EXCLUSIVE: OPay’s Super App Plans Have Crashed; The Startup Is Firing And Getting Fired [Updated]

![EXCLUSIVE: OPay’s Super App Plans Have Crashed; The Startup Is Firing And Getting Fired [Updated]](https://weetracker.com/wp-content/uploads/2020/05/OPAY-PROMO-COBRAREVIEW-800x400-1.jpg)

After hitting the ground running in 2019, OPay seems to have lost all of its gloss since the turn of the year and the Opera-backed company is understood to be currently facing major problems.

OPay caused heads to turn in 2019 when it announced its presence by aggressively and simultaneously chasing growth across several verticals, including bike-hailing (ORide), food delivery (OFood), ride-hailing (OCar), bus-hailing (OBus), classifieds (OList), digital lending (OKash), fund transfers and various bill payments incorporated into the OPay app.

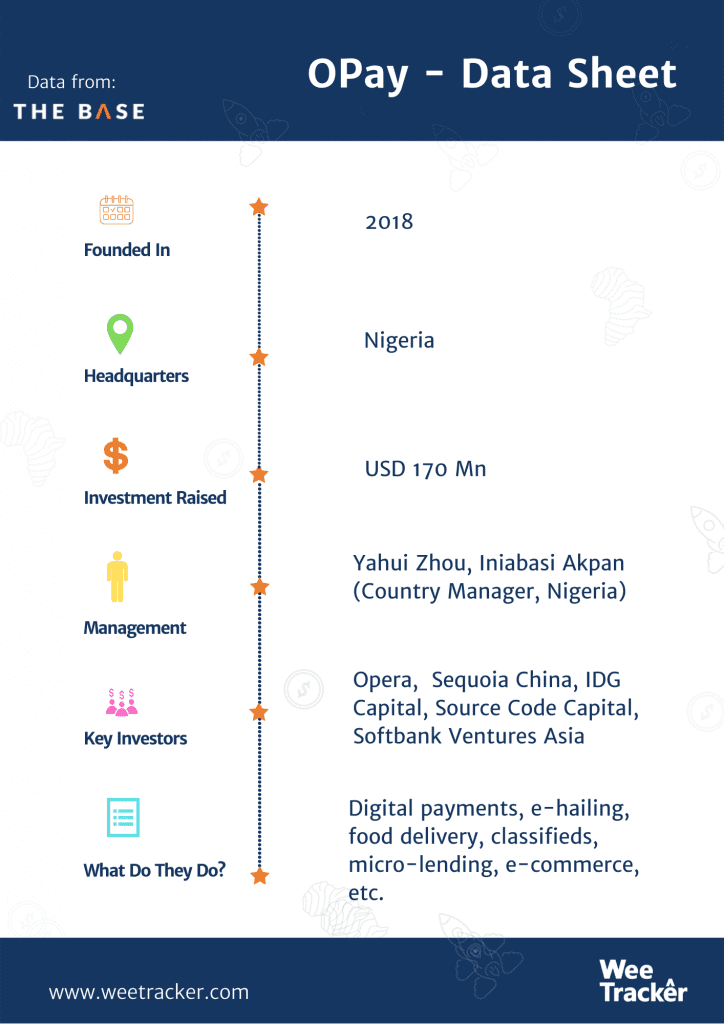

The company had raised no less than USD 170 Mn across two separate funding rounds and the quest to build a super app was very much on, starting with Lagos, Nigeria. By offering loads of freebies, tons of incentives, and highly-subsidised services, OPay was able to gain significant traction.

Within a short period, the startup claimed it had already amassed over 1,000 bikes on its most popular platform, ORide, and by July 2019, OPay said the number of agents on its platform was over 40,000.

However, the year 2020 hasn’t been so kind. OPay appears to be struggling, especially since the well-documented “Okada ban” took effect. Add that to the ongoing pandemic and the picture is even more troubling.

