How David Malpass’s African Debt Pile Slant Occasioned A Fracas Between AfDB & The World Bank

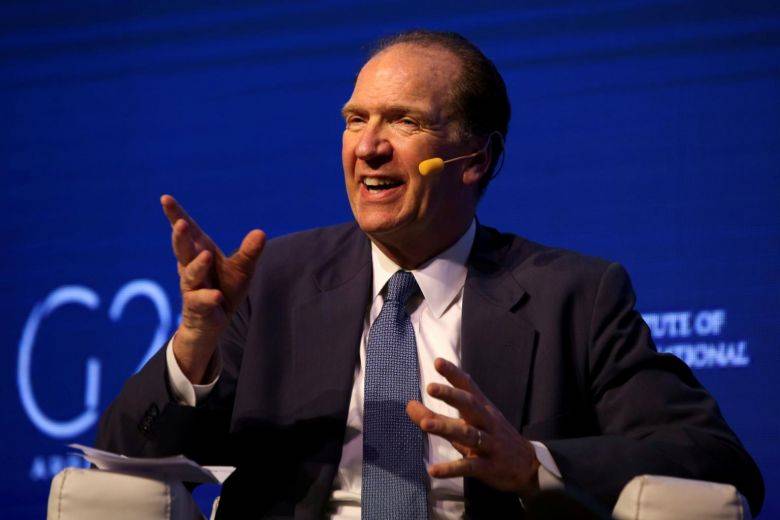

Africa’s rising debt situation is a cause for worry. The IMF and the World Bank are concerned that the continent’s borrowing culture is becoming unsustainable. But David Malpass, President of the World Bank Group, seemed to have taken the topic to a whole new level by pointing accusing fingers.

Lending Too Quickly

Malpass made a pass on the Asia Development Bank, European Bank for Reconstruction and Development, and of course, the African Development Bank for being lend-happy.

According to him, these institutions borrow money to quickly, thus increasing the debt burden of countries, most of which are in Africa.

“In the case of Africa, the African Development Bank is pushing large amounts of money into Nigeria, South Africa and others without the strongest program to sustain it and push it forward,” the American economic analyst said.

In a critical response, AfDB dismissed Malpass’s comments, describing them as inaccurate and nonfactual.

“Not The AfBD!“

An official statement from the Akinwumi Adesina – led multilateral development bank say the Malpass slant “undermines its governance systems, and incorrectly insinuates that we operate under different standards from the World Bank.”

“For the record, the African Development Bank maintains a very high global standard of transparency. In the 2018 Publish What You Fund report, our institution was ranked the 4th most transparent institution, globally, the AfDB flouted.

The institution also argued that it provides a strong governance program for our regional member countries that focuses on public financial management, better and transparent natural resources management, sustainable and transparent debt management and domestic resource mobilisation.

Pot Calling Kettle Black?

In the same official statement, the AfDB seems to redirect the Malpass comment back to the World Bank on the back of its larger lending lecture in Africa.

Fact is, the World Bank has a more substantial African balance sheet compared to the AfDB. The former’s operations approved for Africa in the 2018 fiscal year resulted to USD 20.2 Bn. Meanwhile, the AfDB has only green-lighted USD 10.1 Bn for the same period.

In Nigeria and South Africa – the continent’s two largest economies – the World Bank’s outstanding loans for the 2018 fiscal year stood at USD 8.3 Bn and USD 2.4 Bn respectively.

AfDB’s financial efforts to the these countries for the same fiscal year, on the other hand, amounted to USD 2.1 Bn and USD 2.0 Bn respectively.

The AfDB who put forth this argument, said it recognises and closely monitors the upward debt trend, noticing no systemic risk of debt distress. A part of AfDB’s stance on the issue suggests that the World Bank could be more responsible for any unsustainable debt in Africa, if truly there is one.

Concern Justified

Even though the drama between the AfDB and the World Bank, debt in Africa is not a misplaced concern.

For Sub-Saharan Africa, total external debt jumped nearly 150 percent to USD 583 Bn in 2018. That figure may be quite disturbing if one considers it was just at USD 236 Bn a decade earlier.

The worry of unsustainable debt could be caused because the average public debt in the region increased from 40 percent in 2010 to 59 percent in 2018.

As Africa prepares for game-changing times such as the Fourth Industrial Revolution, there;s only more concern that debt stress is inevitable.