Africa’s Busiest Fintech Market Has A Pandemic Problem

Igniting the fintech flame

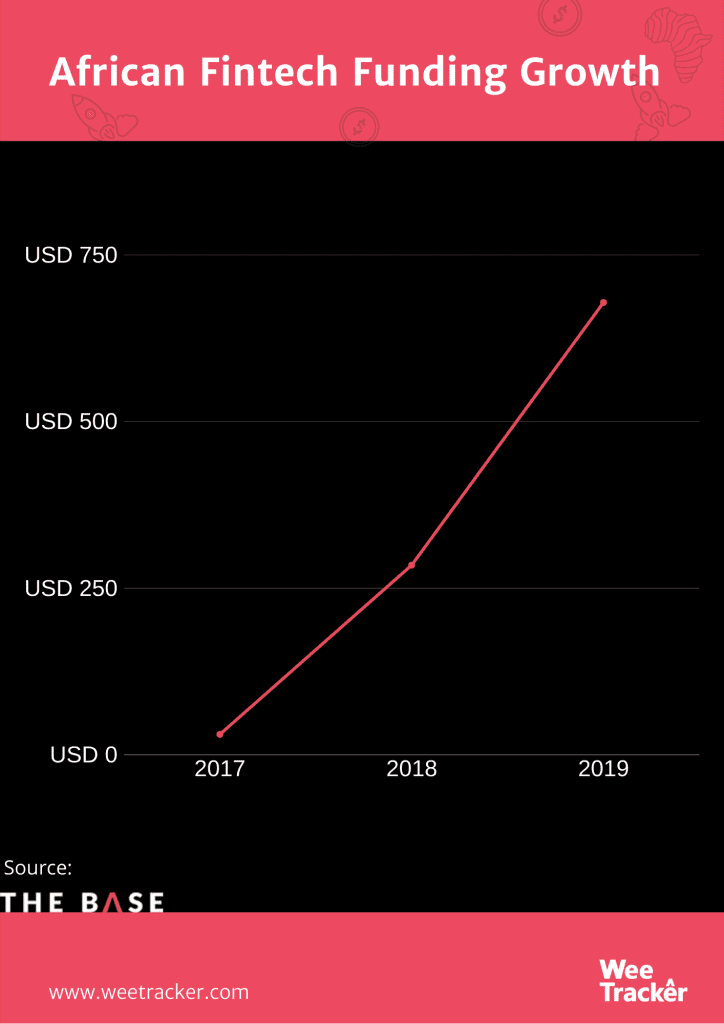

Every year for the last 3 years, no other tech sector has attracted more funding in Africa than fintech. And for good reasons too. In 2019 alone, African fintech startups raised a combined USD 678.73 Mn in funding.

However, the global pandemic could potentially put a damper on the prospects of one of Africa’s busiest fintech markets, as detailed in a recent report by PricewaterhouseCoopers (PwC).

Indeed, the flurry of funding activity witnessed in African fintech in the last few years is in keeping with a trend that has become evident across the globe. All over the world, fintechs are disrupting the conventional banking models, using technology to make financial services faster, easier, and more accessible.

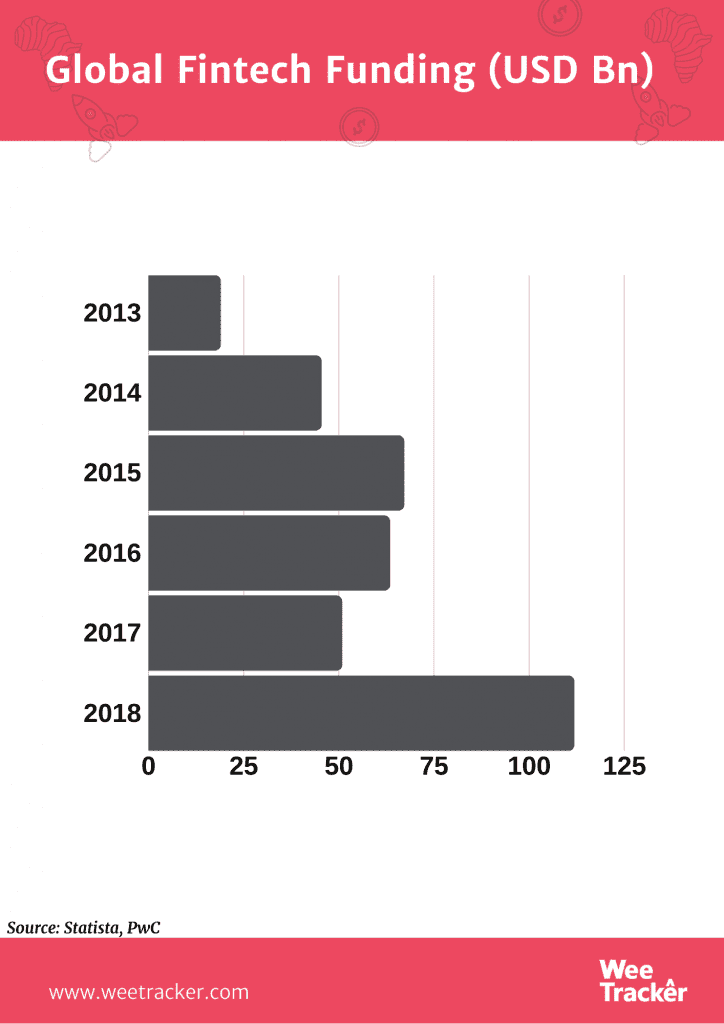

Globally, the number of fintechs has more than tripled over a seven-year period to about 4,464 fintechs in 2017 from a little over 1,000 as of 2010. Memorably, global fintech investments reached USD 111.8 Bn in 2018, more than doubling the figure posted in the previous year.

