Africa’s Top Investment Destination Could Suffer Its Biggest Loss In The Last 3 Years

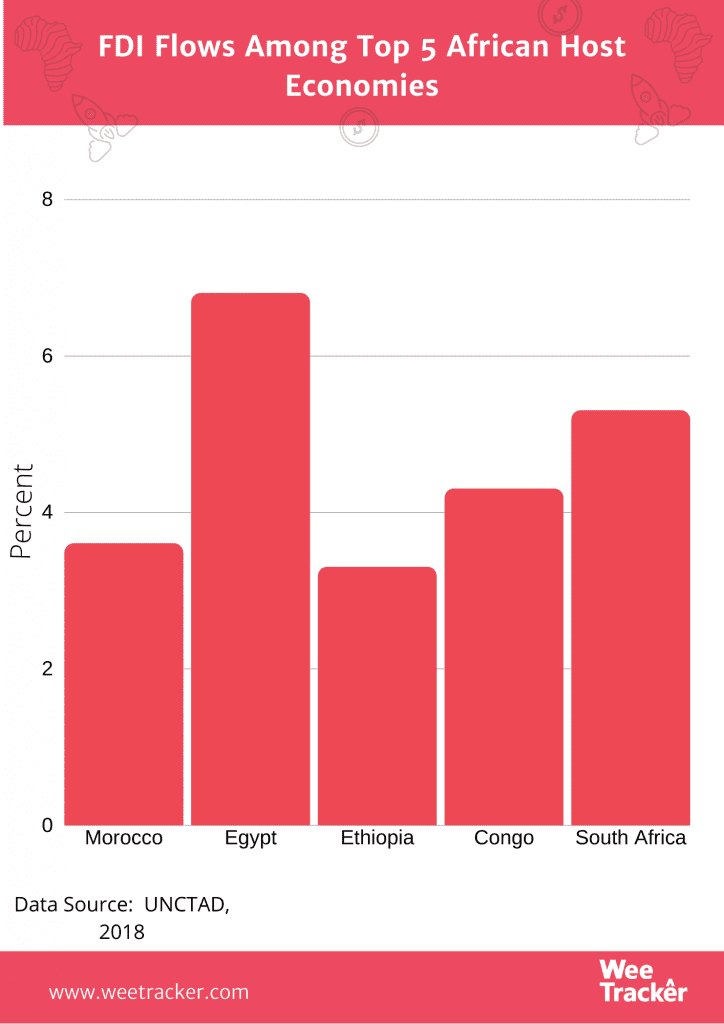

Since confirming Africa’s index case, Egypt now has 7,588 coronavirus cases. The outbreak in what is Africa’s top investment destination will reportedly decrease total investments by 30 percent.

Contextually, Egypt’s Foreign Direct Investments (FDI) reduced by around 8.6 percent from USD 8.1 Bn in 2016 to USD 7.4 Bn in 2017. It further went down to USD 6.7 Bn in 2017, representing an 8.2 percent decline.

Should the 30 percent reduction be realized, it would be the country’s most significant FDI decline in the last 3 years.

Egypt’s Economy

According to South Africa’s Rand Merchant Bank’s 2020 investment report, Egypt tops the list of most attractive African countries to invest in for the third year running. This position is attributable to sheer size of its market, accompanied by a relatively sophisticated business sector relative to its neighbours.

Egypt’s economy is heavily based on tourism, trade, gas and exports. The Covid-19 outbreak is posing an increasing threat to these and other lifebloods of the North African country’s wealth.

But one of the most obvious impacts of the pandemic on the Arab nation’s private investment, in turn, bringing down the volume of total investments. The 30 percent slump estimate is expected if the coronavirus crisis lasts until mid-fiscal year (FY) 2020/2021.

One of the implications of these changes is that the 100 milion population of Egypt will find it hard to make a living. The country struggles to boost the private sector and attract a substantial amount of investment outside its gas industry to offset the economic costs of coronavirus.

Egypt already has an estimated overall investment volume of EGP 740 Bn (USD 46,880,839) for 2020. But even though this stands to be affected, government investments are projected to increase by 33 percent to EGP 280.7 Bn in FY 2020/2021 compared to EGP 211 Bn in FY 2019/2020.

Retaining Investors

One of the biggest questions is whether or not investors would flock back to Egypt after the relapse of the coronavirus crisis. More importantly, will the country be able to retain its position as Africa’s top investment destination?

