Nigeria’s Mobile Money License Now Comes With A USD 13 Mn Capital Criterion

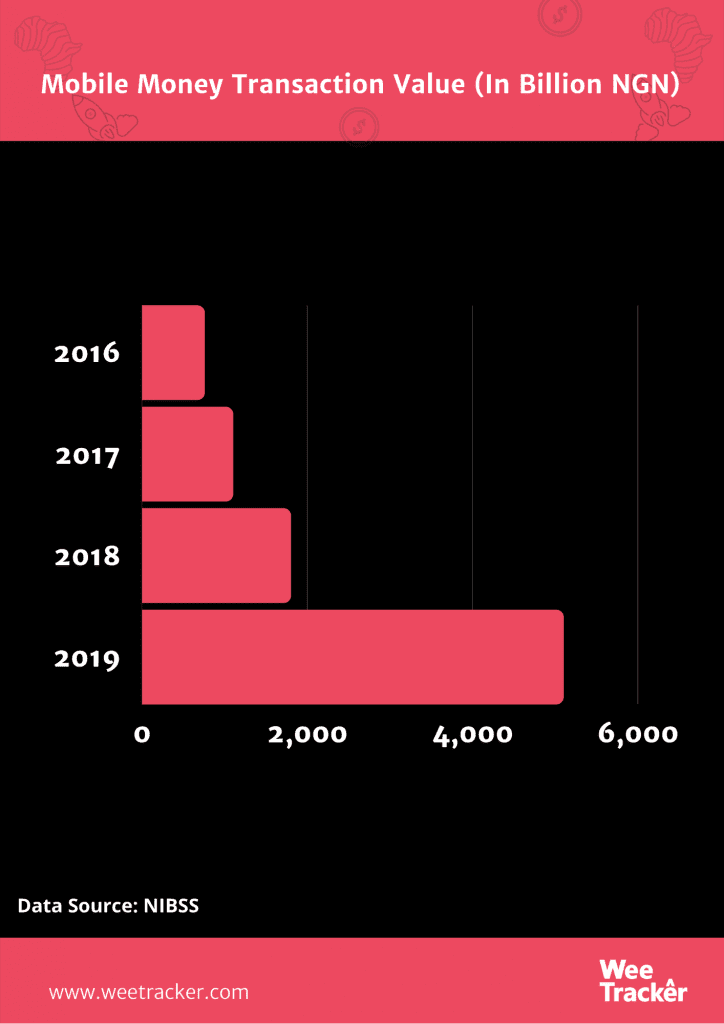

While Africa is more or less the forte of mobile money, the Nigerian chapter of financial inclusion is mostly stunted. Nigerian mobile money has not experienced success like that of Eastern African because regulations are tough, competition is strong and lobbying is rampant.

In Africa’s largest economy, telecommunications companies, fintechs, and banking agents are vying for a share of the mobile money market. But getting the license to do so has perhaps proven tougher than doing the business itself.

Now, the Central Bank of Nigeria (CBN) has stated it is now ready to grant more licenses to payment service firms. However, the bank has set a minimum capital base of USD 13 Mn for interested businesses to have before they can get the approval to operate.

That NGN 5 Bn (the present day naira equivalent) needs to be set aside for a separate payments company, which will be run as an entity that is independent of the parent firm’s existing operations.

Even as regulators seem to now be listening to the proverbial mobile money “good word”, the new set of rules could very well dull the interest of telecommunications service providers and a crop of other non-bank entrants. Also, it could effectively stop them from entering Nigeria’s digital payments landscape.

Stiff Licensing?

The CBN, Nigeria’s apex bank, is licensing mobile operators as part of its policy to boost financial inclusion and in hopes to replicate the Indian and Kenyan examples of mobile money triumph. Being that more than half of the country’s 180 million people do not have bank accounts, there is evidence of what is possible.

It was only last year that the country finally turned to telcos to drive financial inclusion. But this new licensing requirement could bring about reproach on the part of the telecom operators, as well as retail chains and postal services.

In 2018 when the CBN first suggested mobile money guidelines for discussion, telcos argued that they are not banks, and should not be treated as such. That means, they do not need a capital base before they can offer mobile money services in the country.

The CBN’s new circular on the licensing points out that it could mandate payment banks to recapitalize for specific risks. This position is a long way from the former which totally hesitated to welcome telcos into the payments sector.

In Ghana, Africa’s fastest-growing mobile market, the Bank of Ghana (BoG) mandated a minimum capital requirement of USD 3.6 Mn, up from USD 0.9 Mn. This happened in September 2019, at which point the bank said that the new threshold would become effective for telcos and banks in 9 months. However, BoG has extended the deadline from June this year to December 2020.

Interest Conflict

The central bank’s change of tact provided MTN, Nigeria and Africa’s largest telco, to launch it Momo Agent mobile money service. Likewise, Airtel Nigeria’s third largest carrier, used a USD 1.2 Mn funding to make inroads. It has now partnered with WorldRemit to expand the mobile money service. 9PSB, a unit of local telecom firm, 9mobile, has also been granted a license.

In addition to the USD 13 Mn necessity, the CBN has said that payment banks should mostly operate in rural areas and unbanked locations. They should accept deposits from individuals and small businesses, but are not permitted to grant loans.

If these telcos are given the avenue to become the Nigerian replica’s of East Africa’s Safaricom—or more precisely,—MPesa, they could become an existential threat for players who have long operated in the financial services sector, especially banks.

Not to forget fintechs like OPay and Paga, who are among those pulling the best of their resources to reach Nigeria’s unbanked population. Telcos like MTN, 9mobile and Airtel have an upper hand in terms of brand recognition and already existing reach, since they typically serve more customers than the financial institutions.

Nevertheless, there is no telling how these new set of rules would change the game for telcos and other potential players. Moreover, being a deterrent to other operators may be an advantage for existing players.

Featured Image: Qz