Is The Shock IPO Of This Fledgling African Music Platform Overambitious?

Africa’s technology scene is still a stranger to companies going public as IPOs are still few and far between. But it seems the feat achieved by the likes of Jumia and Helios Towers (both Africa-focused tech firms that went public last year) has emboldened the ecosystem.

As yet another African tower operator, IHS Holdings, plots a massive IPO of its own, one little-known African music streaming platform has opted to get in on the act — declaring ambition that might be thought of as outsized and maybe too optimistic in some circles.

Mdundo, as it is called, is a music streaming platform focused on sub-Saharan Africa. With over 40 Danish business angels as investors, the fledgling music platform has existed since 2013.

Although Danish-owned, Mdundo focuses on 15 countries in Africa with a team in Kenya and commercial focus in Kenya, Nigeria, Tanzania, Ghana, and Uganda. On Monday, August 17, the company announced far-along plans for an IPO on Nasdaq First North, Denmark.

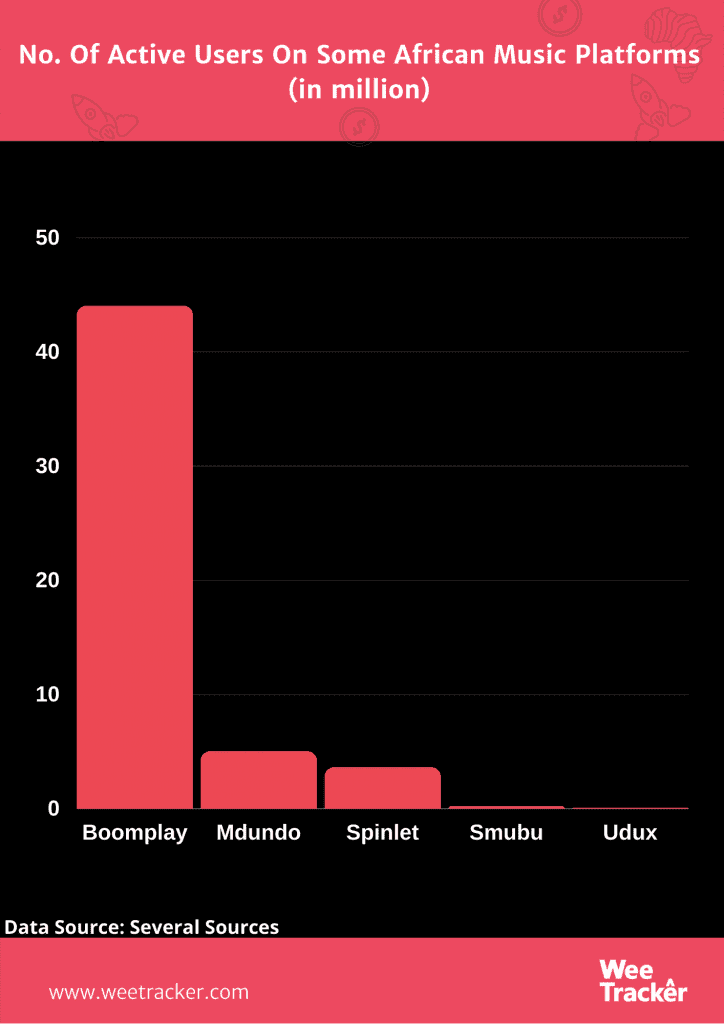

Mdundo, which claims 5 million monthly active users and 20 million monthly downloads on its website and Android app, said it is applying for admission to Nasdaq First North, Denmark, to accelerate the current growth in sub-Saharan Africa.

First North is described as Nasdaq’s European growth market, designed for small and growing companies, allowing approximately 200 European trading members of Nasdaq to easily trade on the two markets.

The subscription period runs from 17 August to 28 August 2020, and the offer price is DKK 10.00 (USD 1.60) per share, corresponding to a market value pre-offering of DKK 61.9 Mn (USD 9.92 Mn). The offering of new shares is up to DKK 40 Mn (USD 6.41 Mn).

“Mdundo has 5 million monthly users, but the potential is more than 30 times greater,” said Martin Nielsen, CEO of Mdundo.

“With a steep growth curve and a very scalable solution, we plan to invest further in user growth to increase our market coverage in sub-Saharan Africa and within approximately three years establish Mdundo as the leading Pan-African music service for consumers and musicians. We want to achieve in Africa what Spotify has achieved in the West and what Tencent has achieved in Asia,” he added.

Africa’s fledgling music streaming scene hosts both local and international players with more than 25 such platforms known to have put some skin in the game over the last few years by our estimate.

Besides Mdundo, platforms like Boomplay, Spinlet, Smubu, Udux, Mziki Ghaneely, etc. are among the Africa-focused players. The likes of Apple Music, Spotify, Deezer, and Tidal are popular global platforms that are starting to look towards the African continent, though still quite limited in availability.

