Covid-19 Bled Prepaid Subscribers Off SA’s Vodacom But Boosted The Telco’s Data Traffic

Vodacom South Africa, a mobile communications company, providing voice, messaging, data and converged services, has released its trading update for the year that ended June 30th, 2020. While South Africa’s notorious coronavirus lockdown chopped down the telecoms provider’s number of prepaid customers, it led to a boost in data traffic, driving up Vodacom’s revenues.

Bleeding Subscribers

The unwilling loss of prepaid subscribers is nothing new for African telcos. Customers are always switching carriers to get the best connection, data bundles and voice offers. For South Africa’s Vodacom, subscribers declined by 9.9 percent from 43.7 million in June 2019 to 41.3 million at the end of March this year (2020).

The decline was majorly due to a fall in prepaid customer, which went from 37.8 million in 2019 to 35.2 million this year. Prepaid customers are hardly loyal to network service providers. Most of them see their relationship with telcos as a partnership rather than a transaction. Complex processes are a turnoff, as they expect nonstop reliable services.

Being that South Africa’s severe coronavirus containment measures prevented customers from walking into nearby Vodacom stores to activate new prepaid accounts, the decline was both somewhat precedent and heavy. However, there is little to prove that the reverse would have been the case if the lockdown was out of the picture.

In 2019, MTN Nigeria, Nigeria’s largest telecoms provider by market share was witnessing a prepaid customer mass exodus from its mobile communications domain. At the time, it was because users felt the telco still had a long way to go in making its data bundles not just affordable, but less prone to draining in the “twinkle of an eye”.

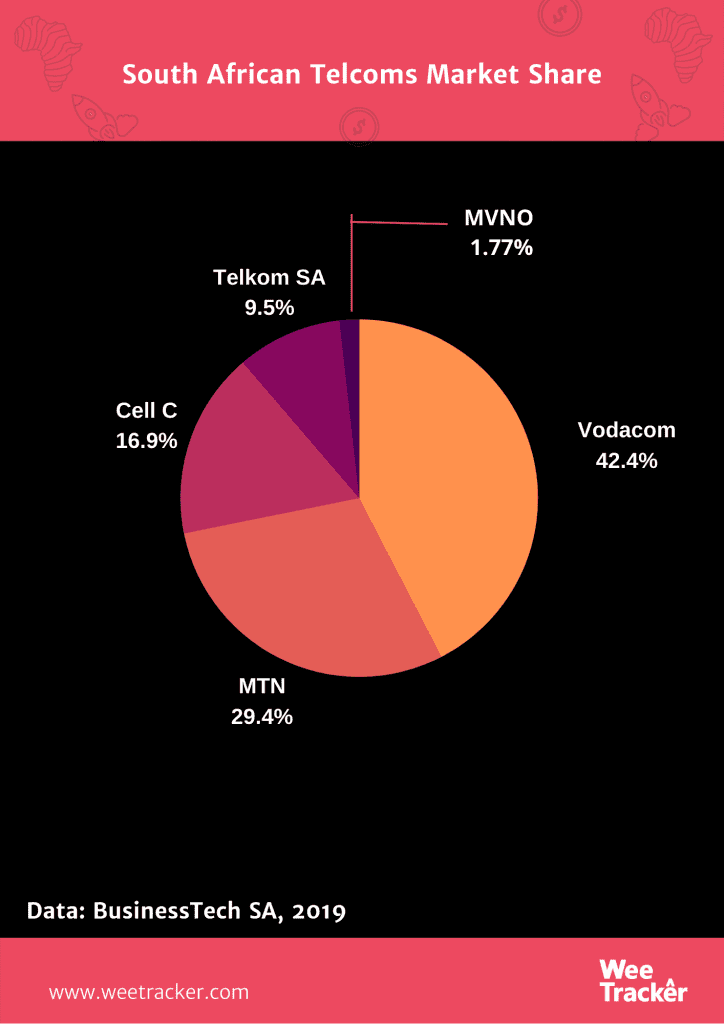

Vodacom is currently the largest mobile operator in South Africa, followed by MTN, Africa’s largest telecoms provider.

But Strong Data Demand

The coronavirus-controlled increase in data traffic in South Africa is estimated to be at 15 percent, expected to continue increasing. Thanks to working and studying remotely, there was a significant increase in online video streaming as well as on online collaboration services. For instance, the climb for use of video streaming platforms like Netflix was 20 percent since the start of the country’s lockdown.

No wonder why Vodacom’s revenues have gone up substantially, drawing from the surging data traffic. The mobile operator reported a 7.6 percent rise in its first-quarters group service revenue, from ZAR 17.4 Bn (USD 1. 039 Bn) in the year earlier to ZAR 18.7 Bn (USD 1.116 Bn) in 2020. Meanwhile, the overall group revenue grew by 5.6 percent.

“Following the implementation of lockdown regulations in South Africa we noted a surge in data traffic on the network of up to 40 percent in comparison to pre-lock down implementation due to increased traffic as people work and entertain from home, but also due to zero-rating certain education, government and health sites to assist during the crisis,” it said in a statement on Thursday (16th April).

Vodacom South Africa saw its data traffic surge by 97.7 percent, thanks in part to cuts in its data prices as implemented from April 2020. “We also implemented price reductions of 34 percent on average from 1 April, 2020 for 30-day data bundles. The increased demand more than offset these price reductions during the period,” the company said. A subsidiary of U.K-based Vodafone, South Africa is Vodacom’s largest market.

Featured Image: Muhammadtaha Ibrahim Ma’aji Via Unsplash.