Africa’s Crypto Boom Defies Regulatory & Infrastructural Tightropes

African countries have the highest cryptocurrency adoption rates in the world. That is a tectonic shift from a position which was once described as “high searches but less adoption”.

A new report from Arcane Research shows that the unique combination of Africa’s economic and demographic trends makes the continent a potentially enormous crypto industry.

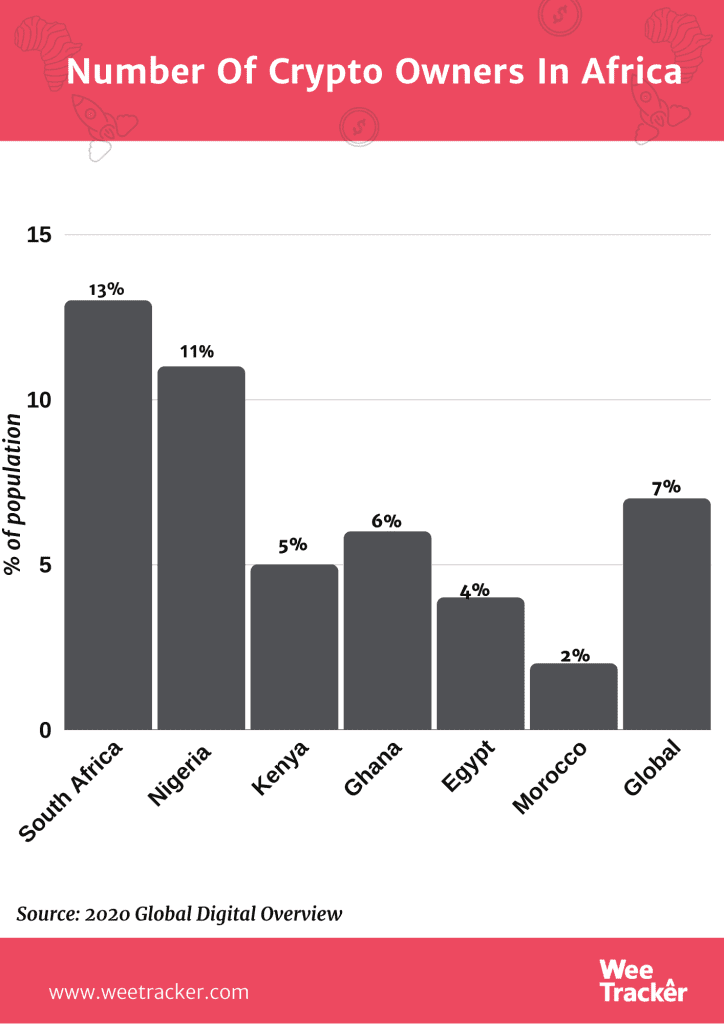

South Africa ranked third throughout the world with 13 percent of its internet users owning or using cryptocurrencies. Nigeria took the fifth spot with 11 percent of internet users owning digital assets. The worldwide average for the same stands at 7 percent.

Hurdling Through

The report, titled The State Of Crypto: Africa, highlights the challenges to crypto adoption in Africa, the first of which is the continent’s lack of proper banking infrastructure.

Unlike elsewhere, Africa’s crypto adoption is dichotomized because typicals such as mining bases, supporting merchants, Bitcoin ATMs, crypto exchanges and nodes are hard to come by.

These bottlenecks in marriage with inadequate internet coverage, the raging competition from mobile money and the uncertainty of regulations from African governments are hindering the prime, full adoption of digital currencies in the continent. These challenges form part of a series of well-documented roller-coaster rides Africa has with crypto and blockchain.

Is Bitcoin legal or illegal in Africa? The answer depends on which country you ask. The legality of crypto is substantially vague across the continent, given that more than 60 percent of African governments remain unwilling to clarify their position. Such skepticism may not be a tough barrier, but it does inhibit the speed of adoption.

Erratic power supplies, low internet penetration and lack of proper banking infrastructure join the strong force of factors hindering Africa from realizing its full cryptocurrency potential, in comparison to the boom of mobile money services.

Well-Suited, Regardless

The infrastructural and regulatory ingredients that spoil the broth in Africa’s crypto cooking pot are almost matched by the right condiments driving its adoption. Africa, compared to the rest of the world, does not have sufficient amount of Bitcoin ATMs (or BTMs), for example. But it has a young and mobile-native population that fuels interest.

Twitter CEO, Jack Dorsey, recently announced he would be moving to Africa to work on Bitcoin. Although he has since backtracked on the decision due to some reasons, his interest in the crypto-sphere of Africa made a compelling suggestion that the continent is the next frontier for digital currencies.

