Who Is To Blame As Nigeria’s External Reserves Hit 10-Month Low After Shedding USD 2.9 Bn In 2 Months?

In just a matter of two months, Nigeria’s external reserves have nosedived by quite some margin.

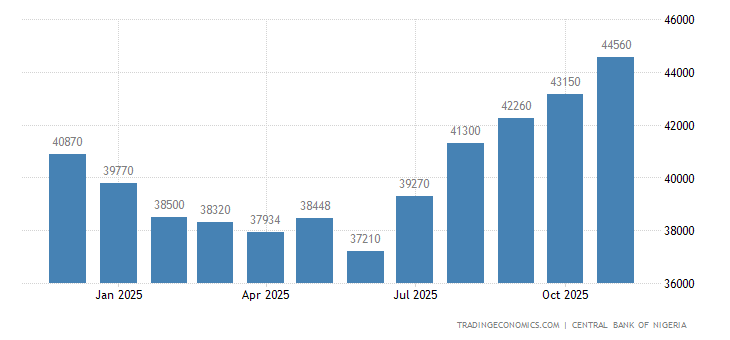

According to the data from the Central bank of Nigeria (CBN), Nigeria’s foreign reserves descended to a 10-month low after depleting by USD 2.9 Bn between August and September 2019.

As of July 2019, Nigeria’s foreign reserves stood at USD 45 Bn. But that figure has dipped rather quickly, now somewhere around of USD 42.1 Bn as of today.

Where The Dip Began

Nigeria’s external reserves have been on the free-fall since July 9th, when the gross reserves last stood at USD 45.1 Bn. The latest data represents a dip unlike anything seen in the last 10 months.

Back in August, Nigeria’s foreign reserves fell by USD 1 Bn, finishing the month at somewhere around USD 44 Bn.

By early September, it had dipped further to USD 43 Bn. As of 25th September, it was USD 42.1 Bn. That’s USD 1 Bn off Nigeria’s foreign reserves in less than 30 days. The last time the country’s reserves were this low was November 2018 when it hit USD 42 Bn.

Why Nigeria Is Losing Its External Reserves

The depletion of Nigeria’s foreign reserves can be blamed on two factors. On the one hand, there is the fluctuating oil price and on the other, there’s what appears to be the constant tweaking of the foreign exchange windows by the country’s apex bank.

The CBN has continued to inject funds into the FOREX markets as part of its continued intervention in the foreign exchange market. In July, the bank of banks disclosed that it injected a cumulative sum of USD 2.63 Bn to further sustain relative stability in the FOREX.

Further inspection of CBN data shows that, as part of its intervention in the FX market, currency sales to the Bureau De Change (BDC) rose by 3.8 percent in July 2019, an estimated USD 1.08 Bn. Essentially, the biggest share of FX that month went to the BDC FX window.

At the moment, citing import data for Q2 2019, Nigeria’s total foreign reserves are only good for 7 months of import of goods and services, or 10 months of goods only.

The general view from financial experts is that the intervention strategy of the CBN in the multiple exchange window is not sustainable, as the country’s reserves are being used to defend the naira from devaluation. And the latest external reserves data does support the view.

What’s The CBN’s Counter-Play?

On their part, the CB has moved to shore up Nigeria’s foreign reserves in recent times by putting in place policies aimed at discouraging “foreign spending.”

As foreign reserves are being depleted by the CBN’s interventionist plays, the bank has sought out other means to protect Nigeria’s external reserves.

And one of those is the recent forex restrictions placed on 43 items, which is aimed at discouraging their importation. Plus, there are indications that there may be much of such restrictions.

Featured Image Courtesy: Nairametrics