The “Fund Manager’s Fund” Filling The Missing Middle Has Forked Out A Fresh USD 8 Mn For Funders In Emerging Markets

The “Fund Manager’s Fund”, Capria, which claims to be the largest network of emerging market fund managers, has announced that it would be investing up to USD 8 Mn in specific countries in emerging markets, including African countries like Uganda, Senegal, Côte d’Ivore, Tanzania and Ethiopia.

When Capria first launched in 2015, it positioned itself as an accelerator for VC fund managers in developing markets, offering investment, support and helping to capitalise new fund managers backing early-stage startups primarily in Africa, South and Southeast Asia, and Latin America.

Capria took some measure of pride in its claim of being the first global programme dedicated to incubating impact VCs in developing markets.

However, Capria sort of adjusted its position two years after launching, no longer offering an accelerator but framing its work as a collaborative network for fund managers.

Presently, Capria has taken the form of a global investment firm leading, partnering with, and funding a large network of emerging market fund managers collaborating to deliver superior returns and scaled impact.

The investment firm is focused on bringing venture capital innovation and global best practices to local venture capital, private equity and innovative debt funds, managed by local investment experts.

As per a press release seen by WeeTracker, Capria is not relenting in its quest to build a robust network of emerging/frontier markets-focused fund managers.

“Capria’s efforts will focus on supporting local fund managers to strengthen their business, accelerate growth, and build world-class investing operations through our collaborative network,” reads a part of the company’s statement.

“Capria will invest across fund managers from select countries to add to its global network that’s already 22 managers strong. By the end of 2020, we anticipate their collective AUM to reach USD 1 Bn.”

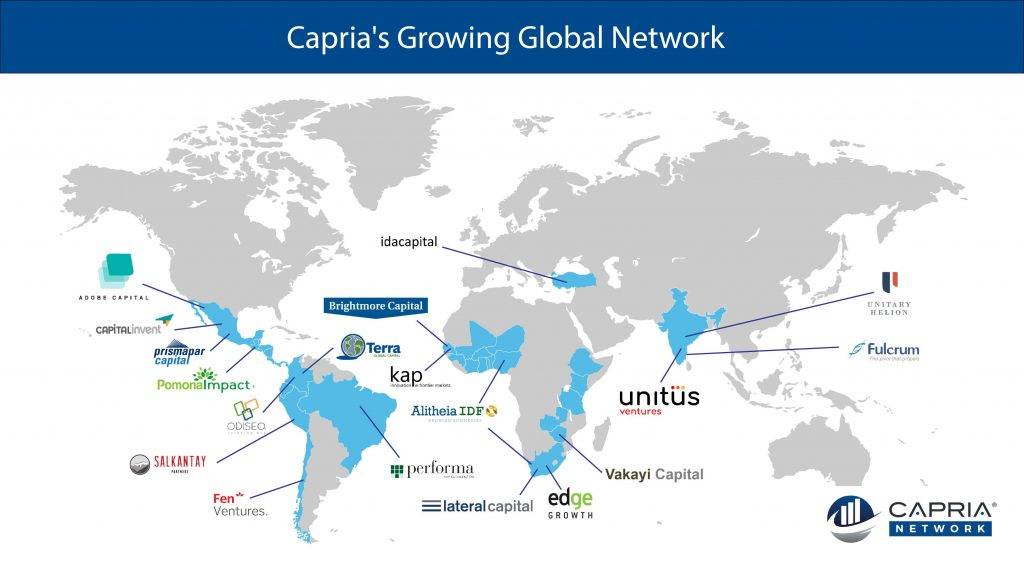

Capria boasts a network of investing partners which collectively manages over USD 300 Mn in assets deployed in early-stage and early growth companies in Latin America, Africa, and Asia.

The firm invests in partners through its USD 100 Mn network fund which was first announced in 2016, taking anchor GP and LP positions. Capria currently has offices in Seattle, Paris, Bangalore, Nairobi, and Singapore.

Capria currently has six African Fund managers in its Network – Lateral Capital based in Nigeria, Edge Growth in South Africa, Senegal-based KAP (the USD 60 Mn fund fuelling financial innovation in frontier markets), Alitheia IDF based in South Africa, Brightmore Capital in Senegal, and Zimbabwe’s Vakayi Capital.

Plus the firm is also believed to be in the final steps of adding three additional funds from Africa. Both Lateral Capital and Alitheia IDF reached first close at the end of 2019.

In 2018, the International Finance Corporation (IFC), the for-profit investment arm of the World Bank, made a second investment of up to USD 13 Mn in Capria’s USD 100 Mn network fund.

According to Will Poole, co-founder and managing partner at Capria, the firm has already backed a number of fund managers in Africa with some of those funds and there’s more to follow sooner rather than later.

“We have deployed a total of USD 250 K in warehouse capital into 2 companies in Zimbabwe, with an additional IFC approval for USD 2.5Mn to be deployed in H1 2020. We have also gotten IFC approval for a USD 3 Mn LP investment and have made soft commitments for an additional USD 7 Mn,” Poole tells WeeTracker.

Last November, Capria stated that it was investing up to USD 20 Mn in two new African funds after opening an office in Nairobi. But according to Poole, the recently announced USD 8 Mn fund is not to be confused with the USD 20 Mn fund, as the USD 8 Mn fund will only focus on the Private Sector Window (PSW) countries.

“This USD 8Mn comes from IFC to be invested in IFC PSW designated countries. Capria plans to partner and work deeply with 2-3 fund managers with this investment,” says Poole.

He also maintains that a key component of Capria’s strategy is “to invest in fund managers based in and investing in emerging and frontier markets that can deliver superior financial returns, scalable local impact, and who are excited to collaborate with the Capria Network.”

And by the firm’s reckoning, Africa, as well as Latin America, and South/South-East Asia, are prime grounds for such fund managers. As Poole puts it, “Africa is one of the world’s fastest-growing economies. Fast-growing emerging economies offer uncorrelated and diversified alternatives to US and European markets

“Innovative, fast-growing, tech-enabled businesses can profitably serve consumer and business needs in vast, largely under-served markets of Latin America, Africa, and South/South East Asia.

Investing in a diverse range of companies primarily addressing local consumption of essential products and services results in resilience to economic downturns. Africa is central to all the essentials that make it a promising economy to invest in,” he adds.

To capitalize on the abundant opportunities in the fastest growing and stable emerging economies, Capria is looking to invest in a few fast-growing economies and is now open for applications from fund managers based in any of Uganda, Côte D’Ivore, Senegal, Tanzania, and Ethiopia.