A set of more interesting and unlikely factors is beating infrastructural and regulatory challenges to influencing crypto adoption in Africa. The main catalysts are instabilities in its economics and politics, supported by digital and mobile trends, demographics and financial infrastructure.

According to a 2019 Finder survey, 14.4 percent of Americans own cryptocurrency, up from 7.95 percent in 2018. Granted, the United States surpasses most African nations in terms of crypto infrastructural and regulatory advancement. Nevertheless, 13 percent of South African internet users own digital assets, while the Nigerian counterpart of that statistic stands at 11 percent.

Another survey shows that 16 percent of South Africans with internet access either use or own crypto, giving the country a ranking that is only behind Turkey, Brazil and Colombia. Also, a few African countries surpass the global crypto ownership average of 7 percent.

Nodes & Mines

To some, it is a mixed picture, but to others a bullish trend that defies normal expectations. Africa’s crypto ownership rates are strangely mirrored by an extremely underdeveloped infrastructure. For instance, Arcane’s report reveals that only 0.2 percent of the 10,267 Bitcoin nodes across the world are located in Africa.

And, most of the nodes in the continent are located in South Africa, the most industrialized and diversified economy in the region. The continent also account for just 0.24 percent of BTC Lightning nodes and contributes just 0.7 percent of total network capacity.

“Even though these numbers might be an underestimation, as many operate nodes out of data centers like AWS, it clearly indicates a lack of low-level adoption of the technology on the continent,” the report says.

Couple that with the total absence of crypto mining activity in Africa in comparison to that of China, the United States, Germany and France, it leaves the wonder why the continent is still the ‘headquarters of crypto adoption in the world’.

The U.S leads the pack with over 2,625 nodes, followed by Germany and France with 2016 and 698, respectively. Incredibly, these three countries are responsible for over 50 percent of all operational Bitcoin nodes.

Demand

There will be 725 million mobile phone subscribers in Africa by 2020, according to the GSM Association. This represents the interests of mobile operators globally. That means, more Africans will have the tools to plug into the cryptocurrency ecosystem.

Within this opportunity lies the very reality of demand. More and more Africans are using their mobile phones to access cryptocurrency platforms. In Kenya, case in point, there seems to be organic demand for cryptocurrency.

Ahlborg’s research indicated that Paxful and LocalBitcoins’ traction in the country doubled over the past year to roughly USD 44 Mn worth of annual volume.

Currently, with Bitcoin precisely, it looks as though the usage is hedging against the fluctuation of currencies, acting as an asset store and not just for daily transactions, says Kofi Genfi, CEO of Accra-based Mazzuma—a mobile money payments system that utilizes a distributed secure infrastructure and cryptocurrency to enable seamless payments.

“I think the biggest thing that can overcome the many challenges with African Bitcoin adoption is demand. Necessity is the mother of invention. Because the demand is higher than the hindrances, there will hardly be impediments. The trends over the past months of a pandemic has shown more interest in cryptocurrencies, showing another wave in African crypto,” he told WeeTracker.

According to LocalBitcoins, its daily volume in South Africa, Nigeria, Kenya, and Tanzania was around USD 615,370 (ZAR 10.9 Mn), USD 1.3 Mn (NGN 498 Mn), USD 57,394 (KES 38 Mn), USD 55,341.80 (TZS 126 Mn), respectively, on 21st March, 2020.

Inflation, Volatility

The report which was done in collaboration with Luno, shows that Africa’s high inflation rates and volatile currencies are likely to result in an increase in the adoption of cryptocurrencies. Digital currencies as well offer lower-cost and faster remittance fees than what is currently available in the continent.

Traditional money transmitting services charge very high fees and intra-African payments are often slow. The lack of crypto-specific infrastructure presents a huge opportunity to deliver the much-needed transformation of financial systems across many countries on the continent, notes Luno GM for Africa, Marius Reitz.

In 2015, Zimbabwe’s inflation skyrocketed so much that the Southern African country’s authorities were forced to print USD 100 Tn notes, with each worth just USD 40. At that time, Zimbabweans turned to Bitcoin, something other African citizens do in response to their hyperinflated currencies.

Between September 2016 and September 2017, the inflation of South Sudan was at 102 percent, according to the World Bank. Egypt, Ghana, Malawi, Nigeria, Zambia, South Africa, Kenya and Mozambique are other countries with double-digit inflation rates. To no surprise, most of these countries form Africa’s major Bitcoin economies.

In fear of a collapse in the banking industry or the arbitrary appropriation of money by the government, Africans without access to banks and those who live in politically unstable countries could be attracted to cryptocurrency. Bitcoin transactions help to eliminate the procedural bottlenecks that plague traditional banking and financial services.

Photo by André François McKenzie via Unsplash .