Cash-Strapped Nigeria Trying To Rake In Funds By Squeezing USD 62 Bn Out Of An Oil Contract Signed 26 Years Ago

The Nigerian government has its sights on recovering up to USD 62 Bn from international oil companies that allegedly failed to comply with a contract signed 26 years ago.

The government is using a 2018 Supreme Court ruling on the matter which the state says enables it to increase its share of income from production-sharing contracts (PSC).

A contract-law agreed to by a number of oil firms in 1993 apparently entitled Nigeria to a greater share of revenue when the oil price exceeds USD 20.00 per barrel. This is according to a document seen by Bloomberg, prepared by the Attorney-General’s office and the Justice Ministry, which also verified the document.

The government is now looking to recover those funds which currently total as much as USD 62 Bn. While the government hasn’t said how it will recover the money, it has said it wants to negotiate with the companies.

The companies that were part of that agreement are Royal Dutch Shell Plc, ExxonMobil Corp., Chevron Corp., Total SA, and Eni SpA.

Under the production-sharing contract law, the companies to fund the exploration and production of deep-offshore oil fields on the grounds that they would share profit with the government after recovering their costs. Those costs would have been recovered for years now as crude has been selling a well over USD 20.00 per barrel for several years.

Crude was selling for USD 9.50 per barrel in 1993, when the contract-law was agreed to. The oil companies currently take 80 percent of the profit from these deep-offshore fields, while the government receives 20 percent, according to the document.

The government, however, now wants to get the oil companies to honour the long-standing contract and remit funds that have gone unremitted since crude crossed the USD 20.00 per barrel mark.

Most of Nigeria’s crude is pumped by the five oil companies, which operate joint ventures and partnerships with the state-owned Nigerian National Petroleum Corporation (NNPC).

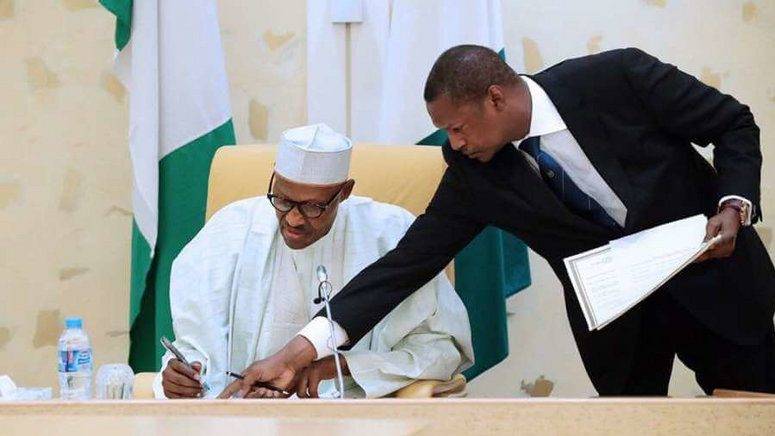

Bloomberg also reports that representatives of the oil companies met Justice Minister, Abubakar Malami, in Abuja last week. During the said meeting, Malami is understood to have maintained that the government will ensure all the country’s laws are respected, though no hostility is intended toward investors.

The proposal comes as President Muhammadu Buhari tries to comb in revenue after a drop in the output and price of oil, Nigeria’s main export.