South Africa’s Banking Playground Mostly Remains The Turf Of Only 5

The South African banking system comprises of many players, but a group of five financial institutions are and have remained the financial heavyweight champions. A slew of new players and tech-based financial services are shaking up the industry, but that has not done much to change the position of the Big Five.

What The Numbers Say

According to Rel Banks, there are 10 locally-controlled, 7 foreign-controlled, 3 mutual and 2 cooperative banks in South Africa. The majority of the playing field is, however, has been dominated by only five players.

According to the 2019/20 annual report by South African Reserve Bank’s Prudential Authority, these biggest banks continue to have the biggest slice of the pie in spite of an increase in competition—some of which are tech-enabled.

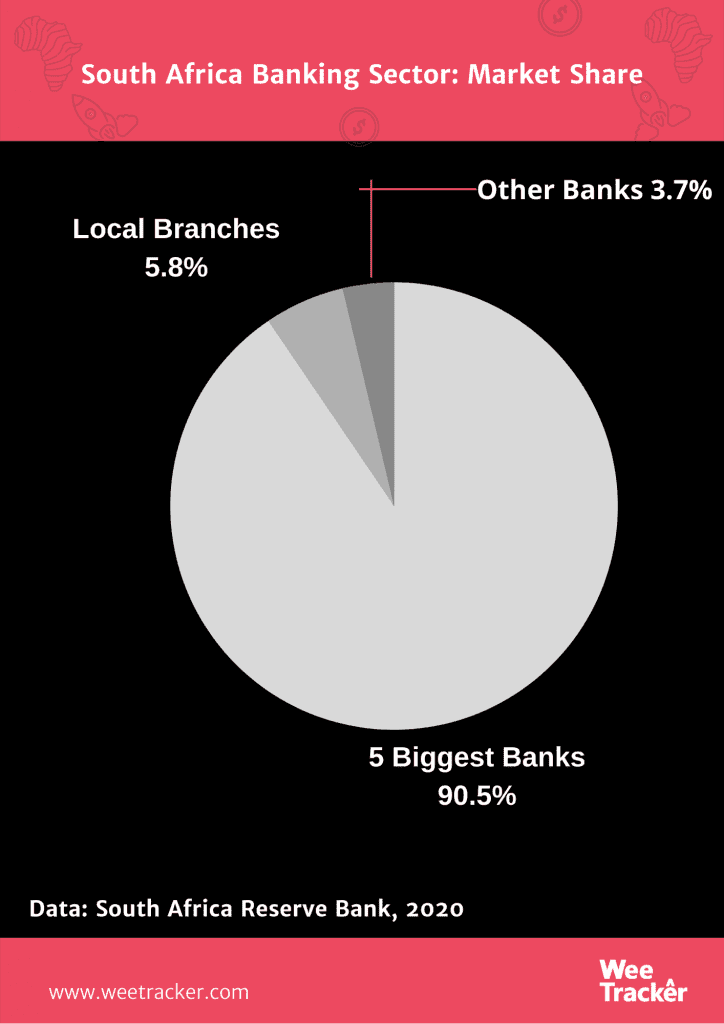

Per the SARB report, 89.4 percent of the South African banking sector is controlled by the five largest players. That is the percentage of the market share they hold as at 21st March, 2020. Meanwhile, the local branches of international players accounted for only 7 percent of the sector’s assets.

Other banks have claim to only 3.6 percent of the playground. The figures remain mostly unchanged because the five banks had 90.5 percent of the sector’s assets as of March 2019.

Per a PwC report, the South African financial services industry is increasingly ‘a marketplace without boundaries’, where banks are being challenged ‘by digital solutions with lower-cost models’.

Adding, it said that the market share of the incumbents will likely be squeezed by innovative new entrants unless banks implement strategies ‘to remain relevant in the future banking market landscape’.

The Big Five

South Africa’s banking segment grew by 16.3 percent year on year to ZAR 6.6 Tn at the end of March 2020. In March 2019, the sector’s value was put ayt ZAR 5.7 Tn (over USD 341 Bn). The increased was brought on by an increase in gross loans and advances, investment, trading securities, and derivative financial instruments.

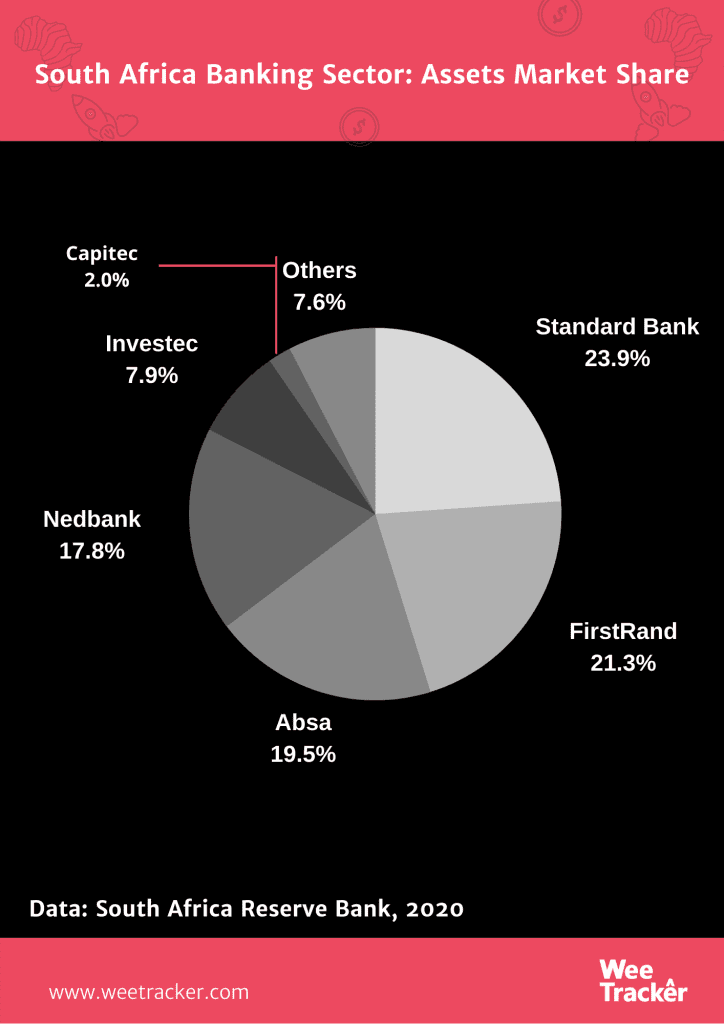

SARB’s report identified Standard Bank, FirstRand, Absa, Nedbank and Investec as the biggest in the South African banking system. They face competition from small players and new entrants such as Capitec, African Bank, Discovery Bank and TymeBank.

SARB’s findings are backed by that of The Banker—an international banking, finance and business coverage and analysis organization—whose annual ranking of the world’s 1,000 biggest banks in terms of tier 1 capital levels feature the same 5 banks.

According the 2020 ranking, South Africa’s banks were still able to grow their tier 1 capital despite entering a recession in 2019’s fourth quarter and experiencing disruption caused by repeated electricity blackouts.

Standard Bank maintained its position as the country’s biggest bank, recording USD 10.54 Bn in tier 1 capital in 2020, followed by FirstRand, which is closing the gap with the country’s leader, The Banker noted.

In terms of total assets market share, SARB’s annual report says Standard Bank leads with 23.9 percent, followed closely by FirstRand’s 21.3 percent.

The banking sector remain profitable in the review. Nevertheless, SARB notes that the impact from the coronavirus pandemic would have a major impact on the 2020/21 data.

Featured Image: Mclarens.co.za