Although music streaming revenue in Africa is projected to hit a 12 percent annual growth that will see the market reach a volume of USD 822 Mn by 2024, much of the music consumed in these parts still come through illicit sources.

With global leading music streaming startups offering their services on the basis of subscriptions charged to users, there are legitimate concerns over how many Africans can spare a sum to pay for music given the dire economic realities.

And then the artists themselves are known to upload their music online for free and instead bank on shows, concerts, and brand endorsements as the preferred income route. There’s also the piracy problem. Hence, music streaming has been slow to take off in these parts.

As Mdundo pointed out in its prospectus, “There are few established record companies in Africa, and a lot of people listen to illegal music – just as was the case in Denmark 10-15 years ago. Mobile users listen to music on their mobile phones, but this is primarily through illegal downloads similar to the situation in Europe and the U.S. 15 years ago.”

Mdundo has built a platform solely for African music, which it claims makes up approximately 80 percent of music listened to in Africa.

Although the company indicates knowledge of the obstacles to streaming on the continent, it appears to be banking on smartphone penetration (expected to grow to 483 million mobile users by 2025), cheaper internet, a youthful tech-savvy population, and its track record in the last few years.

Mdundo claims to have seen user growth of over 100 percent in the last year. It also says revenue from advertising has increased by 400 percent in the past year, following the implementation of new strategies.

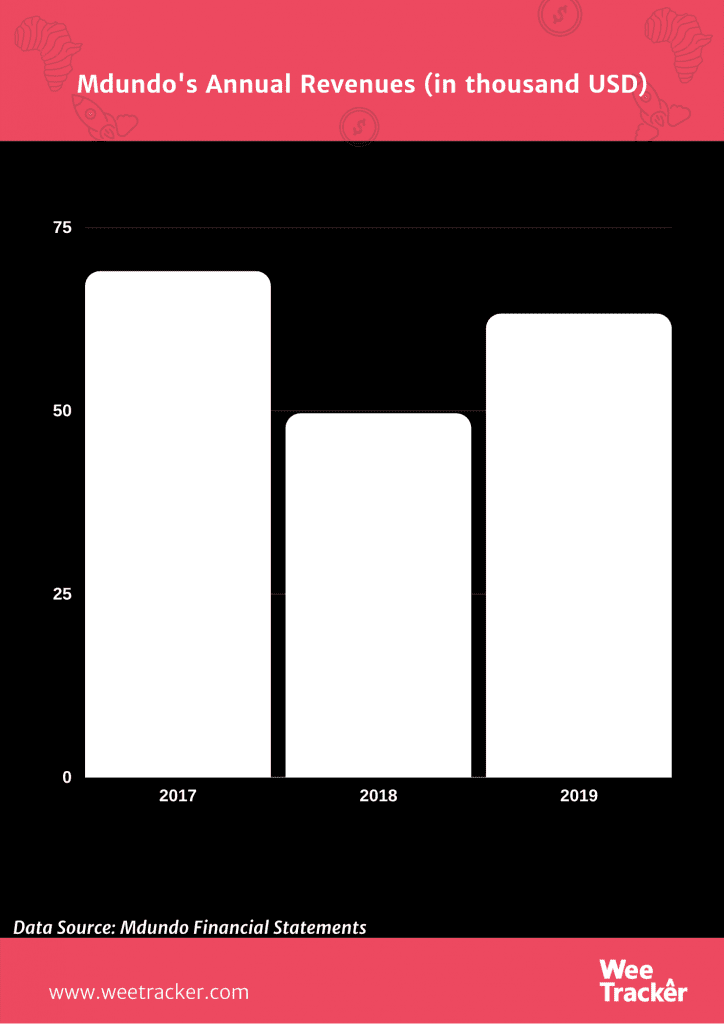

As seen in its annual report and financial statements, Mdundo posted revenues of USD 63.2 K and USD 49.6 K in 2019 and 2018 respectively, though it lost USD 193.8 K in 2019 and USD 157 K in 2018.

At the end of 2019, Mdundo’s accumulated losses hit USD 692 K, climbing from USD 556.3 K recorded at the end of 2018.

As its current freemium model relies solely on advertising revenue, Mdundo’s highly optimistic pitch suggests that it is taking a shot at 149 million potential users and an advertising market of approximately DKK 1.6 Bn (USD 256 Mn) by 2022.

As things stand, its revenue since inception is less than USD 1 Mn per available data, though it claims to share its earnings with the approximately 80,000 local musicians who have added 200,000 music tracks to the platform and received up to DKK 1.9 Mn (USD 304 K) in payments from Mdundo so far.

With the funds raised from the IPO, Mdundo targets a rather ambitious growth to 9 million active users by 2021 and twice that figure by the following year, in a market that is still pretty much touch-and-go, featuring several dead platforms like iRoking and Nichestream and a number of crumbling investments.

The IPO is also expected to fuel a premium offer, Mdundo pegged its subscription fee at USD 2.00 per month. Its trading debut in Denmark is slated for September 4.

Featured Image Courtesy: newtimes.co.rw