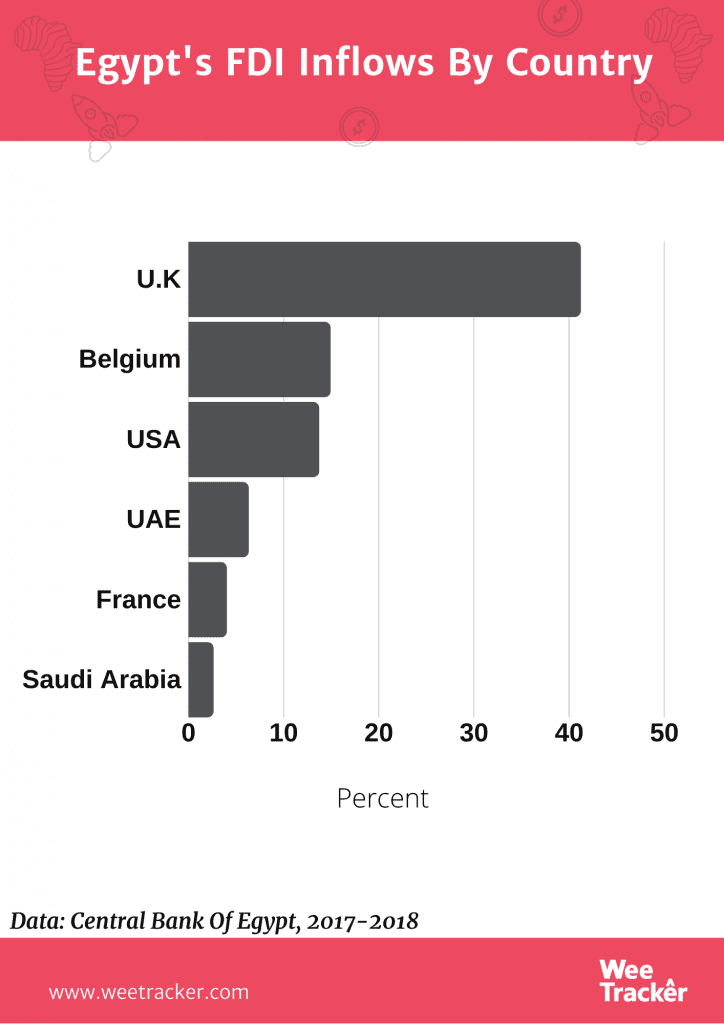

Before now, Egypt’s Ministry of Investment releases reports on a regular, possibly monthly basis to show how world powers are investing in the country. These reports show how countries like France, Netherlands, Canada, Qatar, China and Germany and ramping up their investment efforts in the country.

As of 2018, the trade ties between Egypt and China had already exceeded USD 13.8 Bn, a record high at the time, even for any African country. Now, China’s business romance with Africa as a whole is being assailed on three fronts, comprehensively culminating in an investment slump no one knows when would pick back up. But, the U.K is by far the largest investor in Egypt.

Other of Egypt’s trading partners like Italy, Denmark, United Kingdom and even Japan are currently trying to deal with the effects of Covid-19 on their own economies. It is unclear how or when dealings would resume and how long it would take for things to go back to normal.

Richard House, CIO emerging market debt, Allianz Global Investors, believes Egypt is a well-loved credit by the market and tourism is a big dollar generator, making the virus mean a big hit.

“But you have to put your money somewhere and Egypt is a decent story still. I would be concerned about putting money into local currency bonds as these frontier markets are not very liquid,” he said.

According to the World Bank, the pandemic aside, Egypt is launching another wave of reforms to address longstanding constraints to a strong, private sector-led economic transformation.

If the pandemic continues throughout 2020, global FDI levels may also hit their lowest levels since the Global Financial Crisis of 2008-2009. This could lead to a decline of up to 35 percent, compared to a projected growth of 5 percent during 2020-21 prior to the pandemic.

Slumping On Ice

Before the emergence of the global pandemic, performance indicators in the economy suggested that the nation’s wealth growth rate reached 5.6 percent. At the same time, unemployment rate fell to less than 8 percent, while the average inflation was decreased to around 5 percent.

Taking one of the worst hits is Egypt’s travel and tourism industry, which offered about EGP 389 Bn to the country’s GDP in 2018. About 88 percent of the direct T&T contribution is derived from leisure spending, compared to 12 percent of business spending.

In fact, the first person to die of Covid-19 in Egypt was a German tourist at a Red Sea resort. Even the world’s major economies will also see drastic declines in spending as the coronavirus pandemic shuts down travel.

Indeed, the coronavirus is simply a disaster for tourism, first because international flights have been grounded. The average number of commercial flights per day fell from more than 100,000 in January and February this year to around 78,500 in March and 29,400 in April, according to data by Flightradar24, a website that tracks flights globally.

Still, passenger revenue for airlines is estimated to plunge by USD 314 Bn in 2020—or a 55 percent drop from where it was in 2019, according to the International Air Transport Association.

This is significant in that Egypt’s tourism revenue rose to a record high of USD 12.57 Bn in the financial year that ended in July. It continued to gain in the July-Sept quarter, the latest figure published by the central bank, to USD 4.19 Bn, the sector’s best quarter ever.

Photo by Paul Busch via Unsplash