400 pounds in 2005, which was a decrease of 14 percent compared with that of 2000. Production was considerably less than that of 1990 because of the long-term decline in South African production. From 1990 to 2005, Africa’s share of world gold mine production decreased from 32 percent to about 21 percent.

Image Courtesy: Junior Mining Network.