According to well-placed sources who spoke to WeeTracker, OPay has laid off up to 70 percent of its staff, and this includes both Chinese nationals and local employees. The affected Chinese staff are also said to be stuck in Africa as they have been unable to buy tickets and fly back home, possibly due to travel restrictions.

“They’ve been through a massive layoff and paused most of their programmes, whereas their staff are still stuck in Africa, not able to buy flight tickets back home,” a source told us.

Responding to the claim of OPay’s Chinese staff being stuck in Africa, the company confirms that these members were not able to go back due to the travel restrictions and closing down of the airport in Nigeria. However, they have “purchased the first tickets available now, and continue to find resolutions.”

Another source who didn’t want to be mentioned told WeeTracker that things have gone south for OPay since commercial motorcycles were banned from operating in certain “important” routes in Lagos. Since then, attempts to pivot to deliveries have not stopped the malaise.

Confirming the pivoting of deliveries, OPay team said that “the company is pivoting its two-wheeler services into the delivery business which will have B2B and B2C models. Commercial bikes in Lagos is only a minor part of our overall ORide business, all throughout Nigeria – so while we suffered a loss like other ride-sharing platforms, it is relatively minor.”

“OPay has been struggling especially since the ban on motorcycles in Lagos. OPay has laid off up to 70 percent including local and Chinese employees. Some of the bikes are now into deliveries, but it’s not a big space for business compared to ride-hailing,” the source said. OPay did not immediately respond to queries for comments.

As per an email statement sent to WeeTracker, OPay said that due to the government ban laid in February this year, they were forced to lay off some members from ORide business. The email claimed that the lay off was not massive and “way less than 70%”, but did not give the exact percentage of staff that was let go.

Another source confirmed to WeeTracker that the local person in charge of the ORide (Ridwan Olalere), has jumped ship and joined Uber Nigeria. To support this claim, Olalere’s LinkedIn profile does reflect that he exited the company in February 2020, though there’s nothing about Uber as of yet.

Interestingly, when OPay first kickstarted what many described as the “OPaycalypse” last year, it was reported that the startup poached up to 13 of its executives from top tech firms. But now it seems OPay is on the receiving end.

Besides the departure of the former ORide director, OPay is known to have already lost several senior managers. Moses Nmor, who formerly led sales and business development at OPay, was poached by fintech startup, Fairmoney, in December 2019. Chukwudi Enyi, OPay’s Senior Marketing Manager since 2018, also left the company for Fairmoney in March. Moriam Durosinmi-Etti joined OPay in June 2019 to lead the company’s Government Relations and Partnerships role. She left the job in January.

Additionally, WeeTracker gathered from sources that Opera’s chairman and CEO, Yahui Zhou — who has led the company since 2016 when Opera was acquired for USD 600 Mn by a consortium of Chinese investors — is currently running OPay himself.

The OPay team, in the email, confirms that “Opera’s chairman and CEO, Yahui Zhou, has indeed resigned from his role of chairman from the conglomerate Kunlun group he has founded, to focus more on OPay. Since 2018 when OPay raised a total of $190Mn from its investors, Mr Zhou has committed himself to focus on OPay. But overall, OPay is directly run by a management team, including CEO Fan Xia and country manager Ini Akpan.”

Also, OPay is now looking to pivot from being a solely consumer-facing company. Sources tell us that OPay now wants to explore e-commerce and SME services like working capital financing.

Indeed, on March 31, the company quietly released two new e-commerce products: OMall and OTrade. While OMall is understood to be purely an e-commerce platform not unlike Jumia, not much is known about OTrade at the moment. Other new products like its savings product, FlexiFixed, and its smartphone business, Olla, haven’t quite gathered momentum either.

[Opay team responded to the claims gathered by WeeTracker sources on the points pertaining to the percentage of laid-off staff, Chinese staff stuck in Nigeria, management responsible for running OPay in Nigeria and the company’s stance on its new programmes/products. OPay’s responses have been added to the story after each claim.]

Featured Image Courtesy: TechCabal