South African Airways Wants To Get Back In The Air At A Sky High Price

After months of being grounded due to the coronavirus crises, it appears that South African Airways (SAA) wants to get back in the air in any way possible. But, before the outbreak of Covid-19, the national carrier was already in a difficult situation.

Too Much Debt?

South African Airways is in trouble because it has been accumulating debt at levels higher than what it can sustain. It topped USD 3.9 Bn since 1994, last making its profit in as far back as 2011.

With this, there is no wonder why the business has gone into an involuntary rescue, as President Cyril Ramaphosa decided that was the single best way to resolve issues for the cash-trapped carrier.

At some point, SAA was thought to be in a situation it cannot be saved from. That is because its traumatic period had many implications, from unmet pay demands to a heckload of cancelled flights.

The situation was so complex that, in early May, the South African government moved to shut the business down and form a new national airline.

In the past decade, over USD 946 Mn in taxpayer money was spent on bailouts for the airline. As though that was not disturbing enough, the country’s government committed to settle more than USD 516 Mn in debts that SAA is obviously unable to pay back. This is equivalent to more than ZAR 5 K (USD 286.99) per registered individual taxpayer in South Africa.

Maintenance Woes

A part of South African Airways’ problems can be traced back to 1991 when the government deregulated the domestic airline industry. The change allowed any company in the industry to fly any route it chooses. SAA, which at the point controlled 95 percent of the local market, started losing its dominant position to new competitors.

Even though many of the new companies crashed, SAA was able to remain in the air because the South African government always came to its financial rescue.

That is why the failed companies—including 1time, Sun Air, Phoenix Airways, Nationwide and Flitestar—blamed their fate on unfair competition.

But as the government’s deep pockets served as respite for the business, there was enough on the wrong side to offset it. Apart from debt, the sharp drop of the rand in recent years massively added to the airline’s fuel bill. However, most importantly, the business battled with maintenance issues.

SAA owns SAA Technical (SAAT), a body that sees to the maintenance of its planes alongside those of other firm like Comair. In 2019, the airlines were cajoled into grounding some of their aircraft for compliance checks after irregularities were found in SAAT inspection.

SAAT provides line maintenance services to more than 30 customers at both domestic and international stations. Its aeronautical engineers attend to approximately 400 hundred flights daily.

Fingers Unequal

There were reports that SAAT used fake parts when servicing aircrafts, as were circulations that a crime syndicate had infiltrated SAA’s technical team.

In the same South Africa, FlySaFair, another airline, has been able to shine where SAAT faltered. During that period of backs and forths, the Kempton Park-headquartered aviation firm continued flying while other plans were grounded.

As the airline says, aviation is a complex business. The industry is hugely capital intensive, with thin margins, which means that it’s generally tough to make money, but very easy to lose it.

It’s not possible to propose a single panacea for all airline woes, the challenges each business faces are unique. But FlySaFair is profitable, as far as the Covid-19 pandemic and its consequences are not weighed in.

“We made our first profit in our second year of operations and reached a position of Positive equity by the end of our third year. We believe that our market advantage is our punctual and hassle-free service offering. A large part of our strategy at FlySafair is to keep our costs low, therefore our fares are low,” Kirby Gordon, Chief Marketing Officer at FlySafair, told WeeTracker.

He said: “We strive to be punctual and to make the journey as hassle-free as possible. Our focus has been—and will remain—on what our customers want. Doing our own maintenance is without a doubt a big factor in managing our on time performance because our lines of accountability are entirely internal”.

Operating 16 aircrafts, 2,558 flights and with capacity to fly 457,950 passengers, FlySafair became the country’s largest domestic airline in December 2019—just six years after the company was founded. The company is a division of Safair, who ran an aircraft maintenance division long before FlySafair’s first flight in 2014.

Nevertheless, all airlines are subject to the same rules and regulations in terms of the Civil Aviation Act and the South African Civil Aviation Authority, so there are no real differences in any airline’s operational positions. Like any business, they have different shareholders, and the dynamics with those shareholders are as unique as the business they oversee.

SAA’s Comeback?

The South African government has agreed to fund a restructuring of South African Airways if a business rescue plan for the struggling state-owned airline is adopted.

