For Every Kshs 4 Paid As Corporate Tax, Ksh 1 Is From The Banking Sector-PwC

A new study carried out has revealed that for every Ksh 4 of corporate tax paid in Kenya about Ksh 1 is paid by the banking sector.

According to the Total Tax Contribution of the Kenya Banking Sector report by PricewaterhouseCoopers (PwC), the banking sector contributes 26 percent of the corporate taxes collected by the Kenya Revenue Authority (KRA).

The study conducted for a two year period (2017 and 2018) showed banks and micro-finance institutions paid Kenya Revenue Authority Sh 207.2 Bn. Corporate tax payments by banks stood at Sh 52 Bn and Sh 39 Bn in 2017 and 2018 respectively.

The decline in tax contribution for the year 2018 has been attributed to “reduction in taxes borne by banks” particularly the corporate tax paid which was due to low profits.

“The reduction in 2017 profits corresponds with the full year of interest rate cap coupled with a prolonged electioneering period,” PwC tax services director Titus Mukora said.

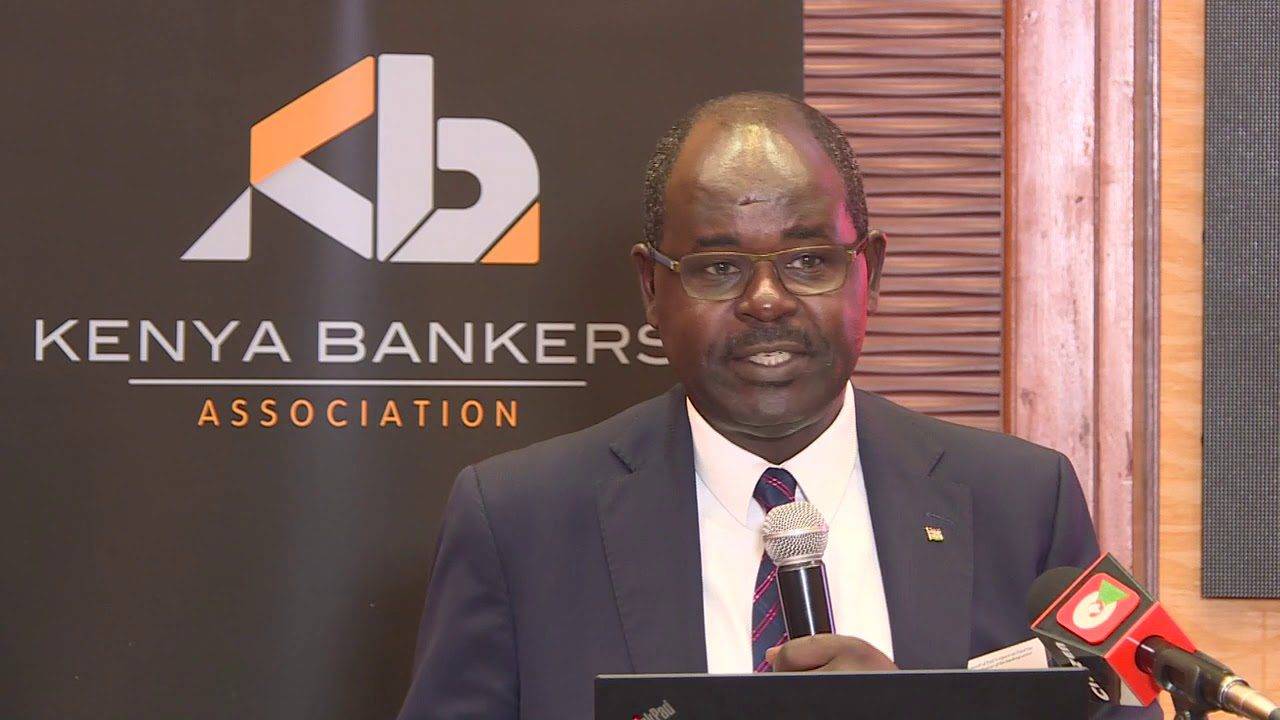

Habil Olaka, Chief Executive Officer Kenya Bankers Association (KBA) says the high tax contribution by the banking sector is due to high levels of compliance.

The report attributed the high tax contribution to corporate taxes to the fact that banks hardly get any tax incentives compared to other sectors like manufacturing. A tax incentive is a reduction made by the government in the amount of tax that a particular group of people pays and the purpose is mainly to encourage investments in the targetted sector.

The total tax contribution report is the first of its own and whose purpose is to “quantify the tax contribution made by the banking sector.”

The report has been released in the wake of policy discussions surrounding new tax policies targetting the banking sector.

Kenya’s economy has consistently and persistently experienced budget deficits prompting changes in the tax landscape aimed at increasing the taxes collected. In the hunt for taxes, the banking sector has remained one of the most targeted.

Featured Image Courtesy: YouTube