Nigerian Wealthtech Startups Wobble As Returns Turn Into Peanuts

Wealth management or wealthtech startups in Nigeria currently find themselves in a tight spot.

On one hand, they have to keep customers happy by offering them decent interest rates on their savings/investments. On the other, these startups are now being forced to ‘prioritise safety over customer happiness’ due to the present realities of Nigeria’s financial markets.

In other words, wealthtech startups in Nigeria have been forced to slash the interest rates on their savings/investment offerings significantly — there’s been as much as a 50 percent drop in some cases.

In plain terms, a savings plan that was yielding 11-15 percent per annum as of early 2019 is currently generating somewhere around 6 percent per annum on a platform like Cowrywise, for instance, which claims to be big on transparency and security of user funds, as opposed to luring people in with attractive rates that are questionable and unsustainable.

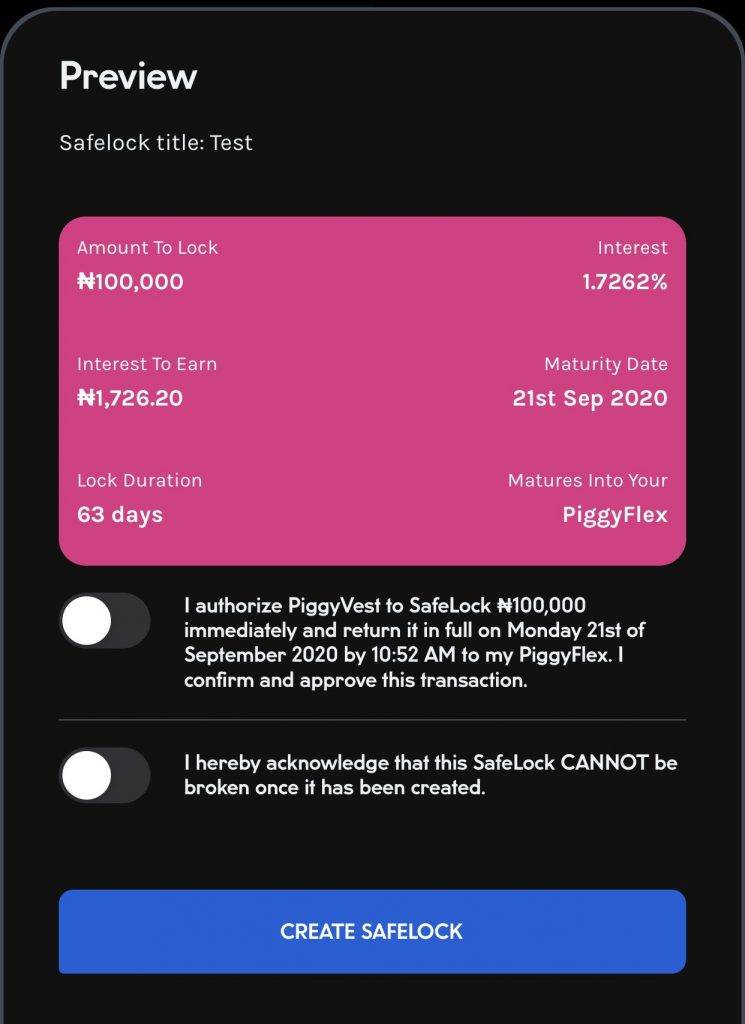

Another popular Nigerian wealthtech startup, PiggyVest (formerly Piggybank.ng), is currently offering a paltry 1.7262 percent interest on its “Safelock” savings plan with a duration of 63 days. Previously, the same savings plan could yield between 8-10 percent interest. Now, that’s quite some drop!

What’s happening to wealthtech interest rates?

At the moment, wealthtechs are sort of faced with two important tasks of which they can only really handle one without creating room for trouble. They have to guarantee returns by pooling resources and investing in risk-free instruments, and they also have to keep customers happy by serving up good returns.

But those risk-free instruments are currently not yielding sufficient returns and wealthtechs find themselves needing to manage customer expectations while attempting to keep users somehow satisfied with significantly shrunken returns. And that’s no easy task.

“When you [look at] the recent drop in interest rates on Cowrywise, it is easy for people to assume that we just decided to cut interests but ideally, the truth is we don’t have that power,” Feranmi Ajetomobi, Head of Brand Engagement at Cowrywise, told WeeTracker.

“What we can only do is to adjust the rates to reflect what is happening in the market space where we invest the money. As a firm, we invest user savings in treasury bills and government bonds. Given that savings can fall within 3 to 6 months, the majority of that will go into treasury bills.”

