These 10 Companies Currently Pay The Highest Amount Of Tax In Nigeria

In recent years, Nigeria tax-recovery agency, the Federal Inland Revenue Service (FIRS), has been going about its job of collecting tax in a manner that would suggest it means business.

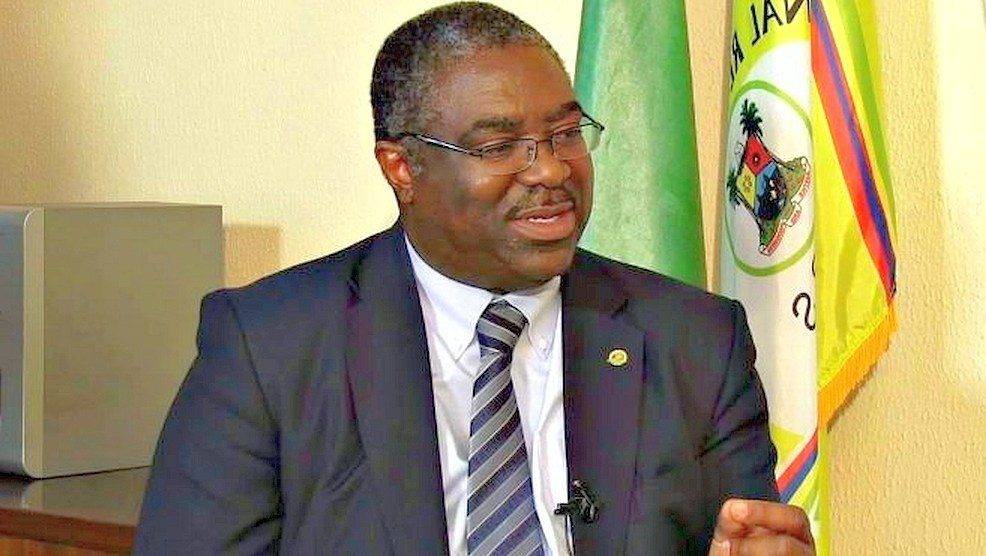

Last year, the agency’s tax remittances to the Federal Government hit a record high. Although Chairman of the FIRS, Babatunde Fowler, had to recently respond to a query from the FG in which some of the agency’s numbers were questioned, everything seems to be going well with the country’s tax office.

After the exploits of last year, the FIRS has gone about 2019 in a similar fashion. In the first half of 2019, the FIRS has collected a total of NGN 187.2 Bn from the top ten taxpayers in the country.

Which Firms Have Paid The Most Tax In Nigeria In This Year?

Data obtained from the Nigerian Stock Exchange (NSE) shows that 10 Nigerian companies (mostly banks) incurred the highest tax expenses in half-year 2019.

A large percentage of companies that have paid the most tax in Nigeria so far this year is made up of banks. In actual numbers, there are seven banks out of the ten companies on the Nigerian highest taxpayers list.

The top two highest payers of Corporate Income Tax (CIT) are on the Premium Board of the Nigerian Stock Exchange and both companies parted with a combined NGN 79.12 Bn.

To put things into perspective, CIT in Nigeria is 30% of every company’s profit-before-tax. This money is usually collected by the FIRS and remitted to the Federation Account.

The only other non-bank high taxpayer on the list is Nestle Nigeria Plc which has already paid NGN 14.19 Bn in taxes this year. The rest of the list is made up of firms that have made a name for themselves in the Nigerian banking industry.

Top 10 Taxpayers In Nigeria For H1 2019

- MTN Nigeria Plc (NGN 42.87 Bn)

- Dangote Cement Plc (NGN 36.25 Bn)

- Zenith Bank Plc (NGN 20.94 Bn)

- Guaranty Trust Bank Plc (NGN 16.65 Bn)

- Ecobank Transnational Incorporated (NGN 15.14 Bn)

- Nestle Nigeria Plc (NGN 14.19 Bn)

- United Bank for Africa (NGN 13.54 Bn)

- Access Bank (NGN 11.09 Bn)

- Stanbic IBTC (NGN 8.4 Bn)

- FBN Holdings (NGN 8.15 Bn)