Real Reason Lawmakers Moved Quicker-Than-Ever To Stop CBN’s New Charge For Transactions Above NGN 500 K

Has The CBN Done Anything Wrong?

Once the Central Bank of Nigeria (CBN) issued the directive for banks to charge a fee on deposits and withdrawals above NGN 500 K, the entire country basically went haywire. But maybe all that anger is misplaced.

Everyone jumped on the matter with little consideration for the real implications of the development. And for the first time in like forever, Nigeria’s Federal House of Representatives actually took a matter seriously — reaching a swift resolution that the CBN should hold off on implementing the policy barely 24 hours after it took effect. It’s like the fastest reaction to a matter by the Nigerian parliament.

And why wouldn’t they react so quickly? If anyone has any reason to question the decision of the CBN, it has to be the politicians who know they have to move huge “Ghana-Must-Go Bags” packed full with cash every once in a while, especially when elections are near.

There is a particular ridiculous video of an “honourable” member of the Green Chambers ranting about “Nigerians suffering and the CBN wanting to do some robbing.”

They might laugh at him, but Honourable Gudaji spoke out about the new CBN policy concerning N500,000 withdrawal and deposit charges in the House of Representatives. pic.twitter.com/mNU3438sHo

— Isima (@IsimaOdeh) September 20, 2019

One might be tempted to think Honourable Muhammed Gudaji Kazaure; a representative of Kazaure/Roni/Gwiwa Constituency of Jigawa State, is a man of the people, who is incensed by the CBN’s new policy, and perhaps he is.

Or maybe he’s just worried that he now has to pay some serious extra cash every time he has to pull out or pay in some serious hush money or diverted funds.

Nigerian politicians have used the opportunity to align themselves with the plight of the masses, urging the CBN to reconsider. And even the “masses” are crying out to the CBN and anyone else who cares to listen.

But maybe the masses should have a rethink and call out dubious politicians for, once again, speaking for selfish interests under the guise of caring for the plight of the masses.

Here’s What The CBN’s Latest Directive Really Means

Per the directive from the CBN, individual withdrawals exceeding NGN 500 K will attract a charge of 3 percent of the excess amount. For individual deposits, the charge is 2 percent of the excess.

Source: TVC News

For corporate institutions, the CBN has ordered banks to charge 5 percent of the excess on withdrawals exceeding NGN 500 K, while corporate deposits will attract a charge of 3 percent of the excess.

Think of it this way; if a person has to absolutely withdraw NGN 510 K (which is highly unnecessary and unadvisable), for instance, the charge will be 3 percent of the excess of NGN 10 K. That is, the charge will be NGN 300.00. If that person wanted to deposit, they will have to pay NGN 200.00 extra.

For a corporate firm, the extra charge will be NGN 500.00 and NGN 300 for withdrawal and deposit respectively, provided the amount in question is NGN 510 K. Anybody can work the math for every amount above NGN 500 K.

Will The Masses Really Be Affected?

Well, the answer is a big NO. For all intents and purposes, “the masses” is the term used to refer to people who fall under the lower-middle-class — the “ordinary Nigerian.”

We are talking about people who make just enough money to pay their bills and still fall short. It refers to people who barely have anything left as savings after basic expenses are subtracted from their income.

These are the people members of the Nigerian parliament have chosen to talk up as people who will suffer because of the new policy. Quite frankly, that is hardly true.

The masses who have cried out against the CBN’s new policy are simply misinformed, unaware of the real implications of the directive. And with the recent talks of cutting down forex on imports, blocking food imports, closing the border, increasing VAT, charging tax on online purchases, and charging a fee on online ads, (pressing topics the Nigerian parliament has conveniently decided to not discuss or resolve in their chambers), it’s easy for the masses to lash out against the CBN.

The average member of the masses is wired to react that way, especially as the CBN has recently come under fire for what is perceived as the continued adoption of insensitive measures that deepen the plight of the quintessential ordinary Nigerian.

And maybe some of the CBN’s policies do come across as insensitive, but this isn’t one of them. Some dubious politicians and public office holders know this, which is they are taking advantage of the cynicism of the masses to further their selfish causes.

This is because they know they will be the ones mainly affected by the new policy, not the masses whom they are happy to build their cases upon.

Where were they when the Advertising Practitioners Council of Nigeria (APCON) asked that all online ads for all businesses be run through them for a steep fee?

All they (the politicians) gave was silence, knowing it doesn’t affect them if a dressmaker has to pay at least NGN 25 K to the government before she can advertise her wares on Facebook?

Like, really, which member of the so-called masses has to move about with anything near NGN 500 K? And that’s if they even have it.

The truth is that the new policy will hardly affect the masses and some selfish politicians are making a meal out of it to protect their own interests under the pretense of speaking up for the masses.

Where This Leaves Us

If the Nigerian parliament has indeed woken up from its years of slumber and finally decided to make laws that will better the lives of the ordinary Nigerian — and that’s quite a stretch — then, they have picked the wrong fight.

The CBN wants to fully implement the cashless policy and this new directive should go a long way. The idea is to further encourage electronic transactions which are fast-becoming commonplace at home and abroad. The CBN’s new charges do not affect transactions via electronic media, and everyone should embrace its convenience.

Any talk of this affecting the masses is either ignorant or deceitful as there are various channels through which the masses can withdraw or make deposits without huge incurring fees. And does anyone really have to withdraw anything near NGN 500 K in this day and age? Does anyone really have to bear the risk of carrying that much money around? Think about it.

The Nigerian masses are not going to suffer for this, because they can’t even get hold of that amount of money. Corporate organisations will not suffer, either, because they don’t have to — there are now automated, electronic options available for all sorts of payments.

Any company that still has to withdraw or pay in any amount of money over the counter has simply refused to evolve. And the same goes for other “well-meaning individuals” who just have to have a million naira in their trunk every day. Good luck putting a target on your back!

Quite frankly, it is people who have to move huge bags of cash surreptitiously to make all sorts of underhanded bribes and shady payments that should be worried. And they know themselves.

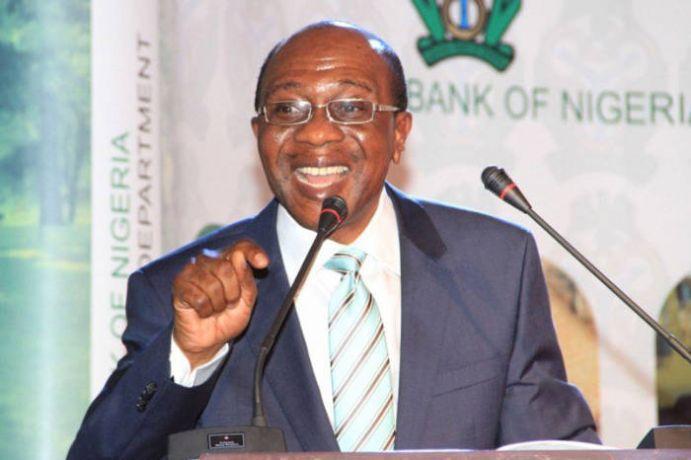

Featured Image Courtesy: DailyPostNG