South Africa Shot China’s Two-Way Trade With Africa In The Foot

The bilateral commerce between China and Africa has by no means remained normal due to the gaps created or widened by the pandemic.

The two-way trade between the two partners fell by 19.3 percent to USD 82.37 Bn in the first half of 2020, creating a virus-shaped chasm in both supply chains and export revenues. South Africa, China’s key trading partner, is responsible for most of the dragging down.

Culprit South Africa

South Africa is arguably China’s leading trading partner and its closest ally in Africa. This (2020) is the 22nd year of the two nations diplomatic and economic ties, whose benefits are more noticeable in the Cyril Ramaphosa-led country.

Exports between South Africa and its Asian ally has been soaring to unprecedented levels in the years before, earning China the position of the country’s largest trading partner for 10 consecutive years. It is by the same token that China overtook the United States to become Africa’s largest trading partner.

China and South Africa’s economic cooperations are multifaceted, stretching across the areas of trade, loans and infrastructure investments. Presumably, being the anchor of China’s dealings with the continent had its downsides.

If South Africa can account for a climb in bilateral trade between Africa and the world’s second biggest economy, it can also be blamed for a drastic turnaround of events. The Covid-19 fallouts suffered by both countries has somewhat made sure of that.

For context, South Africa And China both form part of the BRIC bloc of countries which have a combined Gross Domestic Product (GDP) of USD 15 Tn.

Shot In The Foot

While the Chinese imports from Africa, including copper, cobalt, and oil, dropped by 32 percent, China cut imports from South Africa by nearly a third to USD 8.68 Bn, that is 32.2 percent.

As Chinese exports to Africa fell by an overall 8.3 percent due to lockdowns and border restrictions, the country’s exports to South Africa slumped by aa about a fifth to USD 6.20 Bn. according to customs data.

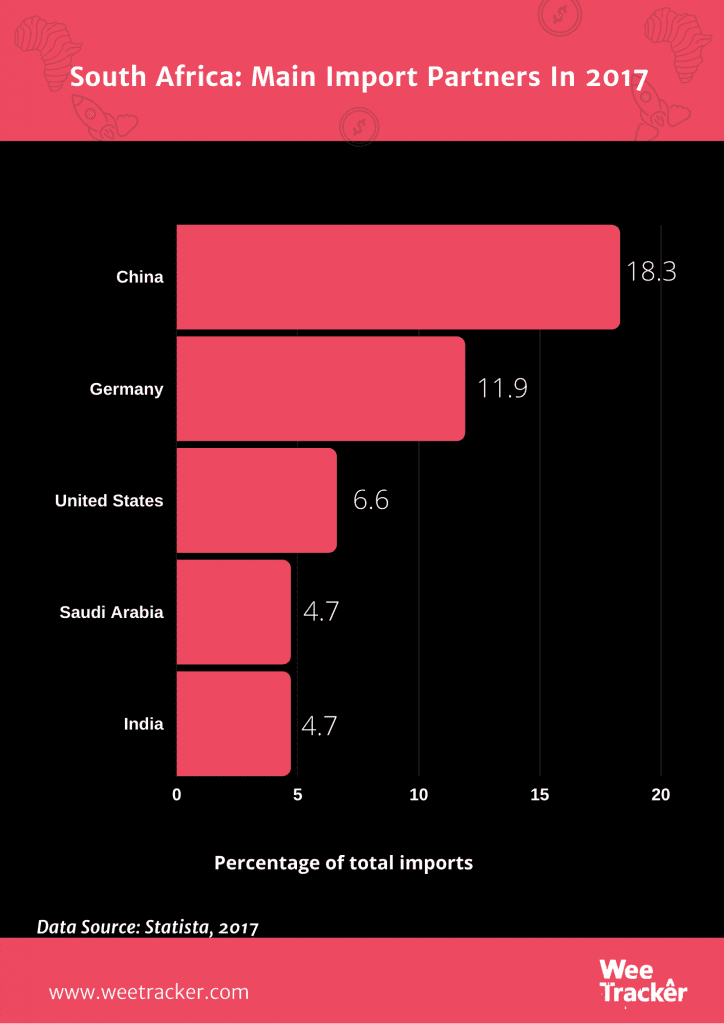

In 2018 alone, South Africa exported goods to the tune of USD 8.6 Bn to China, accounting for 9 percent of the country’s total exports. It imported goods worth USD 17.1 Bn from China, accounting for 18.5 percent of its total import. All this resulted in a trade deficit of USD 8.5 Bn because South Africa imports high value-added products and exports low valued-added ones.

A bilateral trade value of USD 39.17 Bn in 2017 that subsequently grew by 11.18 percent to more than USD 43 Bn in 2018 is enough for South Africa to be branded as the top destination for Chinese investment in Africa.

The country is regarded as the top destination of Chinese investment in Africa, with a bilateral trade value of $39.17billion in 2017, which subsequently grew 11.18% to more than $43bn last year.

In 2018, China’s ambassador to South Africa, Lin Songtian, said that the combined existing and planned direct Chinese investment in South Africa reached more than USD 25 Bn in accumulative terms by June 2017.

Domino Effect

While China is home to the origin of the coronavirus infection, South Africa has arguably suffered the worst from the pandemic in Africa. With 324,221 cases, including 4,669 deaths, South Africa is the fifth most affected in the world, according to today’s stats.

China’s economy has been on a steady growth for the past recent years, but Covid-19 became a showstopper, making it shrink by 6.8 percent in Q1 2020 alone. Meanwhile, South Africa’s economy shrank for 3 consecutive quarters. delivering a pre-pandemic recession that has now been worsened by the virus outbreak.

According to analysts, the sharp drop in the China-Africa trade is attributable to the fall in commodity prices, thanks to coronavirus-inspired lockdowns, the shuttering of borders and the closure of ports and airports, all which which cut demand.

South Africa accounts for most of this drop on the backs of its partner position with China in Africa and the severeness of its movement restrictions in a bid to curb the spread of the coronavirus. Infrastructure-wise, there has also been a slowdown in big Chinese projects in the country.

Nevertheless, Chinese customs says the overall slump in trade with Africa is better than what was initially expected, given that the world is at risk of entering a collective recession and is only trying to sidestep the economic implication of the seemingly unending crisis. China remains Africa’s biggest trading partner, despite the pandemic-related fallouts.

Featured Image: Avi Waxman Via Unsplash