The administrators running the embattled carrier proposed that the government provide USD 1.2 Bn in bailout to enable it repay debt and resume operations. It is uncertain whether this bailout would turn things round, due to strong reasons.

For one, the global aviation industry is in the middle of devastating financial losses as a result of the coronavirus pandemic. The results are numerous, but the mains are job losses, airline restructuring and the complete dismantling of businesses.

Comair, in South Africa, has entered into a voluntary business rescue, while 5,000 SAA’s have been on a near-three-month unpaid leave.

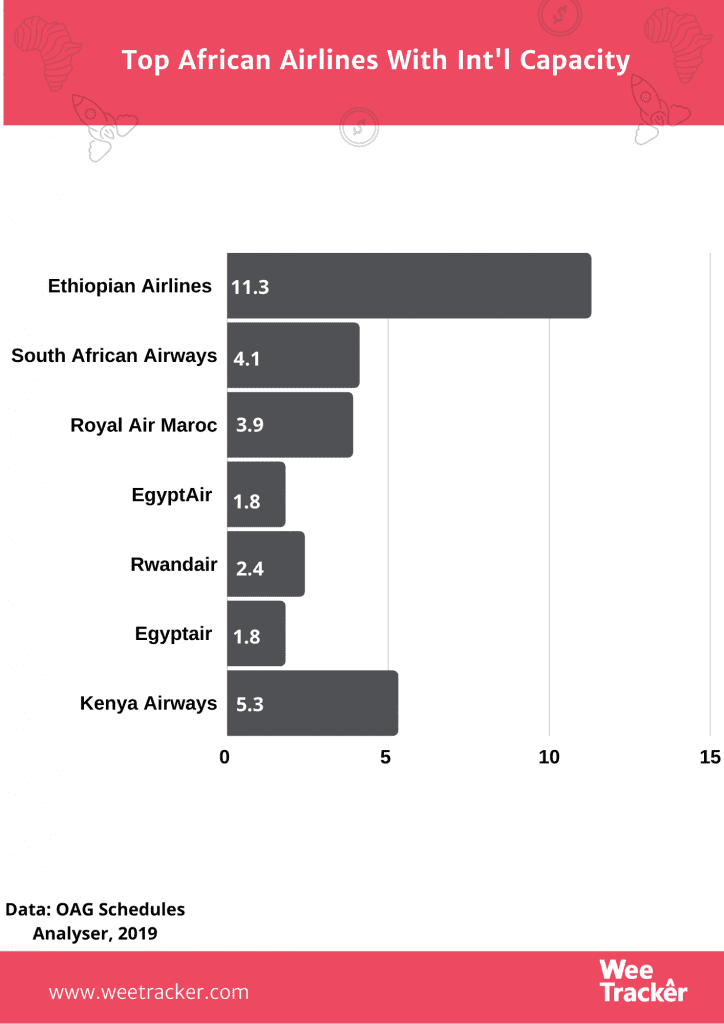

Air Mauritius—a leader airline in the Indian Ocean—has also been placed under voluntary administration. Meanwhile, Ethiopian Airlines—the crown jewel of African aviation—is suffering losses and furloughing staff.

Heavy Implications

Weighing in all these realities together with the fact that SAA’s problems began long before Covid-19, only time will tell if the sought-after funding will turn things round.

South Africa’s severe nationwide lockdown added fuel to the fire faced by the airline. Indeed, Covid-19 response has added layers to difficulties through South Africa’s economy.

Recall that the country went into a recession before the pandemic. According to a survey, 4 in 10 South African businesses are insecure of their financial resources needed to operate through the crisis.

If SAA were to make it work, it will have to do more than just clearing debts and getting its planes back in the air. The future is still bleak. The USD 1.2 Bn funding agreement is yet to be finalized, but a deal of this nature would represent a truce between the government and SAA’s business-rescue team over the airline’s future.

Increased support to financially-distressed state-owned companies—including SAA and energy firm Eskom—has increased by USD 3.4 Bn over the medium term, adding to the South African government’s spending pressures.

Photo by Sebastian Grochowicz via Unsplash