Riding the African fintech safari

In Africa, fintech investments stand over other sectors like a towering figure. For context, fintech funding more than quadrupled the amount raised by the second-best performing tech sector in Africa last year.

This trend points to increased interest and confidence in African fintech; a sector that has found a great anchor in Kenya’s M-Pesa mobile money service which has driven financial inclusion to 83 percent in Kenya (from 27 percent) since launching in 2007.

And beyond Kenya, there is evidence of the impact of financial technology across West Africa where the reach of the mobile money sector is 13 times wider than local banks. For a continent where an estimated 66 percent of the adult population is unbanked, the nascent fintech industry has a huge opportunity to drive financial inclusion outside of traditional banking systems.

Who really leads the way?

Currently, Africa is home to more than 400 fintech firms enabling payments, funds transfer, lending, and even wealth management. Nigeria, Kenya, and South Africa are the top fintech hubs on the continent, accounting for the larger proportion of fintech firms and attracting the lion share of investments.

While Kenya still holds first place when it comes to fintech in Africa (according to global indices), it is undeniable that the fintech market in Nigeria has, by far, been the most active in recent times. During a particularly crazy one-week period in November 2019, Nigerian fintechs clawed in almost USD 400 Mn in investments.

Any talk of saturation of the fintech space in Nigeria is immediately dispelled by words similar to these ones from Olugbenga “GB” Agboola, CEO of one of Nigeria’s leading fintech players, Flutterwave, to WeeTracker:

“I don’t think Nigerian fintech is overcrowded. There are like 20 banks in Nigeria and yet there is a massive delta between the banked and the unbanked. The market is there and the more people solving it from their niche vantage point, the better.”

Referring to this data, there were no less than 56 fintech companies enabling financial inclusion in Nigeria as of 2017. And that number is likely to have risen to anywhere around 100 by now.

For a country where half the adult population (approximately 60 million people) are still unbanked — and a paltry 20 banks continue to be overwhelmed by the task of bringing financial services to the unbanked and underbanked — it’s easy to see why fintechs are stepping in with mobile money wallets, payment solutions, agent networks, savings, investments, and micro-loans. And it’s also easy to recognise why there is enough room for everyone.

Over the course of the last decade, several fintech startups have popped up in Nigeria and prospered in Nigeria and beyond.

According to one source, PiggyVest (founded in 2016) now has around one million users who saved USD 80 Mn (NGN 28 Bn) last year. Millions of people now routinely move, at least, hundreds of millions of dollars online through platforms powered by Paystack and Flutterwave.

Also, Carbon now services hundreds of thousands of users. Wallets Africa did USD 43 Mn in transactions last year. Risevest launched last year and already has over NGN 500 Mn (USD 1.2 Mn) under management. Small wins, perhaps, but it certainly fuels optimism.

But COVID-19 may be coming for Nigerian fintechs

The new report by PwC Nigeria has revealed that the COVID-19 pandemic is expected to have a disproportionate impact on Nigerian fintech companies, and this impact is dependent on which segments they operate in.

As the report clarified, every company in the Nigerian fintech space will be adversely impacted by the pandemic. However, the degree of impact depends on what services the companies offer.

Which fintech segments face the biggest threat?

The report stated that fintechs whose core business involves lending and payment services are likely to be worst-hit by COVID-19.

Indeed, the bulk of Nigerian fintech startups have carved a niche for themselves in these two segments that PwC has now identified to be facing the biggest risk.

As the report explained, fintechs operating in the loan segment will be affected simply because a significant number of their clients will be unable to fulfill their loan obligations.

This is mainly due to the economic fallouts of the pandemic, which has triggered a recession that ultimately resulted in many employees losing their jobs.

“For the digital lending segment, the impact of the lockdown measures on business activities, employers, employees, entrepreneurs, and other entities could affect the ability of lending clients to pay back short-term loan obligations as and when due,” PwC explains.

Digital lending startups in Nigeria like Carbon, Fairmoney, Renmoney, and many others have since adjusted their loan terms with the present realities in mind.

Addressing the fate of fintech startups that have built their value proposition on payments, a part of the report says:

“The payments segment will be impacted by the decline in global fintech investments, which could hinder capital required for physical upgrade or expansion of digital infrastructure and services.”

Crisis and opportunity often exist together

The report from PwC, however, notes that it is not entirely a precarious situation as there is also an opportunity for fintech startups to thrive.

As mentioned in the report, the pandemic and subsequent lockdown measures that were imposed by the government, helped to shift a huge volume of financial transactions online.

Thus, PwC reckons that fintechs are in a good position to benefit from the current situation.

That is, as the world gets used to the new normal — which has pretty much put physical contact on hold — digital payments can be expected to soar with the potential shift in consumer behaviour; a shift that could become a permanent feature in the post-COVID-19 world. And fintech startups may find themselves at an advantage.

Featured Image Courtesy: Buzzercast