CBN’s Remittance Tinkering Might Choke Nigeria’s Inflows As IMTOs Adjust

A week ago, it was reported that the Central Bank of Nigeria (CBN) released a new policy regarding the management of diaspora remittances which fetched the country USD 17.5 Bn in 2019 alone.

The release, as earlier reported, directed all banks to immediately close the Naira Ledger Accounts meant for the receipt of funds from International Money Transfers Operators (IMTOs).

In addition to that, commercial banks were given the sole mandate of the transfer of funds to recipients. The new policy put banks as the body responsible for the final transfer of remittances to the domiciliary accounts of the beneficiaries.

The crux of the policy is that recipients can now get their remittances in a foreign currency, unlike the previous process where funds would be deposited in local currency in their respective ledger accounts.

This new directive is aimed at limiting or possibly eradicating the use of unofficial exchange channels for remittances.

Furthermore, this move is projected by the CBN to help boost remittance inflows and likewise to help narrow down the gap on the exchange rate in the parallel market.

It is somewhat glaring that the new policy would be more beneficial to one end of the remittance cycle while taking a hit on the other.

As it appears, Nigeria’s commercial banks are positioned to benefit more from the new arrangement. The CBN governor, Godwin Emefiele, in his statement last week, noted that he was certain that after some time, commercial banks wouldn’t need to call on the central bank for the provision of dollars to fund commercial operations.

Hence, this structure is one that would affect positively, the FX availability for banks in general.

However, the new policy appears to be a strain for IMTOs, as they so far do not seem to be having it easy. For one, it is something of an open secret that the profit from foreign exchange arbitrage (due to unequal prices), is one of the significant sources of revenue for IMTOs.

How IMTOs are reacting to Nigeria’s new policy on remittances

As earlier stated, the new policy by the CBN appears to be more gloomy for IMTOs. And as such, some of these IMTOs have started adjusting to it, though many others remain silent.

For instance, the popular operator, WorldRemit reached its customers already via email, explaining the situation and the solution they have undertaken.

“We have made some adjustment to our money transfer service in Nigeria following the changes introduced by the Central Bank of Nigeria on how money can be received,” the email read.

It was revealed in the email that the bank transfer and mobile money service has been suspended in Nigeria. Also, in conformity with the instruction of the CBN, WorldRemit has now made cash collection in USD available.

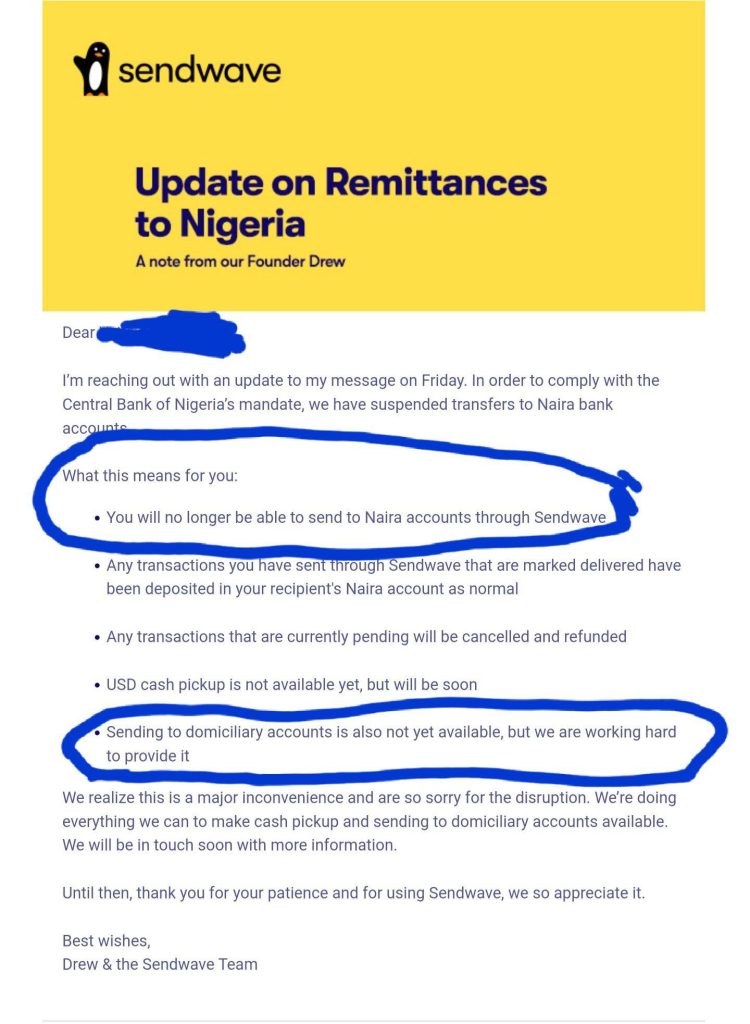

A second money transfer operator called Sendwave has also communicated the directive to their customers, though the outcome for Sendwave seems to be more stringent.

Sendwave, in an email to its customers, announced the indefinite suspension of transfers to Naira accounts.

The email reads in part; “In order to comply with the Central Bank of Nigeria’s mandate, we have suspended transfers to Naira bank accounts.”

This means that sending funds to Nigeria from abroad via Sendwave has been put on hold indefinitely. It was also stated that the transactions already pending would be canceled and refunded within a time frame.

This is due to the unavailability of cash pickup at the time and the that the framework for remittances to be sent to the recipient’s domiciliary bank accounts isn’t yet available on the platform.

The effect of this is clear. It is very likely that, beyond affecting these remittance companies themselves, the directive is likely to hamper remittance inflows to Nigeria, at least for a while.

The harder it becomes for diaspora remittances to get into Nigeria, the more likely it gets that money moving efforts would shrink. When the process then becomes more cumbersome and foggy as previously-available channels close up, there’s a possibility of depression in remittances. This could ultimately have an effect on the total value of remittance into Nigeria.

Commercial banks in Nigeria have also been sighted to have begun USD payouts to recipients, as it should be.

An example is Polaris Bank, which has commenced payment in USD to all beneficiaries of money transfer across all its branches in Nigeria.

The bank sent a notice to its customers earlier in the week that beneficiaries of money transfers could now receive their remittance in US dollars in cash or directly into a domiciliary account in the Bank. The major criteria for the collection is a valid identification, which includes a Bank Verification Number (BVN).

In all of these, it appears that the new policy brings some advantages to the beneficiaries of these remittances. The reason is simple; they now can receive money in the exact currency that was sent and choose to hold it or exchange it for the local currency in the parallel market, which ultimately is likely to give a more favorable value for their FX.

Featured Image Courtesy: Maisonneuve