He added, “Hence, a bulk of the representation of the rates will depend more on treasury bills which have been falling.”

Thus, it follows that the significant decrease in interest rates on investments/savings on some of the most prominent wealth management platforms in Nigeria has something to do with the huge drop in the value of treasury bills.

How Nigeria’s treasury bills got tanked

By definition, a Nigerian treasury bill (T-Bill) is a government-guaranteed debt instrument issued by the Central Bank of Nigeria (CBN) on behalf of the Nigerian government to finance expenditure. Side note: The CBN also uses another kind of T-Bill known as OMO bills to control the supply of naira.

Essentially, T-Bills are one of the ways the government raises funding for its budget. At an auction known as the Primary Market Auction (PMA), banks, foreign investors, pension funds, and others come and buy these T-Bills as a form of investment.

However, last Wednesday, the CBN held an auction to sell treasury bills on behalf of the Nigerian government, and a one-year treasury bill was sold at an interest rate of about 3 percent. Indeed, Nigeria’s T-Bills have declined by 83 percent in the last 3 years, dropping from 18 percent in July 2017 to 3 percent in July 2020.

The value of T-Bills is typically tied to such factors as the health of the economy, inflation, as well as the common laws of demand and supply. As it is, there’s now a lot more demand for T-Bills, especially since the CBN made some prickly adjustments to the requirement for purchasing the other kind of T-Bills known as OMO bills.

Hence, investors are abandoning OMO bills for the regular T-Bills, such that demand for T-Bills is now huge. And it’s common knowledge what happens when a commodity is in high demand.

Since demand is far outstripping supply — as more people are willing to lend the government money — the government can afford to give each person a lower interest rate.

This has created a situation where T-Bills have continued to drop in value over the last few years and now has the Nigerian financial market in an unusual position where a one-year treasury bill has an interest rate significantly lower than inflation which is currently at 12.4 percent.

The net effect is that the yield on investments in mutual funds or savings on wealthtech startups has fallen because a lot of these funds/fintechs ultimately invest in treasury bills and similar investment products.

In general, T-Bills have a big say in determining interest rates and investment returns in Nigeria: be it savings accounts, loans, or pension. It’s kind of the standard that determines the interest rates on other investments in Nigeria, and that pretty much kills the idea of alternatively putting money elsewhere.

Perhaps the only upside to this is that banks and other lenders will now be more willing to give out loans to individuals and businesses and earn better interests since T-Bills yields are now so poor.

Where this leaves wealthtech startups

Wealthtech startups have become quite popular among Nigerian millennials and even boomers.

Indeed, wealth management startups are to Nigeria what digital lenders are to Kenya. There are up to 49 known digital lenders in Kenya, no other African country has more.

In Nigeria, there are currently 20+ wealthtech platforms/investing apps giving individuals freedom and flexibility in making rewarding investments and savings. No other African country has more. And this doesn’t even include crowdfunding platforms like Farmcrowdy (Crowdyvest) and ThriveAgric.

Wealth management platforms like PiggyVest and Cowrywise which launched between 2016 and 2017 are among the most popular wealthtech startups in Nigeria. According to one source, PiggyVest (founded in 2016) now has around 1 million users who saved USD 80 Mn (NGN 28 Bn) last year.

Other platforms like Afrinvestor, Payday Investor, I-invest, Eyowo, Overwood, Carbon, Wealth.ng, KoloPay, and even platforms supported by commercial banks such as ALAT by Wema, FBN Edge, and the mobile app of Stanbic IBTC Bank, are also quite popular. Nigerian wealthtechs like Rise, Bamboo, Chaka, Trove, etc., are even making it possible for Nigerians to easily invest in U.S. stocks.

However, the current investment climate appears to be unfavourable as a good number of the Nigeria-facing wealthtech platforms would have been hit by the T-Bills malaise.

As early as February 2020, Cowrywise had advised that interest rates of 10 percent or more on “secure investments“ was “impossible” at the time. And it seems that trend has continued to manifest, but perhaps not necessarily across the board.

“I think that there’s no certainty here – everyone’s interest rates are based on prevalent market behaviour, and everyone is running a business and will take the best decisions for their business, so I cannot presume to speak for all fintech companies,” Odun Eweniyi, co-founder and COO of PiggyVest had told us back in December.

“From a personal point of view, we’re observing the changes in the rates on the market, and as soon as any new changes are necessary we will make them. The goal is to offer competitive, sustainable rates to our users and we will continue to do that,” she had added.

Featured Image Courtesy: TheAfricaReport